Oil Market Forecast - February 2022

Summary

It has been another busy month for the oil markets, as they recorded their strongest January in 30 years. Demand is surging, while supply is struggling to keep pace and geopolitical tensions exacerbate a limited supply cushion. The tone of the energy transition debate also appears to be shifting, with some acknowledgement in the media and academia that fossil fuels will continue to play a greater role in the energy mix for longer than had been anticipated over the last couple of years.

A few key points:

- The IEA raised its 2022 oil demand estimate by 700,000 bbl/day to 100.6 MMbbl/day, bringing it into line who the EIA and OPEC.

- OPEC+ raised output quotes for March by 400,000 bbl/day, but the spread between actual production and quotas widened again in January.

- US energy policy continues to confuse, with moves to suspend gasoline taxes and tap the SPR on one hand, while the Department of the Interior appeared to welcome a Federal Judge’s decision to invalidate last November’s lease sale on the other.

- TotalEnergies announced it would relinquish its North Platte interest to pursue more profitable options within its portfolio.

- Rice University’s Baker Institute of Public Policy published a paper on the risks to the energy transition of cutting off fossil fuel supply before replacing it with a viable alternative.

- Oil prices remain shy of $100/barrel but jumped again on a tight market and geopolitical tensions.

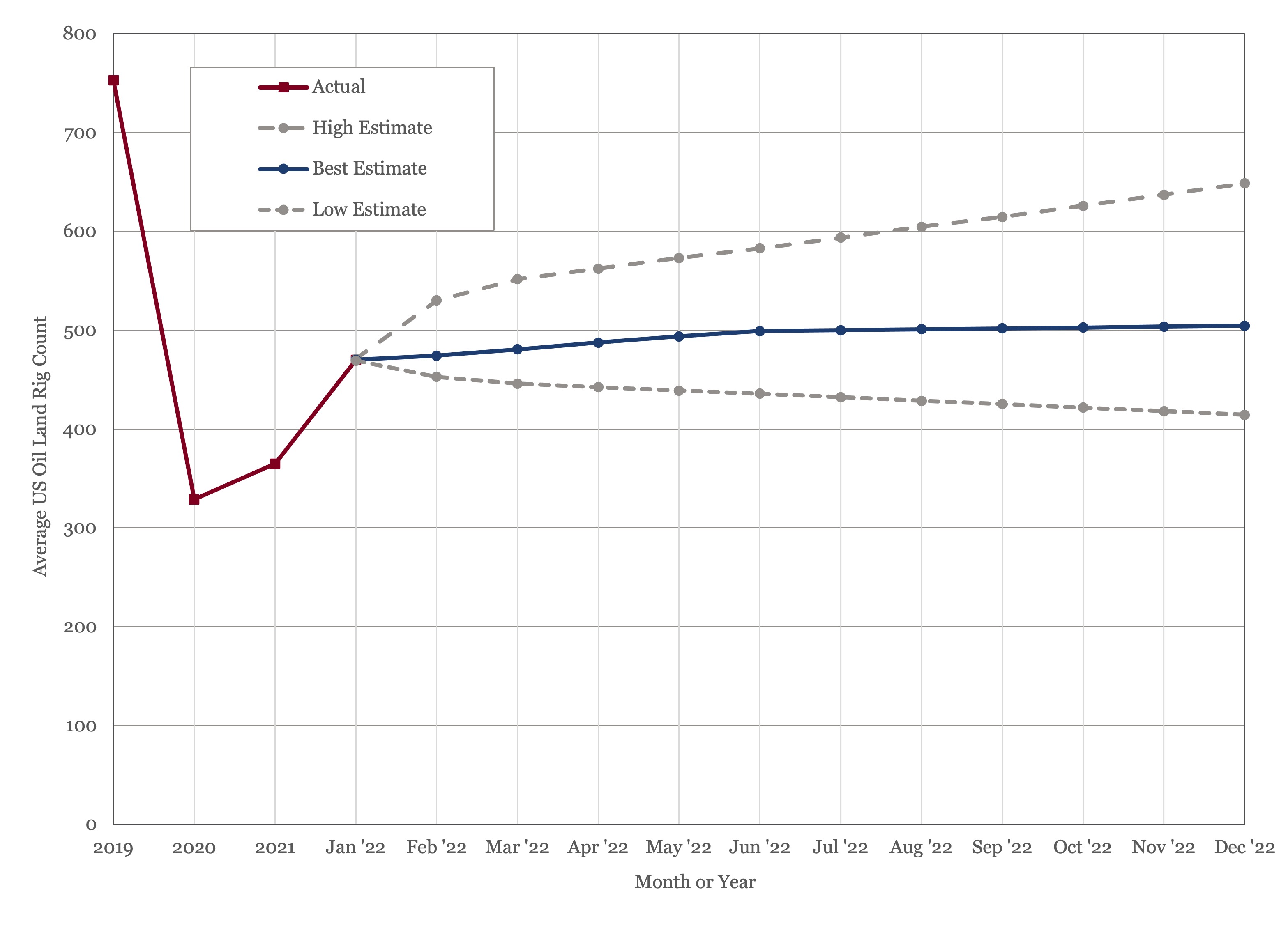

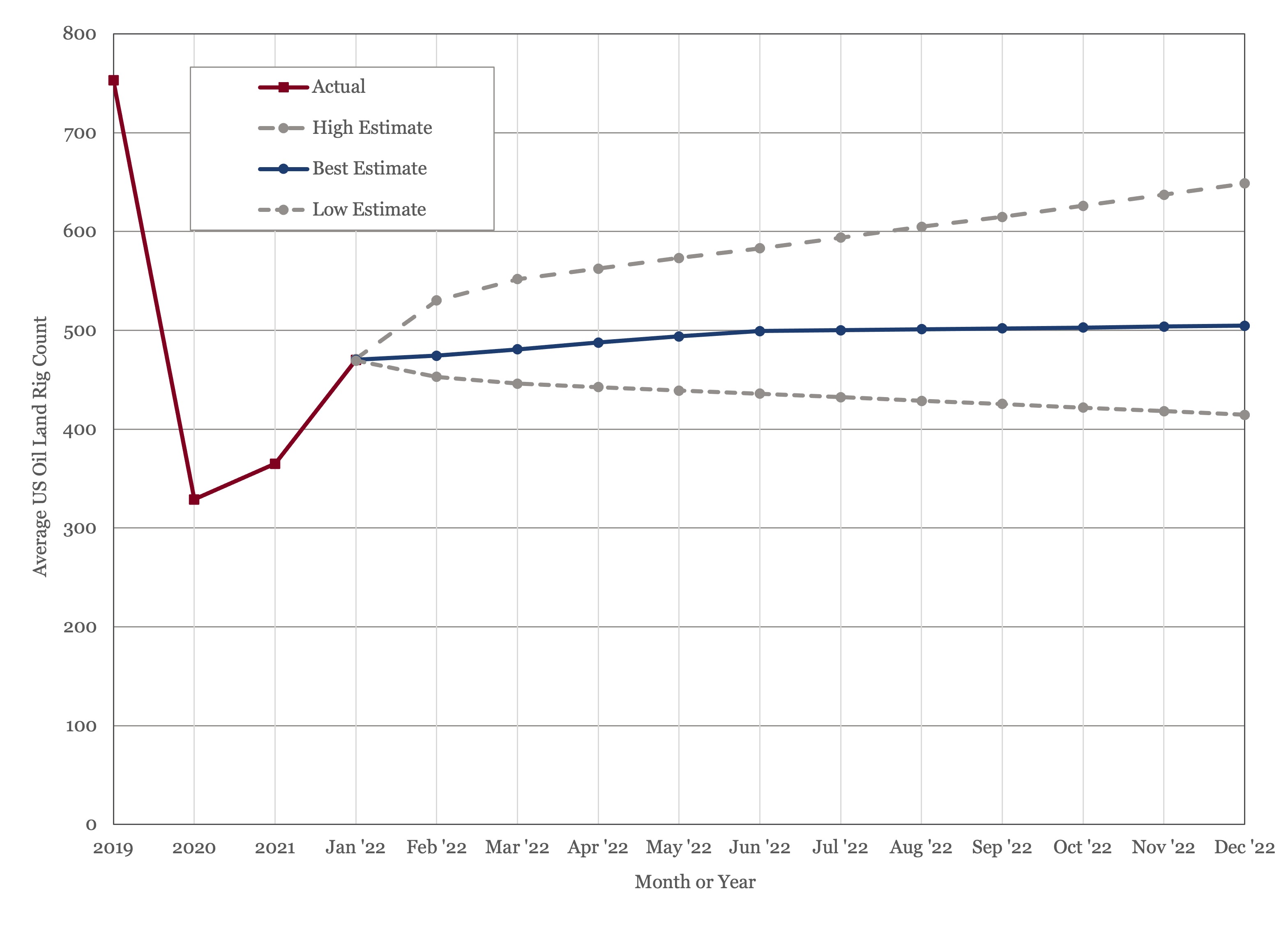

- After growing slowly for a couple of weeks, the US land oil rig count jumped sharply to 498, at the same time as Citi voiced concerns that the first cracks were starting to show in US shale capital discipline.

Oil Supply and Demand

Demand estimates for 2022 from all three main reporting agencies converged this month on 100.6 MMbbl/day through very different routes. The IEA (1) upgraded their 2022 demand estimate by 700,000 bbl/day from 99.9 MMbbl/day to 100.6 MMbbl/day. This was not, however, caused by a perceived strengthening in demand month over month, but rather by a change in their assessment methodology and historic revisions. The EIA (2) added 100,000 bbl/day to its 2022 estimate, bringing in to 100.6 MMbbl/day. OPEC (3) again held their demand estimate flat at 100.6 MMbbl/day for 2022. As we use the IEA demand figures in our supply and demand balance, this revision had a significant impact on our model this month.

