Oil Market Forecast - April 2022

Summary

The Russian invasion of Ukraine marked its 50th day on the 14th of April, and formal and voluntary sanctions on Russian oil are starting to make their presence felt. In this month’s Oil Market Forecast we look at revised global oil demand forecasts and the US and OPEC+ response to the supply crunch. We look at how the Brent and WTI spot and futures market have moved over the last month and provide our usual update on US activity levels and the status of onshore and offshore leasing programs.

A few key points:

- All major reporting agencies cut their 2022 demand estimates this month, with estimates now falling between 99.4 MMbbl/day and 100.5 MMbbl/day.

- The IEA expects Russian exports to fall by 1.5 MMbbl/day in April and 3 MMbbl/day in May as sanctions start to bite.

- Evidence of the market reallocating supply is starting to emerge, with the US buying more Middle Eastern cargoes and Russian crude being marketed at a steep discount.

- The Biden Administration and the IEA announced a coordinated release from member countries’ strategic reserves scheduled to run for the next 6 months.

- OPEC+ raised output quotas for April by 432,000 bbl/day, but the gap between OPEC+ actual and target production widened to 1.63 MMbbl/day at the end of March.

- The oil market to be undersupplied through the forecast period, with a supply deficit of 1 – 2 MMbbl/day this year.

- OPEC replaced the IEA as a secondary source.

- Brent and WTI spot prices bounced between $100/barrel and $122/barrel and Brent and WTI futures hit 12-month highs.

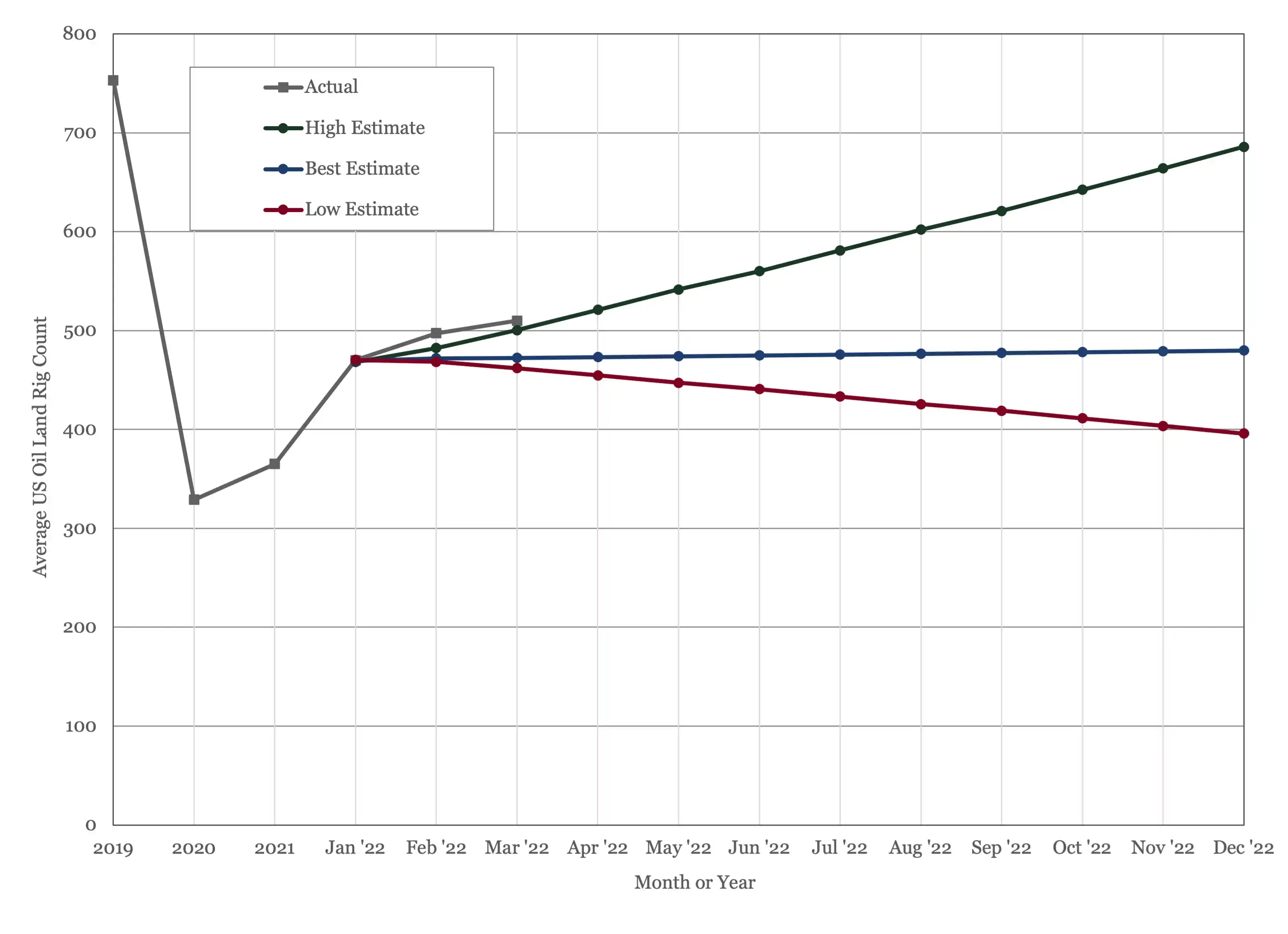

- The US oil land rig count hit 535.

- The Biden Administration resumed oil and gas leasing on onshore Federal land, offering a reduced area at an increased royalty rate.

Oil Supply and Demand

The IEA were the first to cut their 2022 oil demand estimate last month, and they followed up with another smaller cut of 260,000 bbl/day this month (1). They now estimate 2022 oil demand at 99.4 MMbbl/day, against 99.7 MMbbl/day last month, based on their expectation that sanctions related to the Russian invasion of Ukraine would depress economic growth this year. OPEC cut their 2022 demand forecast by 400,000 bbl/day, from 100.9 MMbbl/day last month to 100.5 MMbbl/day this month (2), citing sanctions and the emerging Omicron variant in China. The EIA cut deeper, dropping their 2022 demand estimate by 800,000 bbl/day, from 100.6 MMbbl/day to 99.8 MMbbl/day, again citing concerns about growth in China (3).

Of the headwinds facing the oil market this year, the outbreak of the Omicron variant in China and the Chinese government’s response seems to be the factor that is weighing most heavily on demand estimates. With so much else going on, the impact of this outbreak has not been dominating headlines in the way that it normally would, but The New York Times (4) reported that fully one third of the population, nearly 400 million people, are currently under some form of lockdown, and that “Experts are beginning to warn that China’s target of 5.5 percent economic growth for 2022 is now unrealistic because so much of daily economic life has ground to a halt”.

If clouds are starting to gather on the demand side, then the supply side is under a severe thunderstorm warning. While the US has banned imports of oil from Russia, the ban came with a grace period that allowed deliveries to continue until April 22nd. The IEA reported oil supply in March rising to 99.1 MMbbl/day, but that they expected 1.5 MMbbl/day to leave the market in April, rising to 3 MMbbl/day in May as formal sanctions on Russia and a general reluctance to trade in Russian crude start to bite. This puts the oil market into a steep deficit from April and it is not clear how that will resolve.

In last month’s Oil Market Forecast, I suggested that there would be a gradual reallocation, with Europe and the US switching to alternate suppliers and Russia backfilling that supply at a discount over a period of 18 months or so. There is some evidence that this is happening. Reuters reported that US refiners increased purchases of fuel oil cargoes from the Middle East (5), raising purchases to the highest level in 12 years, while The Wall Street journal reported that LUKOIL tried to sell a cargo of Urals crude at a $31 discount to Brent (6). Wood Mackenzie published an analysis (7) that suggested about 650,000 bbl/day could be reallocated in this way through what they called ‘crude swapping’. They highlighted existing contractual commitments and shipping time as factors that would limit substitution beyond that point. Meanwhile in Russia storage facilities are filling up and production is starting to shut in. Vagit Alekperov, the chief executive of LUKOIL wrote to Russia’s deputy Prime Minister in late March to say storage was full and requesting to redirect oil to power plants to avoid shutting in production (8). One month on, I still think reallocation is a valid hypothesis, but the pace is uncertain and in the interim, the market will see insufficient supply.

In the near term, the US and the IEA have undertaken a coordinated action to release oil from strategic reserves, a total of 240 million barrels over six months, or just over 1 MMbbl/day (9). Releasing oil from a strategic reserve does not actually increase the total amount of oil available, as the release simply moves oil from government storage to private sector storage, and for this reason I was critical of the last Biden Administration release. In this case, however, I think it was warranted, as it provides some liquidity during what is, hopefully, a period of dislocation. This, rather than trying to tamp down oil prices, is what strategic reserves should be for. Beyond the strategic reserves release, the Biden Administration has called for more domestic oil production, but appears unwilling to pursue new policies, or abandon current policies, that would spur an increase in production. The administration seems to see this as a temporary blip, where additional production is required for a few months, but the kind of long-term investment that would result in additional production should be discouraged, as the nation will resume its transition from hydrocarbons in a year or so. That isn’t how the industry works. There is a more detailed discussion on US investment and activity levels later in this Oil Market Forecast.

In looking for additional barrels, it seems OPEC+ may be of limited help. OPEC+ raised their production target for May by a slightly larger than normal 432,000 barrels per day (10), but the gap between OPEC+ actual and target production has widened to the extent that these announcements have begun to lose their significance. OPEC+ also announced that it would increase production in March by 400,000 bbl/day, but only delivered an actual increase of 40,000 bbl/day. The gap between target and actual production was 1.63 MMbbl/day at the end of March with Nigeria, Angola, Azerbaijan, Mexico, and Russia the biggest contributors to the shortfall. Indeed, for each of those nations, the March production target was thought to exceed that nations production capacity. While the OPEC+ supply constraints have a few more months left to unwind, the reality is that the group can probably squeeze out a little more production through quota reallocation, but that it is currently producing at close to sustainable capacity.

Outside of the US and OPEC+, there will should be some additional production this year from Brazil, Canada, Guyana Kazakhstan, and Norway, but this is expected to be in the hundreds of thousands, rather than the millions of barrels per day. Iran has the potential to bring additional oil to market in the near term if, a big if, sanctions are lifted, but as Vitol pointed out at a presentation in Houston earlier this month, that grade of very sour condensate will only fit a very limited number of refineries and so finding a market may be difficult. Global oil & gas industry investment is predicted to rise by 16% this year, but will still fall short of 2019 levels, never mind the investment levels seen in the first half of the last decade (11). It is still not clear if this level of expenditure is sufficient to grow oil production at a sufficient rate to offset underlying declines and growing demand.