Saudi Aramco issued a warning that oil demand is close to pre-pandemic levels, despite a delayed recovery in aviation (4). Bloomberg reported that the four-week average for total oil product supplied in the US surged to nearly 22 MMbbl/day, the highest level on record (5). At the same time as demand is hitting new records, the US seems to be pursuing policies that would expand oil demand. Arizona’s Mark Kelly and New Hampshire’s Maggie Hassan, two Democratic Senators facing reelection in this year’s mid-terms, introduced legislation on Wednesday 9th that would suspend the 18.4 cent/ gallon federal gas tax through the remainder of 2022 (6).

As demand estimates continue to rise, further supply headwinds emerge. The OPEC+ group of nations added a further 400,000 bbl/day of supply for March (7), but data from January saw the spread between quota and actual production continue to widen, from 790,000 bbl/day in December to 900,000 bbl/day in January (8).

There was mixed supply news from the US, which once again released oil from the Strategic Petroleum Reserve in an attempt to contain prices (9), while a Federal Judge invalidated last November’s lease 80-million-acre Gulf of Mexico Lease sale (10). This news appeared to be welcomed by the Department of Interior, who said in a statement that there were “serious deficiencies in the federal oil and gas program”. There is also concern within the US oil and gas industry over the Biden Administrations nominee for Vice Chair for Supervision at the Federal Reserve, Sarah Bloom Raskin. Forty-one industry organizations sent a joint letter to the Senate Committee on Banking, Housing and Urban Affairs raising concerns with her appointment, citing previous statements she had made that the industry should be denied access to capital (11).

In a timely reminder that the US should not take the upstream oil and gas industry for granted, TotalEnergies announced that it was exiting North Platte, stating “The decision not to continue with the project was taken as the company has better opportunities of allocation of its capital within its global portfolio,” (12). North Platte is one of the more promising inboard Paleogene fields, the latest frontier in the US Gulf of Mexico. What makes TotalEnergies’s decision even more concerning is that it comes late in the development cycle; North Platte has been in FEED since 2019, suggesting that TotalEnergies’s US outlook must have changed significantly over the last couple of years.

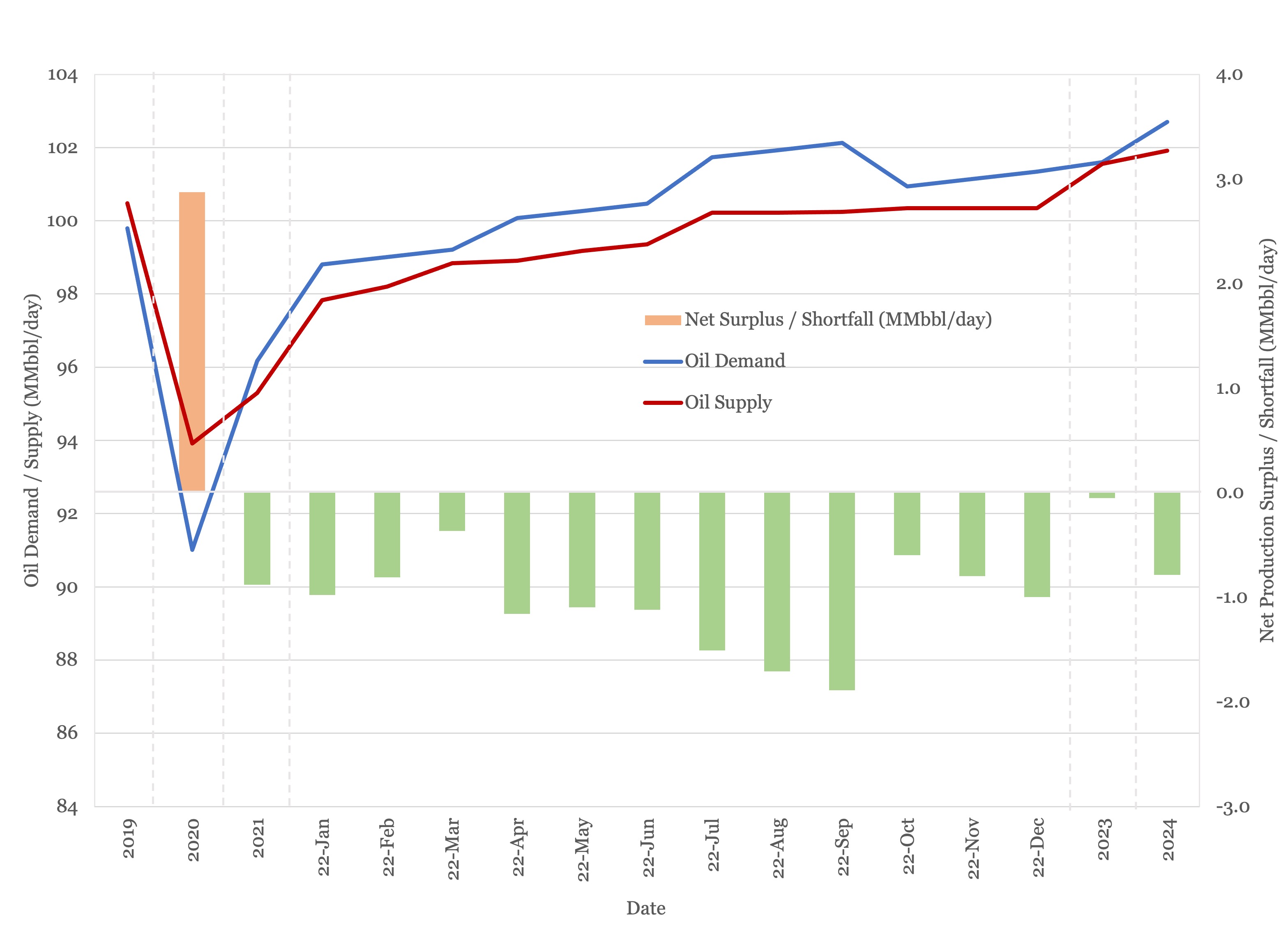

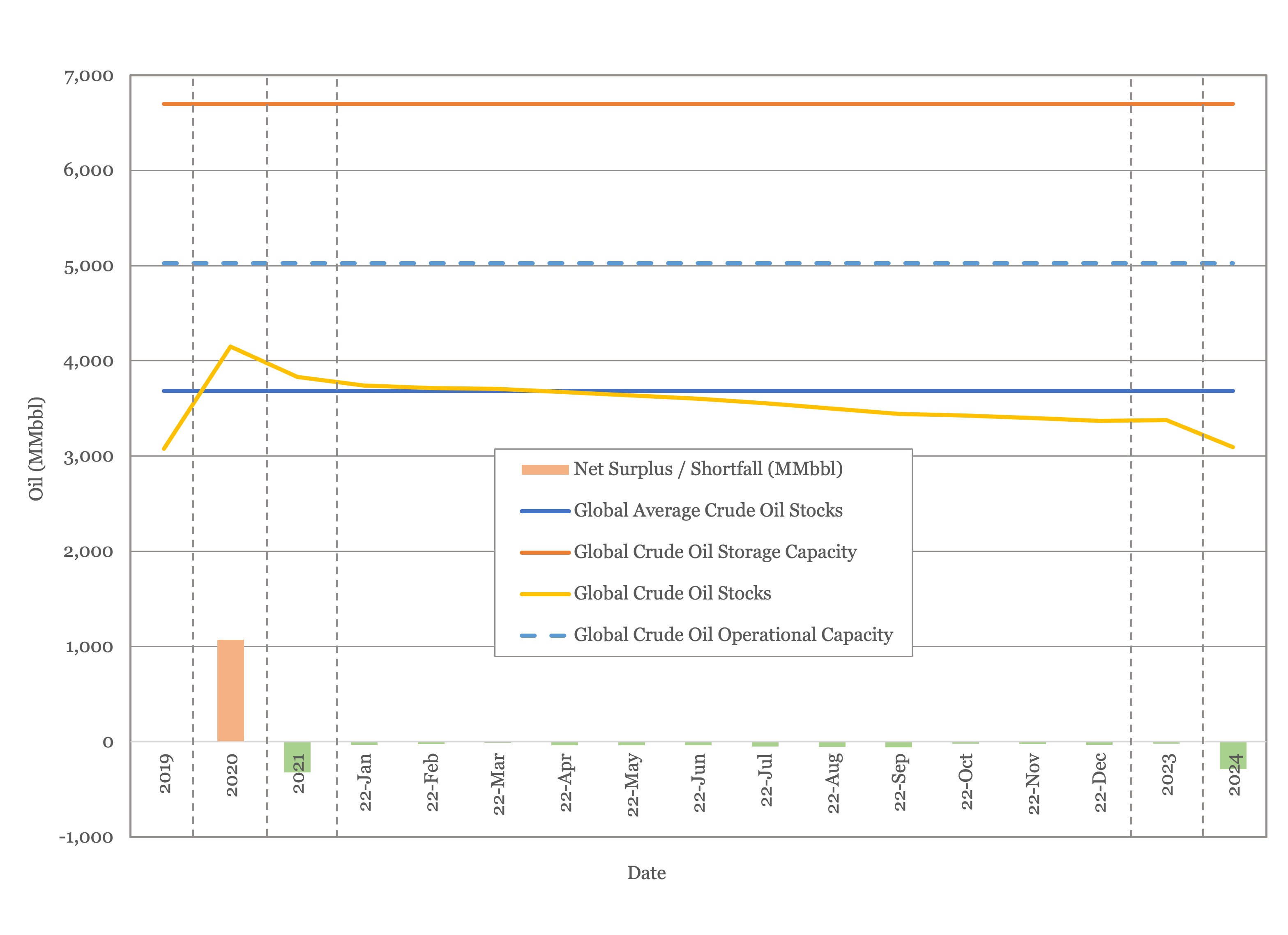

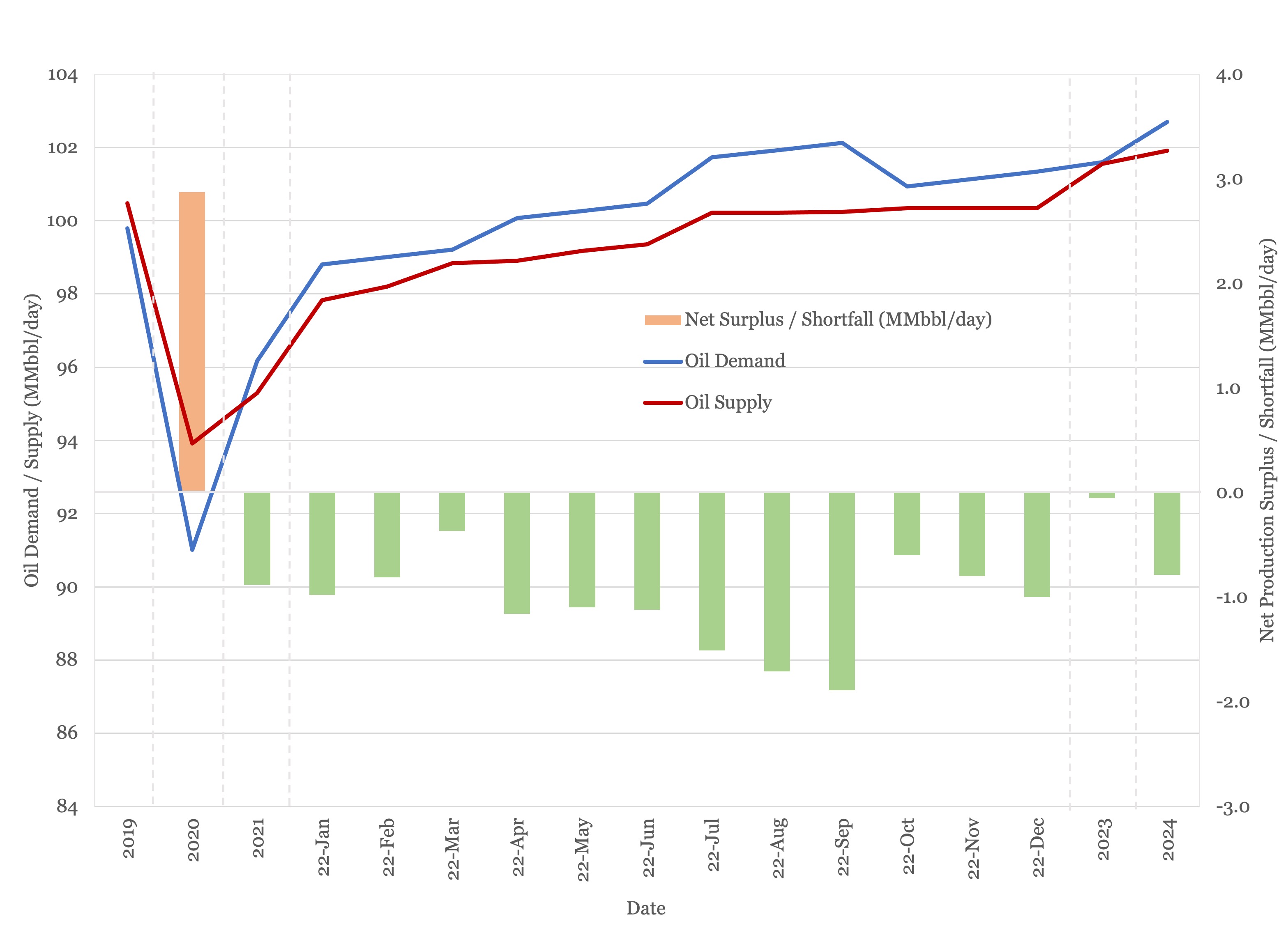

The revision in the IEA’s demand estimate, coupled with a steady supply outlook, means that we now predict a supply deficit through 2022 and beyond, as shown in Figure 1, whereas last month we saw a market that was largely in balance.

Figure 1 - Supply and Demand Surplus Forecast

The global approach to carbon abatement has, to this point, focused more on reducing supply through regulation and capital access restrictions than it has on limiting demand. A couple of articles published over the last month have started to explore the implications of this.

The first article by the New York Times, concludes that if tension emerges between climate ambition and energy reliability and affordability, then climate ambition will lose (13). The second was a paper published by Rice University’s Baker Institute for Public Policy, which explores the risks and consequences of a world in which fossil fuel supply is cut before equivalent renewable alternatives are available; disruption and inflation resulting in unrest that will ultimately delay or derail the transition completely (14).