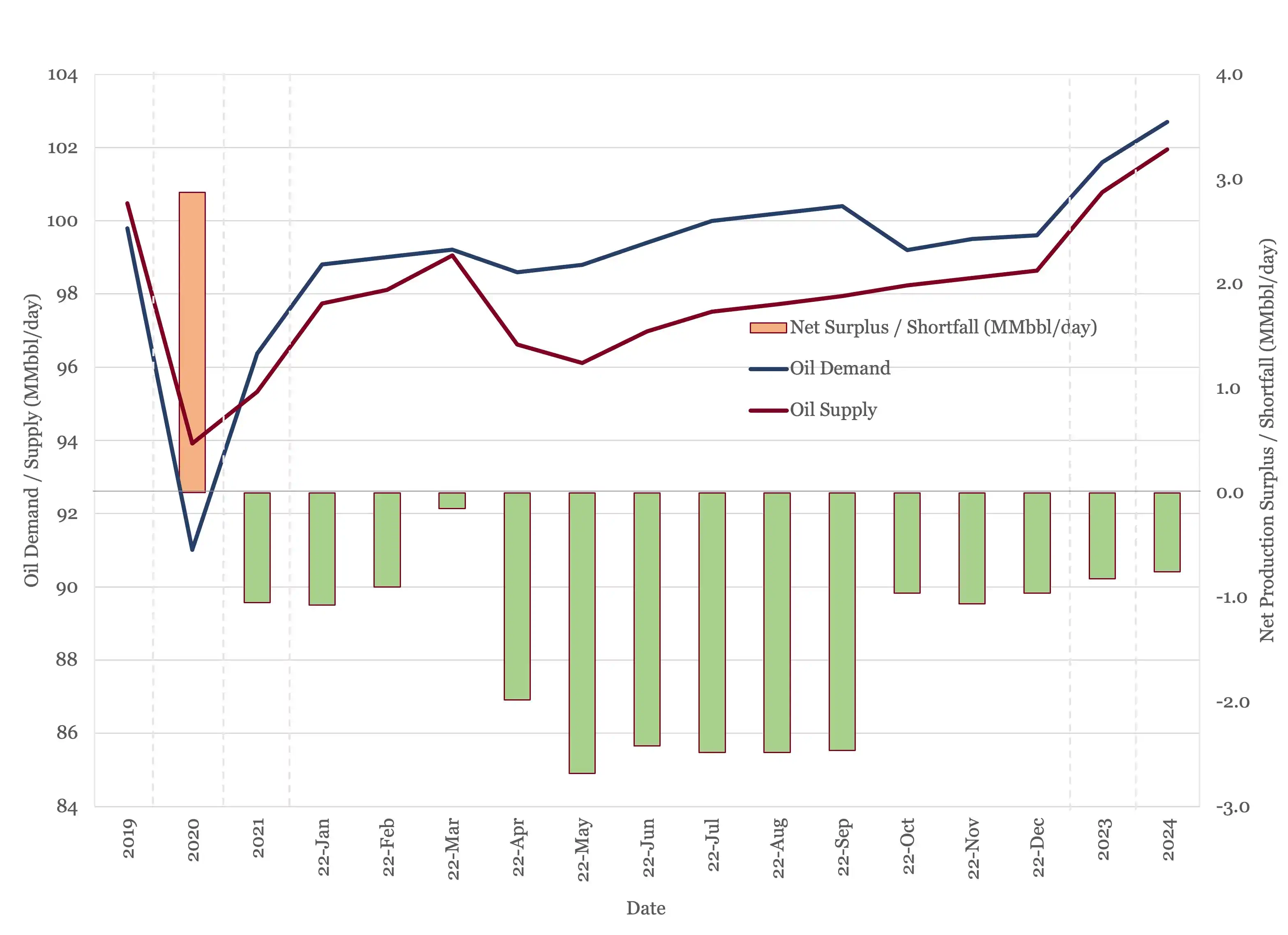

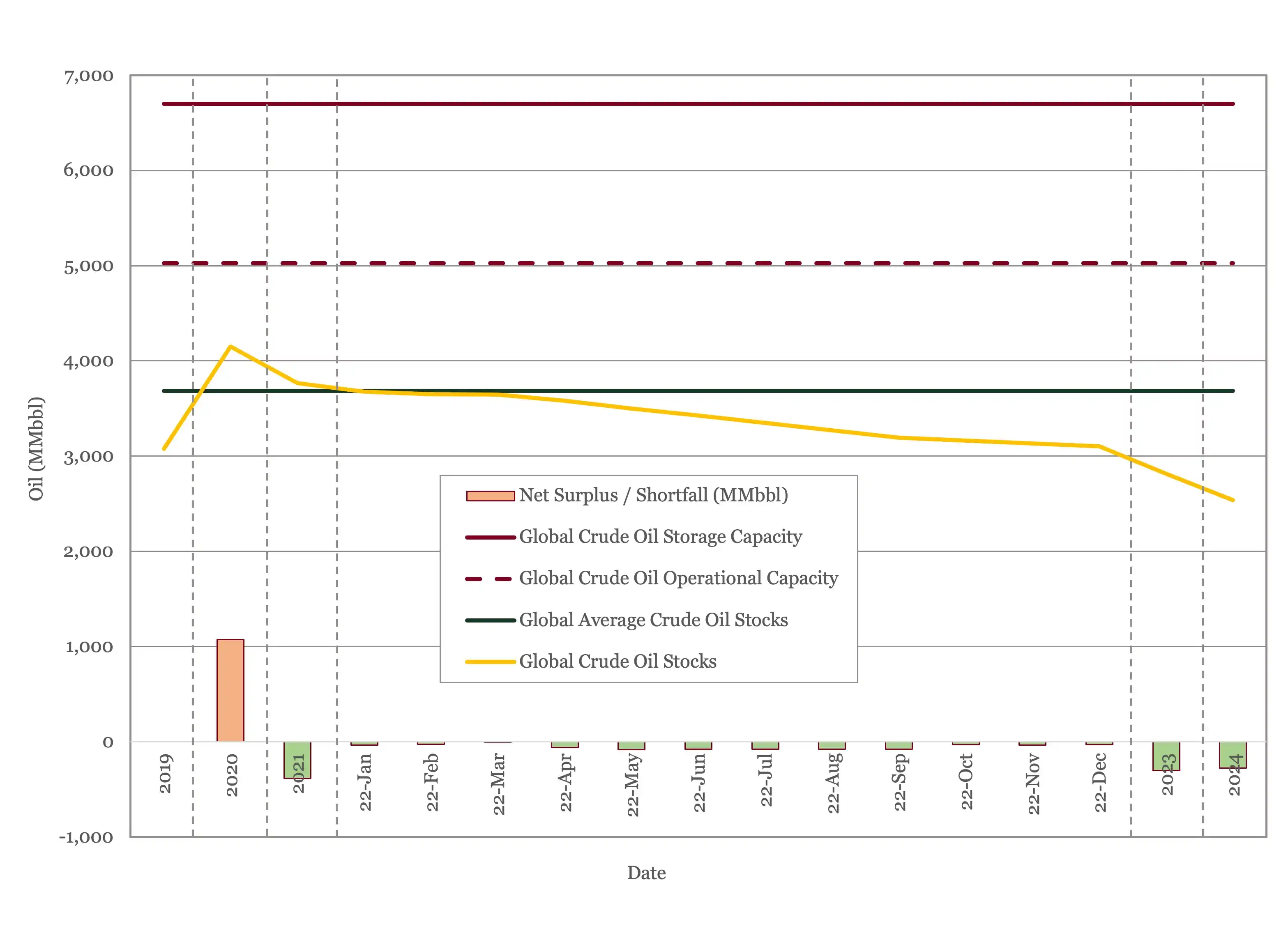

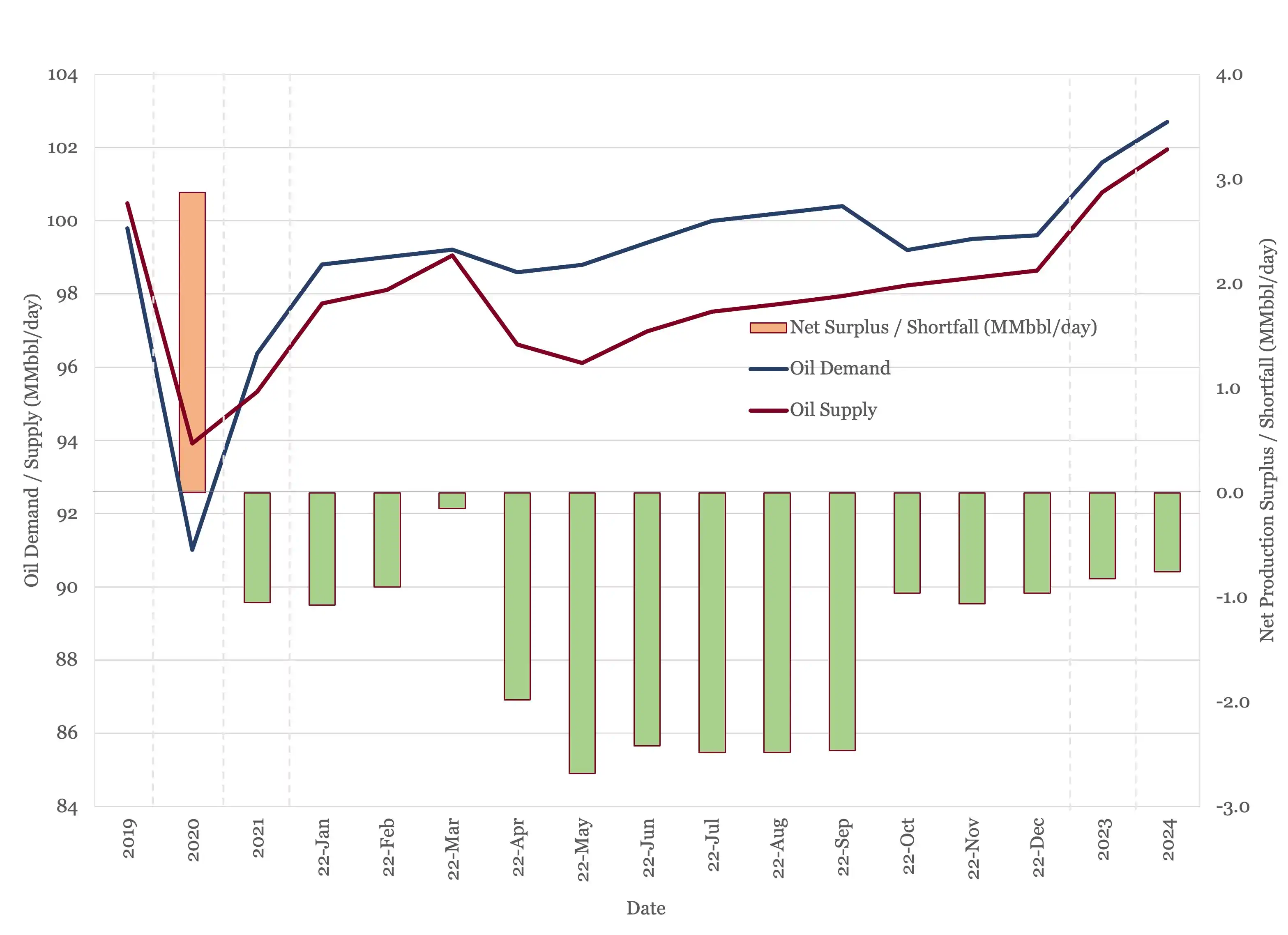

All of this leaves us with a tight oil market that gets progressively tighter, see Figure 1. Even with a projected drop in demand it looks like demand will outstrip supply by 1 – 2 MMbbl/day for the rest of the year.

Figure 1 - Supply and Demand Surplus Forecast

There was another piece of news that didn’t make headlines but may be significant, nonetheless. On the 31st of March, OPEC announced (12) that they had replaced the IEA with Wood Mackenzie and Rystad Energy as secondary sources. Most OPEC nations consider oil production data to be confidential and do not publish it, so OPEC production data is based on estimates produced by a group of secondary sources – now Argus, the EIA, S&P Global Platts, HIS Markit and Energy Intelligence, Wood Mackenzie, and Rystad Energy. Argus quoted a source familiar with the matter who is reported to have said "The reason [for the change] is that the IEA have compromised their technical analysis to fit their narrative,"(13). The example provided was the IEA’s February 2022, 700,000 bbl/day revision to oil demand, which was apparently delayed for weeks despite a growing discrepancy between observed and calculated stock draws. I don’t have any insights into the validity of this claim, but I did provide some comment on the IEA’s “World Energy Outlook 2021” in last October’s Oil Market Forecast, published in the run up to COP 26, and would say that they had most certainly compromised their technical analysis to fit their narrative. So far, the IEA have responded by starting to publish OPEC+ prior month actual vs target production data on a country-by-country basis in the public edition of their Oil Market Report. I’m glad to have the data, normally the IEA only publish data of this granularity in their subscription report, but it could be construed as retaliatory.