The last couple of years saw a decisive shift in the US and Europe in favor of an accelerated energy transition – just last year the IEA reported that to meet Paris agreement targets investment in oil development had to stop immediately. As the cost and the energy transition, and the amount of time required to invent, commercialize, and build out the required technology, becomes better understood, we expect sentiment to shift again, and that there will be growing societal acceptance that oil has an ongoing role in the energy mix that ongoing investment will be required to maintain affordable, stable energy supplies.

Oil Storage

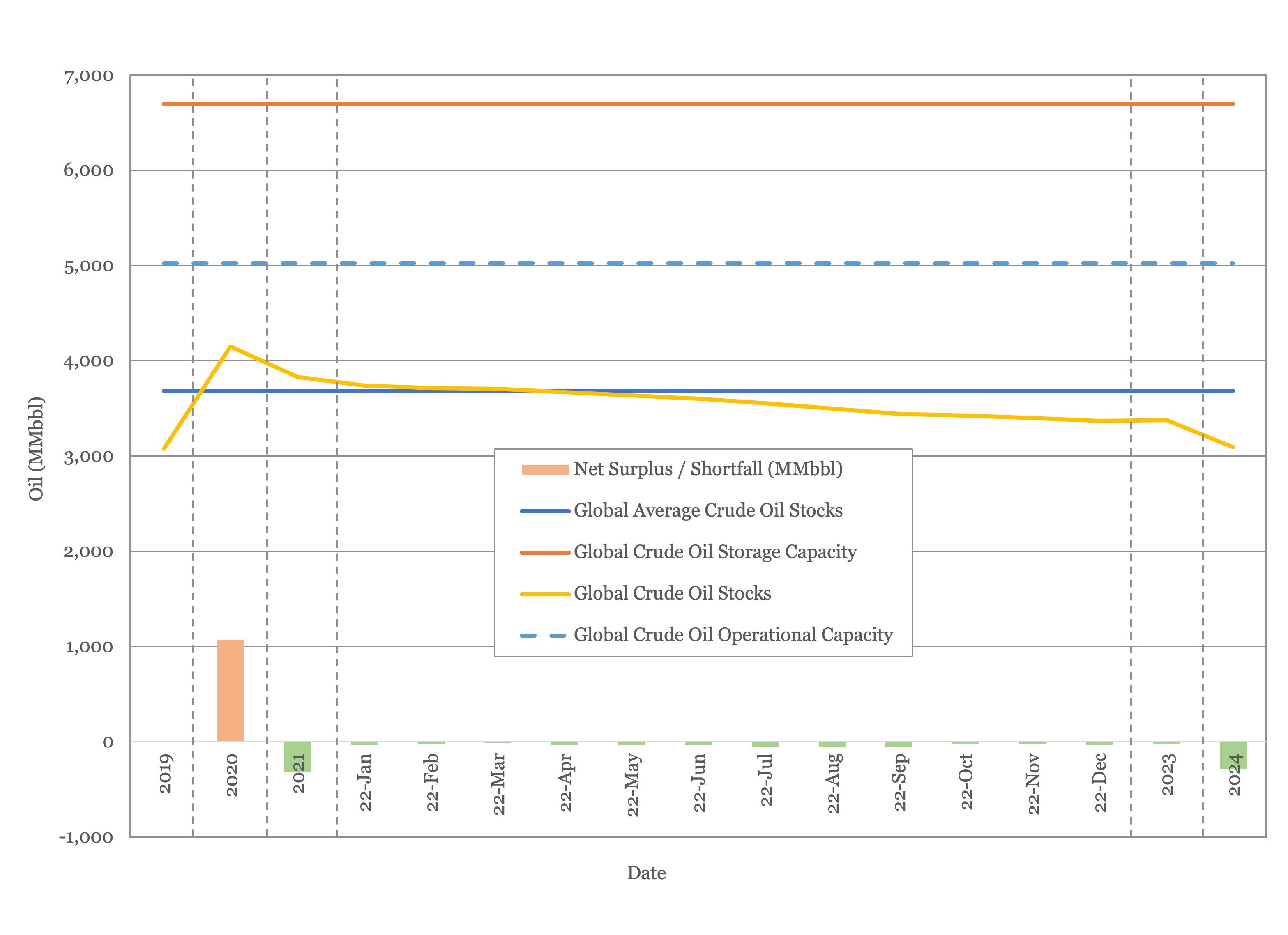

We estimate global oil inventory drawdowns of 321 MMbbl in 2021, following a build of 1,027 MMbbl in 2020. With this month’s sharply higher estimates for 2022 demand and a growing OPEC+ production shortfall, we expect a drawdown of 432 MMbbl for 2022. Figure 2 shows global storage capacity and inventories, which indicate inventory will fall below the five-year average in the first quarter of this year and continue to decline from there. We are starting to see this physical impact, with the US reporting their lowest stock levels since 2018 (5).

Figure 2 - Global Storage Chart

Oil Prices

Oil prices recorded their strongest January gain in 30 years, on a tight supply and demand picture and threat of a Russian invasion of the Ukraine (15). Paul Sheldon of S&P Global Platts thinks global spare production capacity is only about 2.6 MMbbl/day, which would cover just over half of Russian oil exports (16).

At the time of writing, oil prices were up again, with Brent above $96/bbl and WTI above $95/bbl. The EIA revised their average 2022 Brent price up by $8/bbl to $83/bbl (2) and several Wall Street analysts predicted $100/bbl by the summer (17). Natasha Kaneva of JP Morgan predicts that prices will spike to $120/bbl if Russia invades Ukraine but will only fall to $84/bbl in tensions ease (18).

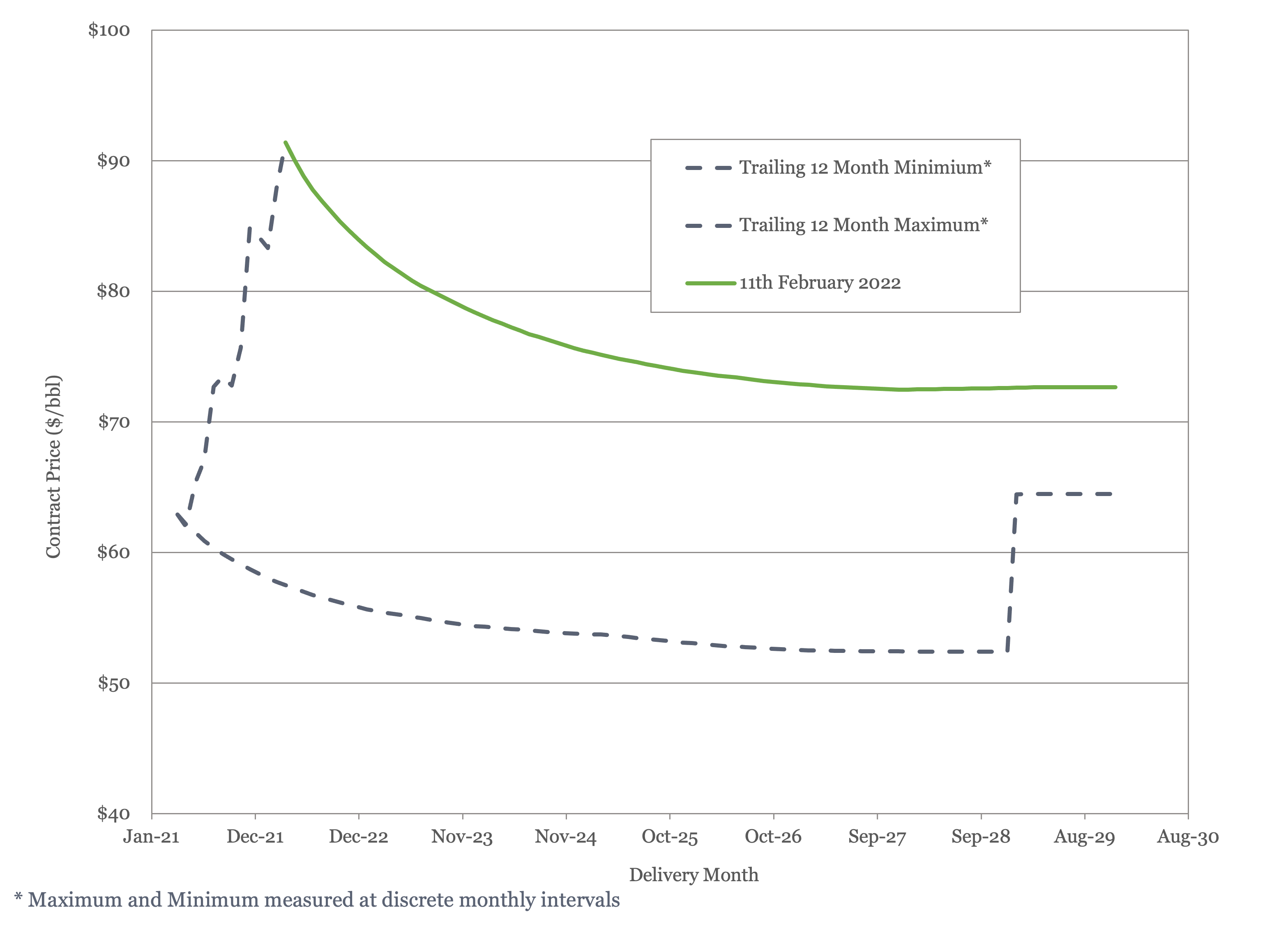

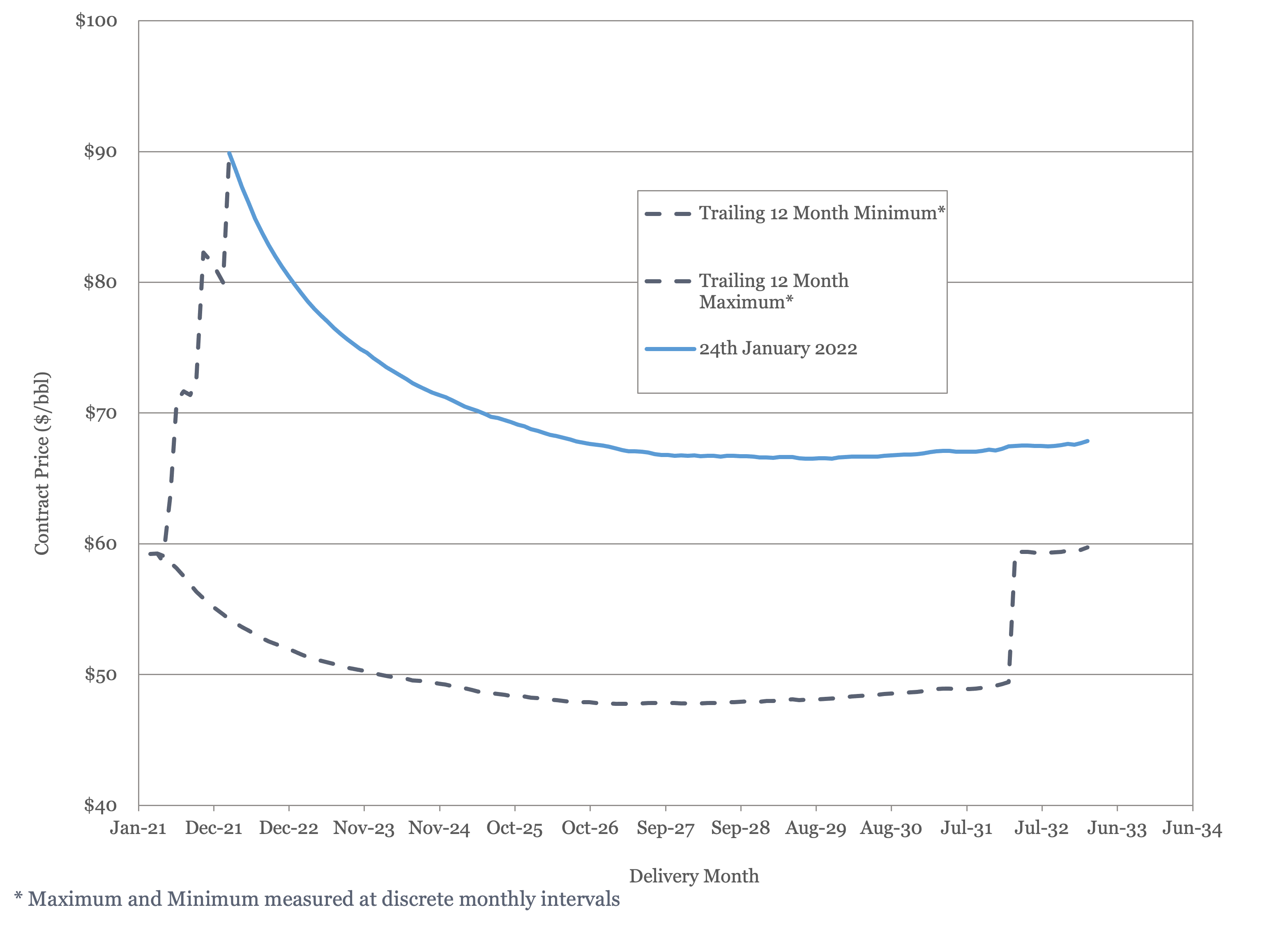

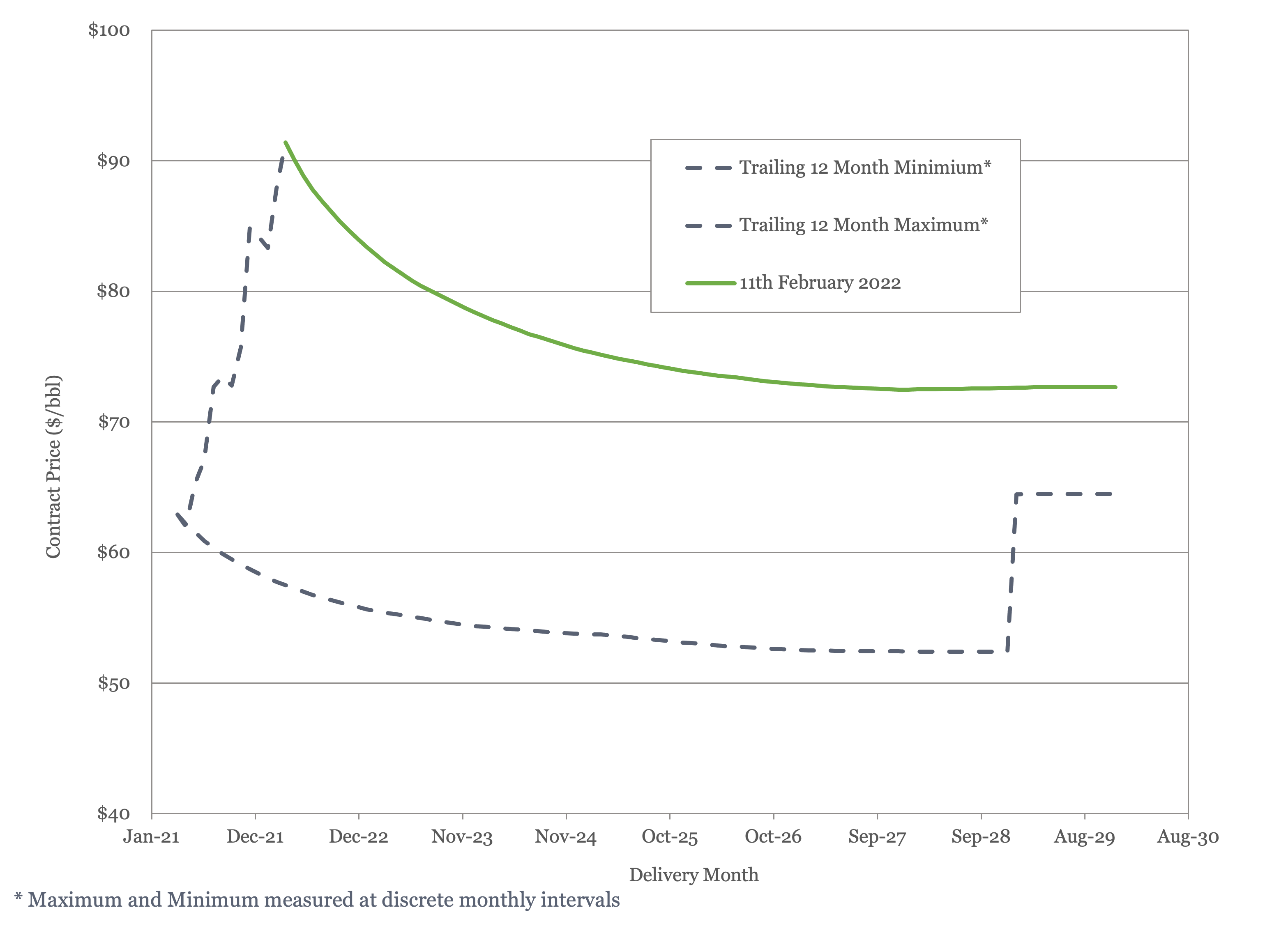

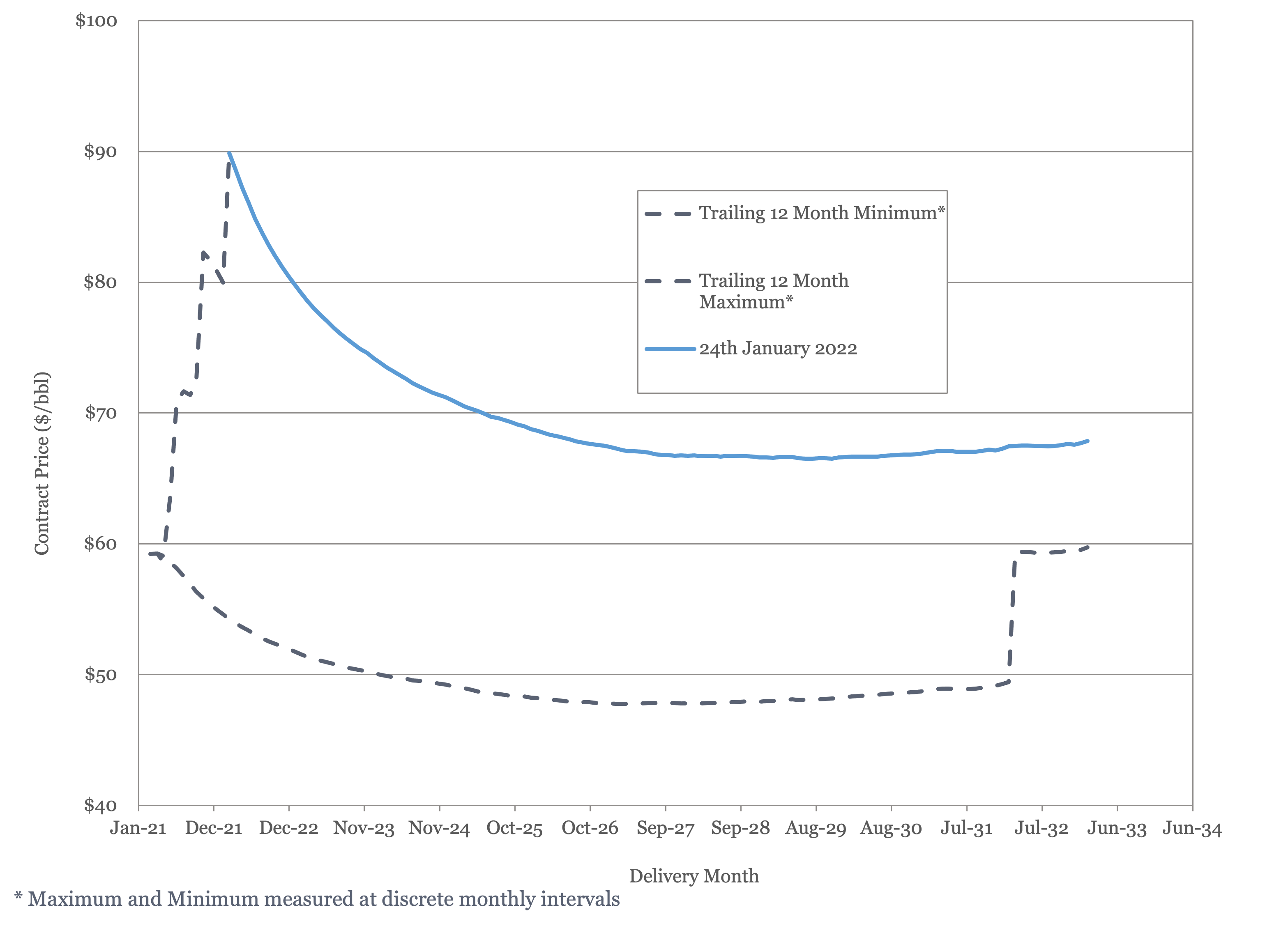

Both Brent and WTI futures rose; at the time of writing both are at the top of their 12-month averages through their entire contract periods. Brent is above $70/bbl out to 2030, with WTI above $65/bbl out to 2033.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

US Activity

After rising slowly, the US land oil rig count jumped by 19 rigs last week to 498. Our US land rig count forecast is shown in Figure 5, below. The current trajectory would place the rig count for the year between our best estimate and high cases. Citi warned of the first cracks emerging in US capital discipline, estimating that budgets will rise by 40% this year (19).

Figure 5 - US Land Oil Rig Count

(1) Oil Market Report – February 2022, IEA, Paris.

(2) Short Term Energy Outlook (STEO), February 8th, 2022, U.S. Energy Information Administration.

(3) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, February 10th, 2022.

(4) “Saudi Aramco sees oil demand near pre-pandemic levels”, Reema Alothman and Matthew Martin, World Oil, January 24th, 2022.

(5) “U.S. oil market heats up further as demand surges to record”, Devika Krishna Kumar and Chunzi Xu, World Oil, February 9th, 2022

(6) “Suspend the Gas Tax, They Cried”, Wall Street Journal, February 11th, 2022.

(7) "25th OPEC and non-OPEC Ministerial Meeting concludes”, Organization of the Petroleum Exporting Countries, February 2nd, 2022