Oil Storage

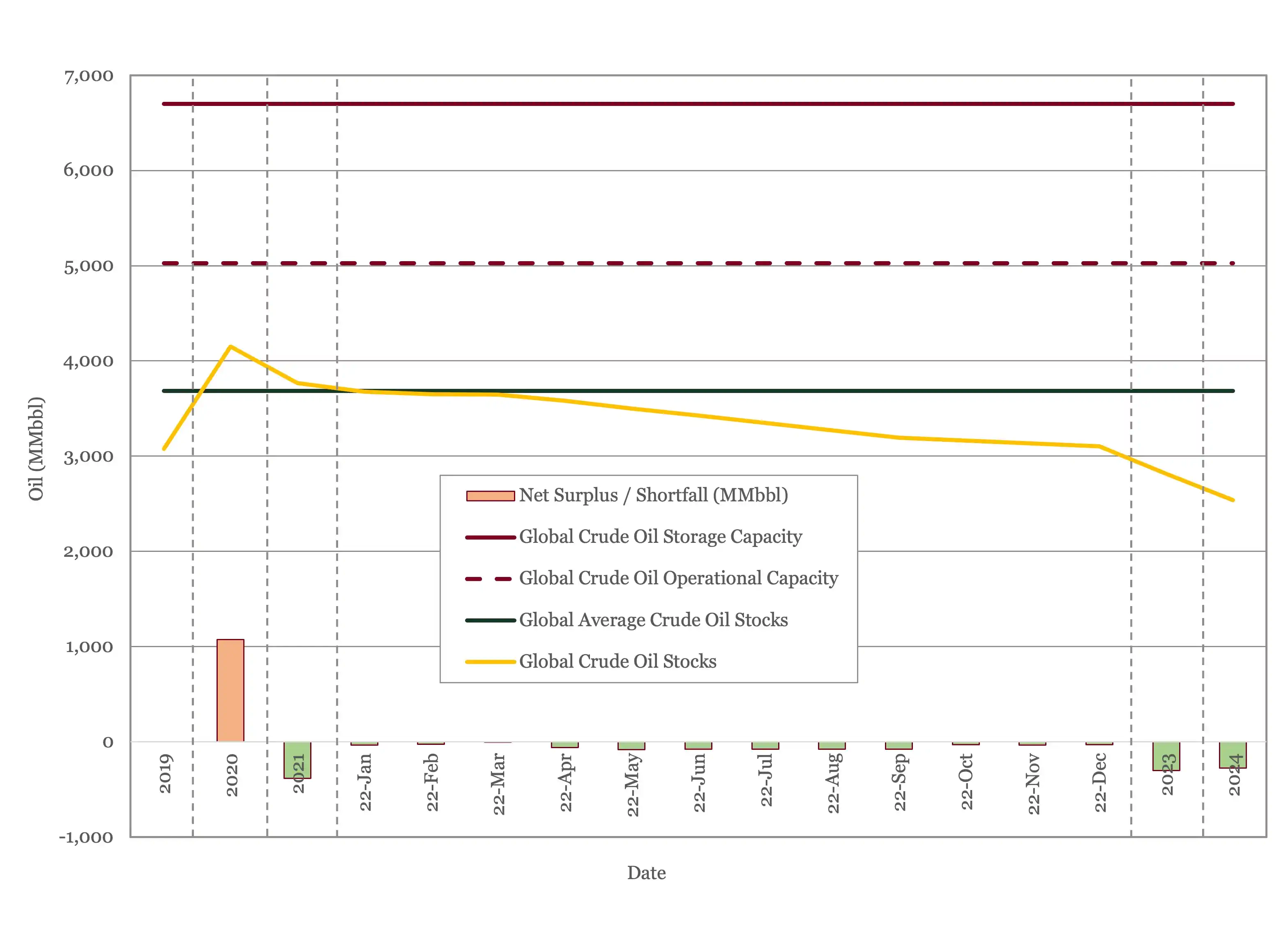

With a downward revision in 2022 demand, global oil inventory drawdowns for 2022 are now estimated at 652 MMbbl, down from 796 MMbbl last month. This is still below the overall build of 1,072 MMbbl in 2020 but combined with stock draws of 321 MMbbl last year we are around the 5-year average now and stocks will fall below 2019 levels by year end.

Figure 2 - Global Storage Chart

Oil Prices

After an initial surge, oil prices have whipsawed. After peaking at $128/barrel on the 8th of March, Brent fell back below $100/barrel on the 16th, rose again to $122/barrel on the 23rd, fell back below $100 on the 11th of April and, at the time of writing, is sitting at $111.