(8) “Oil Price Rise Blamed in Part on OPEC, Russian Output Shortfalls”, Benoit Faucon and Summer Said, Wall Street Journal, January 25th, 2022.

(9) “U.S. clears second-largest ever loan of oil from strategic reserve”, Ari Natter and Sheela Tobben, World Oil, January 25th, 2022.

(10) “Federal Judge Blocks Gulf of Mexico Drilling Leases, Citing Environmental Concerns”, Katy Stech Ferek, The Wall Street Journal, January 27th, 2022.

(11) “Joint Letter by 41 Organizations Opposing the Nomination of Sarah Bloom Raskin as Vice Chair for Supervision at the Federal Reserve”, January 28thth, 2022, Western Energy Alliance.

(12) "TotalEnergies Withdraws from North Platte Deepwater Project in Gulf of Mexico”, Bartolomej Tomic, Offshore Engineer, February 10th, 2022.

(13) “Russia Isn’t a Dead Petrostate, and Putin Isn’t Going Anywhere”, Meghan L. O’Sullivan and Jason Bordhoff, The New York Times, January 27th, 2022.

(14) “Energy Transition Valley of Death”, Gabriel Collins and Michelle Michot Foss, Rice University’s Baker Institute for Public Policy, January 27th, 2022.

(15) “Oil Records Strongest January in Over Thirty Years”, Julia Fanzeres, Bloomberg, January 31st, 2022.

(16) “OPEC grapples with precariously balanced oil market", The Economist, February 5th, 2022, Edition

(17) “What’s Behind Wall Street’s $100 Oil Forecast”, Ryan Dezember, The Wall Street Journal, January 27th, 2022.

(18) “Commodities traders brace for a war in Ukraine”, The Economist, January 29th, 2022.

(19) “This could be when shale driller discipline cracks, Citi warns”, David Wethe, World Oil, February 8th, 2022.

Oil Market Forecast - February 2022

Summary

It has been another busy month for the oil markets, as they recorded their strongest January in 30 years. Demand is surging, while supply is struggling to keep pace and geopolitical tensions exacerbate a limited supply cushion. The tone of the energy transition debate also appears to be shifting, with some acknowledgement in the media and academia that fossil fuels will continue to play a greater role in the energy mix for longer than had been anticipated over the last couple of years.

A few key points:

- The IEA raised its 2022 oil demand estimate by 700,000 bbl/day to 100.6 MMbbl/day, bringing it into line who the EIA and OPEC.