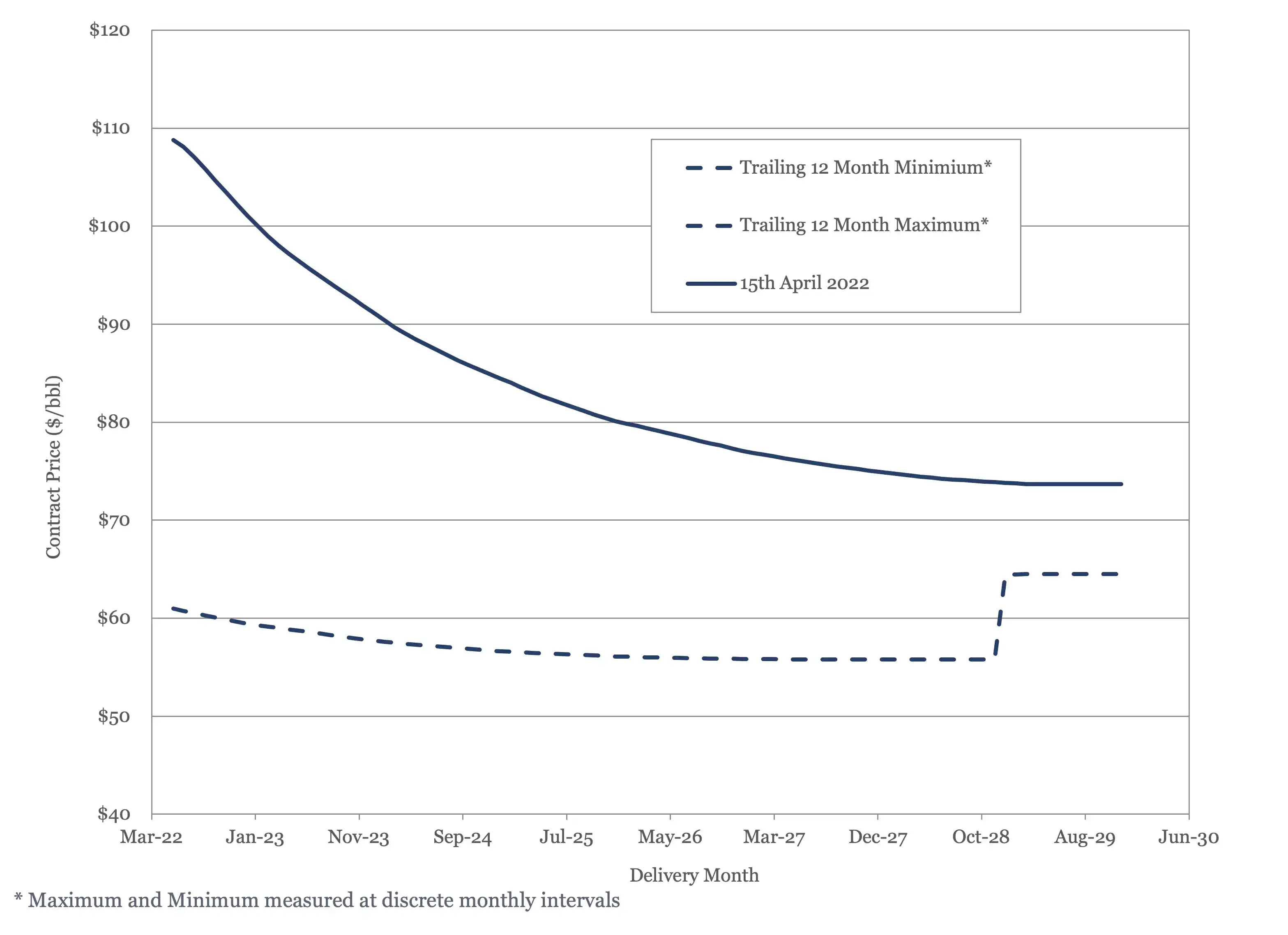

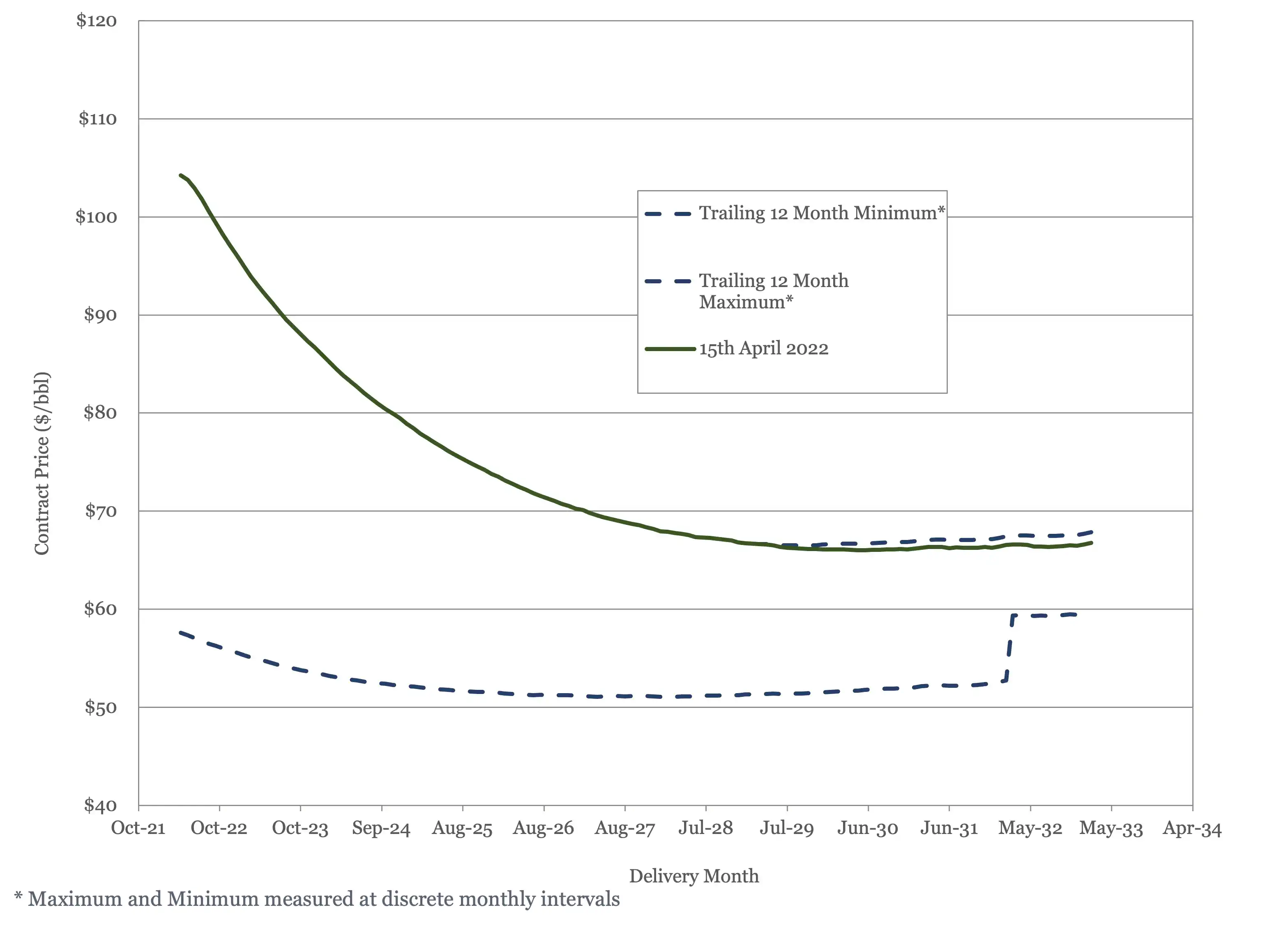

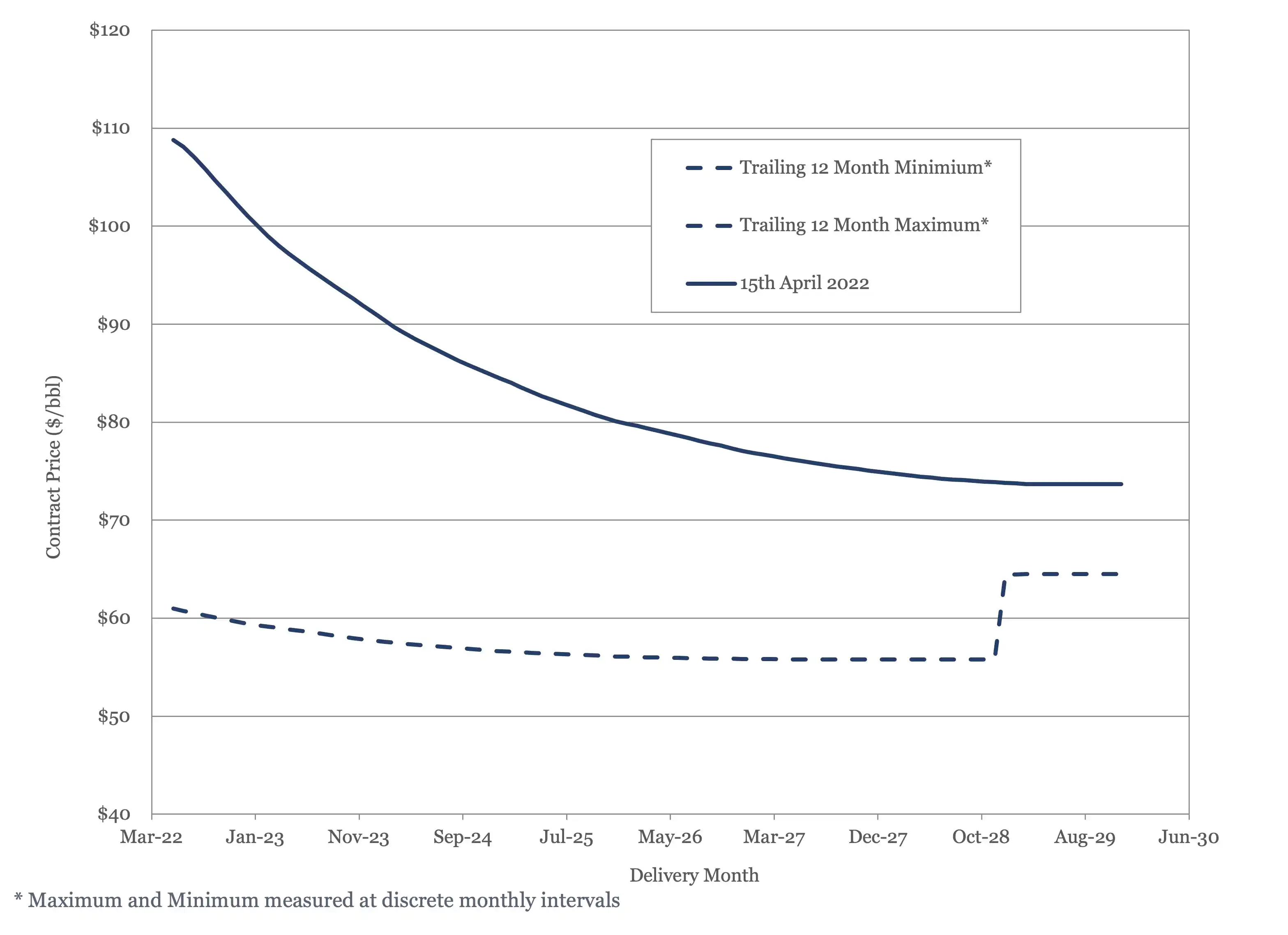

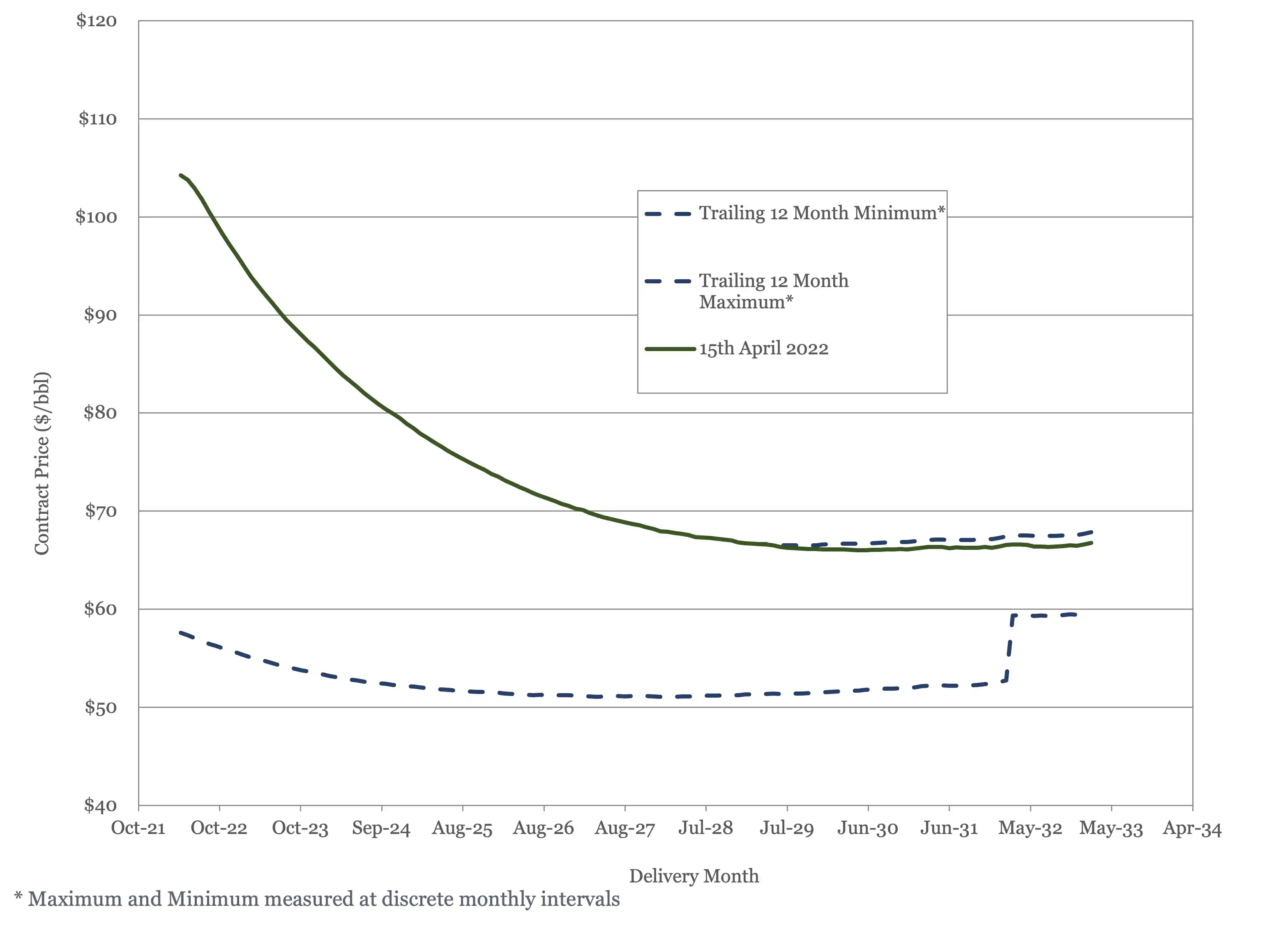

There may be volatility in the spot market, but both Brent and WTI are moving in one direction, both hitting new 12-month highs. Brent remains above $70/bbl out to 2030, with WTI above $65/bbl out to 2033.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

US Activity

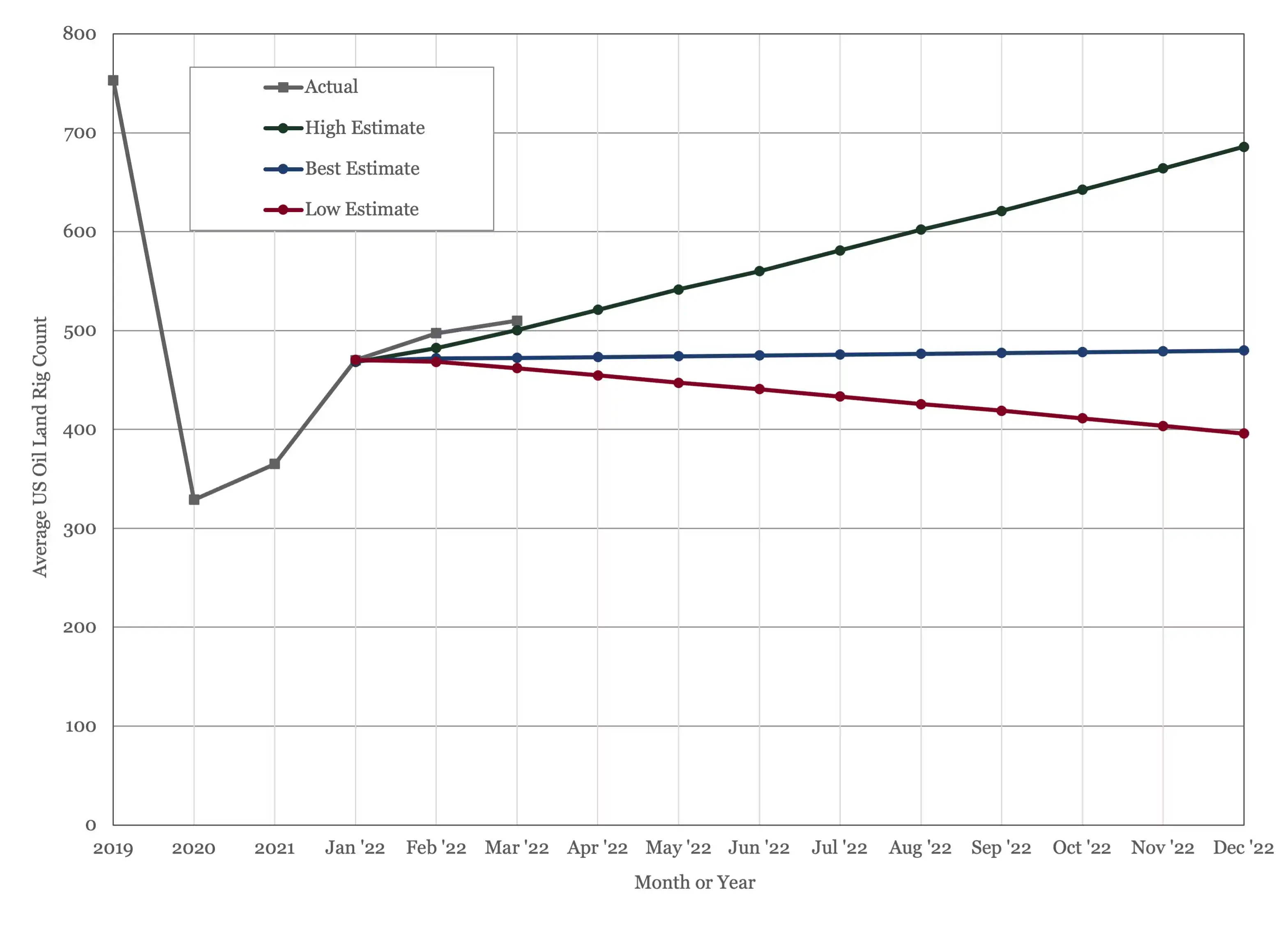

The US land oil rig count continues to rise, hitting 535 on the 15th of April. This has it ahead of my most aggressive forecast, but with the gap starting to narrow, see Figure 5. There is some evidence that the level of activity onshore in primed to pick up with reports that drilling permits in Texas and New Mexico hit an all-time high last month (14).

Figure 5 - US Land Oil Rig Count

The Biden Administration messaging has been mixed. The President himself has called for an immediate increase in oil production, suggested that the US industry is deliberately holding oil off the market and profiteering from the Russian invasion of Ukraine. Unfortunately, there is very little that can be done to increase production today, next month, or even through the rest of the year. As I talked about in last month’s Oil Market Forecast, the US industry faces a number of headwinds, that in the near term have no political solution. Even if company managers were provided with a mandate to increase production by investors, there are personnel, equipment and logistical bottlenecks that prevent a quick expansion in activity. Threatening to impose fines on companies that hold federal leases but are not producing from them will do nothing to encourage further investment in the industry.

There are actions that can be taken to boost production in the medium term. The Biden Administration announced on Friday 15th April that they would re-start oil and gas leasing on some onshore Federal properties – offering 144,000 acres in Alabama, Colorado, Montana, Nevada, New Mexico, North Dakota, Oklahoma, Utah, and Wyoming at a 18.75% royalty, up from 12.5% (15). This met a mixed reception as analysts pointed out that this constituted and 80% reduction from the footprint that had been under evaluation for leasing and the IPA raised concerns over the increase in royalty rates.

This new acreage may not help much; certainly, offering more land at 12.5% would have helped more. Mature basins normally lower government take to attract investment, not boost it by 50%. An argument can be made that with high oil prices, the industry can afford to pay more, but for an investor contemplating leasing additional acreage, the oil price today is meaningless. It is the oil price 12 – 24 months from now when production comes on stream that determines how much royalty the lease can bear, and no one should be using $100 plus for planning purposes.

Whole there has been some modest movement on leasing onshore, there appears to be a complete standstill offshore. World Oil reported that the Biden administration does not anticipate any revenue from offshore lease sales through October 2023 at the earliest (16). This extended pause has the potential to permanently damage a segment of the industry that works on long cycle times and requires stability to support ongoing investment.

The message seems to be that we want more domestic oil production today, because prices are high and it hurts consumers, but that we do not want to expand oil and gas infrastructure because we want less oil and gas production tomorrow. This is, of course, the inverse of the way in which the industry works. It doesn’t make any senses to limit US oil supply while global oil demand continues to grow, any more than it makes sense to introduce policies to reduce oil prices if your stated aim is to reduce carbon dioxide emissions.

(1) Oil Market Report – April 13th, 2022, IEA, Paris.

(2) Short Term Energy Outlook (STEO), April 7th, 2022, U.S. Energy Information Administration.

(3) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, April 12th, 2022.

(4) “China’s economy pays a price as lockdowns restrict nearly a third of its population”, Alexandra Stevenson, The New York Times, April 14th, 2022.

(5) “US refiners turn to Middle East for fuel oil after Russia import ban”, Arathy Somasekhar, Reuters, March 24th, 2022

(6) “Oil Prices Stay High as Russian Crude Shortages Hits Market”, Anna Hirtenstein, The Wall Street Journal, March 27th, 2022.

(7) “About 650,000 barrels per day of Russian crude oil to be ‘swapped’”, Wood Mackenzie, April 5th, 2022

(8) “Russia’s Oil Industry, Linchpin of Economy, Feels Sting of Ukraine War Disruptions”, Joe Wallace and Anna Hirtenstein, The Wall Street Journal, April 13th, 2021

(9) “US Allies to Release Close to 60 Million Barrels of Oil From Reserves”, Matthew Dalton, Wall Street Journal, April 6th, 2022

(10) “27th OPEC and non-OPEC Ministerial Meeting”, March 31st, 2022, Organization of the Petroleum Exporting Countries.

(11) “Global energy spending set to reach record high of over $2 trillion in 2022, led by oil and gas”, Rystad Energy, April 7, 2022

(12) “Outcome of the Extraordinary 183rd Meeting of the OPEC Conference”, Organization of the Petroleum Exporting Countries, March 31st, 2022.

(13) “Opec mulls removing IEA as secondary source”, Argus, March 31st, 2022.

(14) “Record Permian well permits point to growing U.S. oil supply”, Gerson Freitas Jr., World Oil, April 13th, 2022.

(15) “Biden Administration Resumes Oil Leases on Federal Land”, Kary Stech Ferek and Timothy Puko, The Wall Street Journal, April 15th, 2022

(16) “Biden signals third year of offshore oil-leasing delay in gulf”, Jennifer A, Dlouhy, World Oil, March 29th, 2022.

Oil Market Forecast - April 2022

Summary

The Russian invasion of Ukraine marked its 50th day on the 14th of April, and formal and voluntary sanctions on Russian oil are starting to make their presence felt. In this month’s Oil Market Forecast we look at revised global oil demand forecasts and the US and OPEC+ response to the supply crunch. We look at how the Brent and WTI spot and futures market have moved over the last month and provide our usual update on US activity levels and the status of onshore and offshore leasing programs.

A few key points:

- All major reporting agencies cut their 2022 demand estimates this month, with estimates now falling between 99.4 MMbbl/day and 100.5 MMbbl/day.

- The IEA expects Russian exports to fall by 1.5 MMbbl/day in April and 3 MMbbl/day in May as sanctions start to bite.

- Evidence of the market reallocating supply is starting to emerge, with the US buying more Middle Eastern cargoes and Russian crude being marketed at a steep discount.

- The Biden Administration and the IEA announced a coordinated release from member countries’ strategic reserves scheduled to run for the next 6 months.

- OPEC+ raised output quotas for April by 432,000 bbl/day, but the gap between OPEC+ actual and target production widened to 1.63 MMbbl/day at the end of March.

- The oil market to be undersupplied through the forecast period, with a supply deficit of 1 – 2 MMbbl/day this year.

- OPEC replaced the IEA as a secondary source.

- Brent and WTI spot prices bounced between $100/barrel and $122/barrel and Brent and WTI futures hit 12-month highs.

- The US oil land rig count hit 535.

- The Biden Administration resumed oil and gas leasing on onshore Federal land, offering a reduced area at an increased royalty rate.

Oil Supply and Demand

The IEA were the first to cut their 2022 oil demand estimate last month, and they followed up with another smaller cut of 260,000 bbl/day this month (1). They now estimate 2022 oil demand at 99.4 MMbbl/day, against 99.7 MMbbl/day last month, based on their expectation that sanctions related to the Russian invasion of Ukraine would depress economic growth this year. OPEC cut their 2022 demand forecast by 400,000 bbl/day, from 100.9 MMbbl/day last month to 100.5 MMbbl/day this month (2), citing sanctions and the emerging Omicron variant in China. The EIA cut deeper, dropping their 2022 demand estimate by 800,000 bbl/day, from 100.6 MMbbl/day to 99.8 MMbbl/day, again citing concerns about growth in China (3).

Of the headwinds facing the oil market this year, the outbreak of the Omicron variant in China and the Chinese government’s response seems to be the factor that is weighing most heavily on demand estimates. With so much else going on, the impact of this outbreak has not been dominating headlines in the way that it normally would, but The New York Times (4) reported that fully one third of the population, nearly 400 million people, are currently under some form of lockdown, and that “Experts are beginning to warn that China’s target of 5.5 percent economic growth for 2022 is now unrealistic because so much of daily economic life has ground to a halt”.

If clouds are starting to gather on the demand side, then the supply side is under a severe thunderstorm warning. While the US has banned imports of oil from Russia, the ban came with a grace period that allowed deliveries to continue until April 22nd. The IEA reported oil supply in March rising to 99.1 MMbbl/day, but that they expected 1.5 MMbbl/day to leave the market in April, rising to 3 MMbbl/day in May as formal sanctions on Russia and a general reluctance to trade in Russian crude start to bite. This puts the oil market into a steep deficit from April and it is not clear how that will resolve.

In last month’s Oil Market Forecast, I suggested that there would be a gradual reallocation, with Europe and the US switching to alternate suppliers and Russia backfilling that supply at a discount over a period of 18 months or so. There is some evidence that this is happening. Reuters reported that US refiners increased purchases of fuel oil cargoes from the Middle East (5), raising purchases to the highest level in 12 years, while The Wall Street journal reported that LUKOIL tried to sell a cargo of Urals crude at a $31 discount to Brent (6). Wood Mackenzie published an analysis (7) that suggested about 650,000 bbl/day could be reallocated in this way through what they called ‘crude swapping’. They highlighted existing contractual commitments and shipping time as factors that would limit substitution beyond that point. Meanwhile in Russia storage facilities are filling up and production is starting to shut in. Vagit Alekperov, the chief executive of LUKOIL wrote to Russia’s deputy Prime Minister in late March to say storage was full and requesting to redirect oil to power plants to avoid shutting in production (8). One month on, I still think reallocation is a valid hypothesis, but the pace is uncertain and in the interim, the market will see insufficient supply.

In the near term, the US and the IEA have undertaken a coordinated action to release oil from strategic reserves, a total of 240 million barrels over six months, or just over 1 MMbbl/day (9). Releasing oil from a strategic reserve does not actually increase the total amount of oil available, as the release simply moves oil from government storage to private sector storage, and for this reason I was critical of the last Biden Administration release. In this case, however, I think it was warranted, as it provides some liquidity during what is, hopefully, a period of dislocation. This, rather than trying to tamp down oil prices, is what strategic reserves should be for. Beyond the strategic reserves release, the Biden Administration has called for more domestic oil production, but appears unwilling to pursue new policies, or abandon current policies, that would spur an increase in production. The administration seems to see this as a temporary blip, where additional production is required for a few months, but the kind of long-term investment that would result in additional production should be discouraged, as the nation will resume its transition from hydrocarbons in a year or so. That isn’t how the industry works. There is a more detailed discussion on US investment and activity levels later in this Oil Market Forecast.

In looking for additional barrels, it seems OPEC+ may be of limited help. OPEC+ raised their production target for May by a slightly larger than normal 432,000 barrels per day (10), but the gap between OPEC+ actual and target production has widened to the extent that these announcements have begun to lose their significance. OPEC+ also announced that it would increase production in March by 400,000 bbl/day, but only delivered an actual increase of 40,000 bbl/day. The gap between target and actual production was 1.63 MMbbl/day at the end of March with Nigeria, Angola, Azerbaijan, Mexico, and Russia the biggest contributors to the shortfall. Indeed, for each of those nations, the March production target was thought to exceed that nations production capacity. While the OPEC+ supply constraints have a few more months left to unwind, the reality is that the group can probably squeeze out a little more production through quota reallocation, but that it is currently producing at close to sustainable capacity.