- OPEC+ raised output quotes for March by 400,000 bbl/day, but the spread between actual production and quotas widened again in January.

- US energy policy continues to confuse, with moves to suspend gasoline taxes and tap the SPR on one hand, while the Department of the Interior appeared to welcome a Federal Judge’s decision to invalidate last November’s lease sale on the other.

- TotalEnergies announced it would relinquish its North Platte interest to pursue more profitable options within its portfolio.

- Rice University’s Baker Institute of Public Policy published a paper on the risks to the energy transition of cutting off fossil fuel supply before replacing it with a viable alternative.

- Oil prices remain shy of $100/barrel but jumped again on a tight market and geopolitical tensions.

- After growing slowly for a couple of weeks, the US land oil rig count jumped sharply to 498, at the same time as Citi voiced concerns that the first cracks were starting to show in US shale capital discipline.

Oil Supply and Demand

Demand estimates for 2022 from all three main reporting agencies converged this month on 100.6 MMbbl/day through very different routes. The IEA (1) upgraded their 2022 demand estimate by 700,000 bbl/day from 99.9 MMbbl/day to 100.6 MMbbl/day. This was not, however, caused by a perceived strengthening in demand month over month, but rather by a change in their assessment methodology and historic revisions. The EIA (2) added 100,000 bbl/day to its 2022 estimate, bringing in to 100.6 MMbbl/day. OPEC (3) again held their demand estimate flat at 100.6 MMbbl/day for 2022. As we use the IEA demand figures in our supply and demand balance, this revision had a significant impact on our model this month.

Saudi Aramco issued a warning that oil demand is close to pre-pandemic levels, despite a delayed recovery in aviation (4). Bloomberg reported that the four-week average for total oil product supplied in the US surged to nearly 22 MMbbl/day, the highest level on record (5). At the same time as demand is hitting new records, the US seems to be pursuing policies that would expand oil demand. Arizona’s Mark Kelly and New Hampshire’s Maggie Hassan, two Democratic Senators facing reelection in this year’s mid-terms, introduced legislation on Wednesday 9th that would suspend the 18.4 cent/ gallon federal gas tax through the remainder of 2022 (6).