Outside of the US and OPEC+, there will should be some additional production this year from Brazil, Canada, Guyana Kazakhstan, and Norway, but this is expected to be in the hundreds of thousands, rather than the millions of barrels per day. Iran has the potential to bring additional oil to market in the near term if, a big if, sanctions are lifted, but as Vitol pointed out at a presentation in Houston earlier this month, that grade of very sour condensate will only fit a very limited number of refineries and so finding a market may be difficult. Global oil & gas industry investment is predicted to rise by 16% this year, but will still fall short of 2019 levels, never mind the investment levels seen in the first half of the last decade (11). It is still not clear if this level of expenditure is sufficient to grow oil production at a sufficient rate to offset underlying declines and growing demand.

All of this leaves us with a tight oil market that gets progressively tighter, see Figure 1. Even with a projected drop in demand it looks like demand will outstrip supply by 1 – 2 MMbbl/day for the rest of the year.

Figure 1 - Supply and Demand Surplus Forecast

There was another piece of news that didn’t make headlines but may be significant, nonetheless. On the 31st of March, OPEC announced (12) that they had replaced the IEA with Wood Mackenzie and Rystad Energy as secondary sources. Most OPEC nations consider oil production data to be confidential and do not publish it, so OPEC production data is based on estimates produced by a group of secondary sources – now Argus, the EIA, S&P Global Platts, HIS Markit and Energy Intelligence, Wood Mackenzie, and Rystad Energy. Argus quoted a source familiar with the matter who is reported to have said "The reason [for the change] is that the IEA have compromised their technical analysis to fit their narrative,"(13). The example provided was the IEA’s February 2022, 700,000 bbl/day revision to oil demand, which was apparently delayed for weeks despite a growing discrepancy between observed and calculated stock draws. I don’t have any insights into the validity of this claim, but I did provide some comment on the IEA’s “World Energy Outlook 2021” in last October’s Oil Market Forecast, published in the run up to COP 26, and would say that they had most certainly compromised their technical analysis to fit their narrative. So far, the IEA have responded by starting to publish OPEC+ prior month actual vs target production data on a country-by-country basis in the public edition of their Oil Market Report. I’m glad to have the data, normally the IEA only publish data of this granularity in their subscription report, but it could be construed as retaliatory.

Oil Storage

With a downward revision in 2022 demand, global oil inventory drawdowns for 2022 are now estimated at 652 MMbbl, down from 796 MMbbl last month. This is still below the overall build of 1,072 MMbbl in 2020 but combined with stock draws of 321 MMbbl last year we are around the 5-year average now and stocks will fall below 2019 levels by year end.

Figure 2 - Global Storage Chart

Oil Prices

After an initial surge, oil prices have whipsawed. After peaking at $128/barrel on the 8th of March, Brent fell back below $100/barrel on the 16th, rose again to $122/barrel on the 23rd, fell back below $100 on the 11th of April and, at the time of writing, is sitting at $111.

There may be volatility in the spot market, but both Brent and WTI are moving in one direction, both hitting new 12-month highs. Brent remains above $70/bbl out to 2030, with WTI above $65/bbl out to 2033.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

US Activity

The US land oil rig count continues to rise, hitting 535 on the 15th of April. This has it ahead of my most aggressive forecast, but with the gap starting to narrow, see Figure 5. There is some evidence that the level of activity onshore in primed to pick up with reports that drilling permits in Texas and New Mexico hit an all-time high last month (14).

Figure 5 - US Land Oil Rig Count

The Biden Administration messaging has been mixed. The President himself has called for an immediate increase in oil production, suggested that the US industry is deliberately holding oil off the market and profiteering from the Russian invasion of Ukraine. Unfortunately, there is very little that can be done to increase production today, next month, or even through the rest of the year. As I talked about in last month’s Oil Market Forecast, the US industry faces a number of headwinds, that in the near term have no political solution. Even if company managers were provided with a mandate to increase production by investors, there are personnel, equipment and logistical bottlenecks that prevent a quick expansion in activity. Threatening to impose fines on companies that hold federal leases but are not producing from them will do nothing to encourage further investment in the industry.

There are actions that can be taken to boost production in the medium term. The Biden Administration announced on Friday 15th April that they would re-start oil and gas leasing on some onshore Federal properties – offering 144,000 acres in Alabama, Colorado, Montana, Nevada, New Mexico, North Dakota, Oklahoma, Utah, and Wyoming at a 18.75% royalty, up from 12.5% (15). This met a mixed reception as analysts pointed out that this constituted and 80% reduction from the footprint that had been under evaluation for leasing and the IPA raised concerns over the increase in royalty rates.

This new acreage may not help much; certainly, offering more land at 12.5% would have helped more. Mature basins normally lower government take to attract investment, not boost it by 50%. An argument can be made that with high oil prices, the industry can afford to pay more, but for an investor contemplating leasing additional acreage, the oil price today is meaningless. It is the oil price 12 – 24 months from now when production comes on stream that determines how much royalty the lease can bear, and no one should be using $100 plus for planning purposes.

Whole there has been some modest movement on leasing onshore, there appears to be a complete standstill offshore. World Oil reported that the Biden administration does not anticipate any revenue from offshore lease sales through October 2023 at the earliest (16). This extended pause has the potential to permanently damage a segment of the industry that works on long cycle times and requires stability to support ongoing investment.

The message seems to be that we want more domestic oil production today, because prices are high and it hurts consumers, but that we do not want to expand oil and gas infrastructure because we want less oil and gas production tomorrow. This is, of course, the inverse of the way in which the industry works. It doesn’t make any senses to limit US oil supply while global oil demand continues to grow, any more than it makes sense to introduce policies to reduce oil prices if your stated aim is to reduce carbon dioxide emissions.

(1) Oil Market Report – April 13th, 2022, IEA, Paris.

(2) Short Term Energy Outlook (STEO), April 7th, 2022, U.S. Energy Information Administration.

(3) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, April 12th, 2022.

(4) “China’s economy pays a price as lockdowns restrict nearly a third of its population”, Alexandra Stevenson, The New York Times, April 14th, 2022.

(5) “US refiners turn to Middle East for fuel oil after Russia import ban”, Arathy Somasekhar, Reuters, March 24th, 2022

(6) “Oil Prices Stay High as Russian Crude Shortages Hits Market”, Anna Hirtenstein, The Wall Street Journal, March 27th, 2022.

(7) “About 650,000 barrels per day of Russian crude oil to be ‘swapped’”, Wood Mackenzie, April 5th, 2022

(8) “Russia’s Oil Industry, Linchpin of Economy, Feels Sting of Ukraine War Disruptions”, Joe Wallace and Anna Hirtenstein, The Wall Street Journal, April 13th, 2021

(9) “US Allies to Release Close to 60 Million Barrels of Oil From Reserves”, Matthew Dalton, Wall Street Journal, April 6th, 2022

(10) “27th OPEC and non-OPEC Ministerial Meeting”, March 31st, 2022, Organization of the Petroleum Exporting Countries.

(11) “Global energy spending set to reach record high of over $2 trillion in 2022, led by oil and gas”, Rystad Energy, April 7, 2022

(12) “Outcome of the Extraordinary 183rd Meeting of the OPEC Conference”, Organization of the Petroleum Exporting Countries, March 31st, 2022.

(13) “Opec mulls removing IEA as secondary source”, Argus, March 31st, 2022.

(14) “Record Permian well permits point to growing U.S. oil supply”, Gerson Freitas Jr., World Oil, April 13th, 2022.

(15) “Biden Administration Resumes Oil Leases on Federal Land”, Kary Stech Ferek and Timothy Puko, The Wall Street Journal, April 15th, 2022

(16) “Biden signals third year of offshore oil-leasing delay in gulf”, Jennifer A, Dlouhy, World Oil, March 29th, 2022.

Explore Our Services

Business Development

Oil & Gas an extractive industry, participants must continuously find and develop new oil & gas fields as existing fields decline, making business development a continuous process.

Strategy

We approach strategy through a scenario driven assessment of the client’s current portfolio, organizational competencies, and financial framework. The strategy defines portfolio actions and coveted asset attributes.