As demand estimates continue to rise, further supply headwinds emerge. The OPEC+ group of nations added a further 400,000 bbl/day of supply for March (7), but data from January saw the spread between quota and actual production continue to widen, from 790,000 bbl/day in December to 900,000 bbl/day in January (8).

There was mixed supply news from the US, which once again released oil from the Strategic Petroleum Reserve in an attempt to contain prices (9), while a Federal Judge invalidated last November’s lease 80-million-acre Gulf of Mexico Lease sale (10). This news appeared to be welcomed by the Department of Interior, who said in a statement that there were “serious deficiencies in the federal oil and gas program”. There is also concern within the US oil and gas industry over the Biden Administrations nominee for Vice Chair for Supervision at the Federal Reserve, Sarah Bloom Raskin. Forty-one industry organizations sent a joint letter to the Senate Committee on Banking, Housing and Urban Affairs raising concerns with her appointment, citing previous statements she had made that the industry should be denied access to capital (11).

In a timely reminder that the US should not take the upstream oil and gas industry for granted, TotalEnergies announced that it was exiting North Platte, stating “The decision not to continue with the project was taken as the company has better opportunities of allocation of its capital within its global portfolio,” (12). North Platte is one of the more promising inboard Paleogene fields, the latest frontier in the US Gulf of Mexico. What makes TotalEnergies’s decision even more concerning is that it comes late in the development cycle; North Platte has been in FEED since 2019, suggesting that TotalEnergies’s US outlook must have changed significantly over the last couple of years.

The revision in the IEA’s demand estimate, coupled with a steady supply outlook, means that we now predict a supply deficit through 2022 and beyond, as shown in Figure 1, whereas last month we saw a market that was largely in balance.

Figure 1 - Supply and Demand Surplus Forecast

The global approach to carbon abatement has, to this point, focused more on reducing supply through regulation and capital access restrictions than it has on limiting demand. A couple of articles published over the last month have started to explore the implications of this.

The first article by the New York Times, concludes that if tension emerges between climate ambition and energy reliability and affordability, then climate ambition will lose (13). The second was a paper published by Rice University’s Baker Institute for Public Policy, which explores the risks and consequences of a world in which fossil fuel supply is cut before equivalent renewable alternatives are available; disruption and inflation resulting in unrest that will ultimately delay or derail the transition completely (14).

The last couple of years saw a decisive shift in the US and Europe in favor of an accelerated energy transition – just last year the IEA reported that to meet Paris agreement targets investment in oil development had to stop immediately. As the cost and the energy transition, and the amount of time required to invent, commercialize, and build out the required technology, becomes better understood, we expect sentiment to shift again, and that there will be growing societal acceptance that oil has an ongoing role in the energy mix that ongoing investment will be required to maintain affordable, stable energy supplies.

Oil Storage

We estimate global oil inventory drawdowns of 321 MMbbl in 2021, following a build of 1,027 MMbbl in 2020. With this month’s sharply higher estimates for 2022 demand and a growing OPEC+ production shortfall, we expect a drawdown of 432 MMbbl for 2022. Figure 2 shows global storage capacity and inventories, which indicate inventory will fall below the five-year average in the first quarter of this year and continue to decline from there. We are starting to see this physical impact, with the US reporting their lowest stock levels since 2018 (5).

Figure 2 - Global Storage Chart

Oil Prices

Oil prices recorded their strongest January gain in 30 years, on a tight supply and demand picture and threat of a Russian invasion of the Ukraine (15). Paul Sheldon of S&P Global Platts thinks global spare production capacity is only about 2.6 MMbbl/day, which would cover just over half of Russian oil exports (16).

At the time of writing, oil prices were up again, with Brent above $96/bbl and WTI above $95/bbl. The EIA revised their average 2022 Brent price up by $8/bbl to $83/bbl (2) and several Wall Street analysts predicted $100/bbl by the summer (17). Natasha Kaneva of JP Morgan predicts that prices will spike to $120/bbl if Russia invades Ukraine but will only fall to $84/bbl in tensions ease (18).

Both Brent and WTI futures rose; at the time of writing both are at the top of their 12-month averages through their entire contract periods. Brent is above $70/bbl out to 2030, with WTI above $65/bbl out to 2033.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

US Activity

After rising slowly, the US land oil rig count jumped by 19 rigs last week to 498. Our US land rig count forecast is shown in Figure 5, below. The current trajectory would place the rig count for the year between our best estimate and high cases. Citi warned of the first cracks emerging in US capital discipline, estimating that budgets will rise by 40% this year (19).

Figure 5 - US Land Oil Rig Count

(1) Oil Market Report – February 2022, IEA, Paris.

(2) Short Term Energy Outlook (STEO), February 8th, 2022, U.S. Energy Information Administration.

(3) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, February 10th, 2022.

(4) “Saudi Aramco sees oil demand near pre-pandemic levels”, Reema Alothman and Matthew Martin, World Oil, January 24th, 2022.

(5) “U.S. oil market heats up further as demand surges to record”, Devika Krishna Kumar and Chunzi Xu, World Oil, February 9th, 2022

(6) “Suspend the Gas Tax, They Cried”, Wall Street Journal, February 11th, 2022.

(7) "25th OPEC and non-OPEC Ministerial Meeting concludes”, Organization of the Petroleum Exporting Countries, February 2nd, 2022

(8) “Oil Price Rise Blamed in Part on OPEC, Russian Output Shortfalls”, Benoit Faucon and Summer Said, Wall Street Journal, January 25th, 2022.

(9) “U.S. clears second-largest ever loan of oil from strategic reserve”, Ari Natter and Sheela Tobben, World Oil, January 25th, 2022.

(10) “Federal Judge Blocks Gulf of Mexico Drilling Leases, Citing Environmental Concerns”, Katy Stech Ferek, The Wall Street Journal, January 27th, 2022.

(11) “Joint Letter by 41 Organizations Opposing the Nomination of Sarah Bloom Raskin as Vice Chair for Supervision at the Federal Reserve”, January 28thth, 2022, Western Energy Alliance.

(12) "TotalEnergies Withdraws from North Platte Deepwater Project in Gulf of Mexico”, Bartolomej Tomic, Offshore Engineer, February 10th, 2022.

(13) “Russia Isn’t a Dead Petrostate, and Putin Isn’t Going Anywhere”, Meghan L. O’Sullivan and Jason Bordhoff, The New York Times, January 27th, 2022.

(14) “Energy Transition Valley of Death”, Gabriel Collins and Michelle Michot Foss, Rice University’s Baker Institute for Public Policy, January 27th, 2022.

(15) “Oil Records Strongest January in Over Thirty Years”, Julia Fanzeres, Bloomberg, January 31st, 2022.

(16) “OPEC grapples with precariously balanced oil market", The Economist, February 5th, 2022, Edition

(17) “What’s Behind Wall Street’s $100 Oil Forecast”, Ryan Dezember, The Wall Street Journal, January 27th, 2022.

(18) “Commodities traders brace for a war in Ukraine”, The Economist, January 29th, 2022.

(19) “This could be when shale driller discipline cracks, Citi warns”, David Wethe, World Oil, February 8th, 2022.

Explore Our Services

Business Development

Oil & Gas an extractive industry, participants must continuously find and develop new oil & gas fields as existing fields decline, making business development a continuous process.

Strategy

We approach strategy through a scenario driven assessment of the client’s current portfolio, organizational competencies, and financial framework. The strategy defines portfolio actions and coveted asset attributes.