Oil Market Forecast - July 2022

Summary

There has been a notable deterioration in economic sentiment over the last month, with some commentators, Nomura for example, now putting the chance of US recession by year end at more than 50%. While this has certainly impacted oil prices, oil demand expectations for the year have held fairly steady and OPEC was the latest institution to come out with a surprisingly bullish 2023 demand forecast. The supply picture remains clouded by uncertainty over Russian production, and the growing gap between what OPEC+ says and what OPEC+ does. Meanwhile, in the US, rigs are steadily being put back to work.

A few key points:

- The EIA and OPEC held their 2022 oil demand estimates steady, while the IEA downgraded their estimate by 200,000 bbl/day.

- OPEC published its first estimate for 2023 demand, they expect it to rise by 3% year on year to 103 MMbbl/day.

- We estimate oil supply reached 99.7 MMbbl/day in June.

- Crude oil dipped below $100/bbl, both Brent and WTI futures dipped sharply and remain inverted.

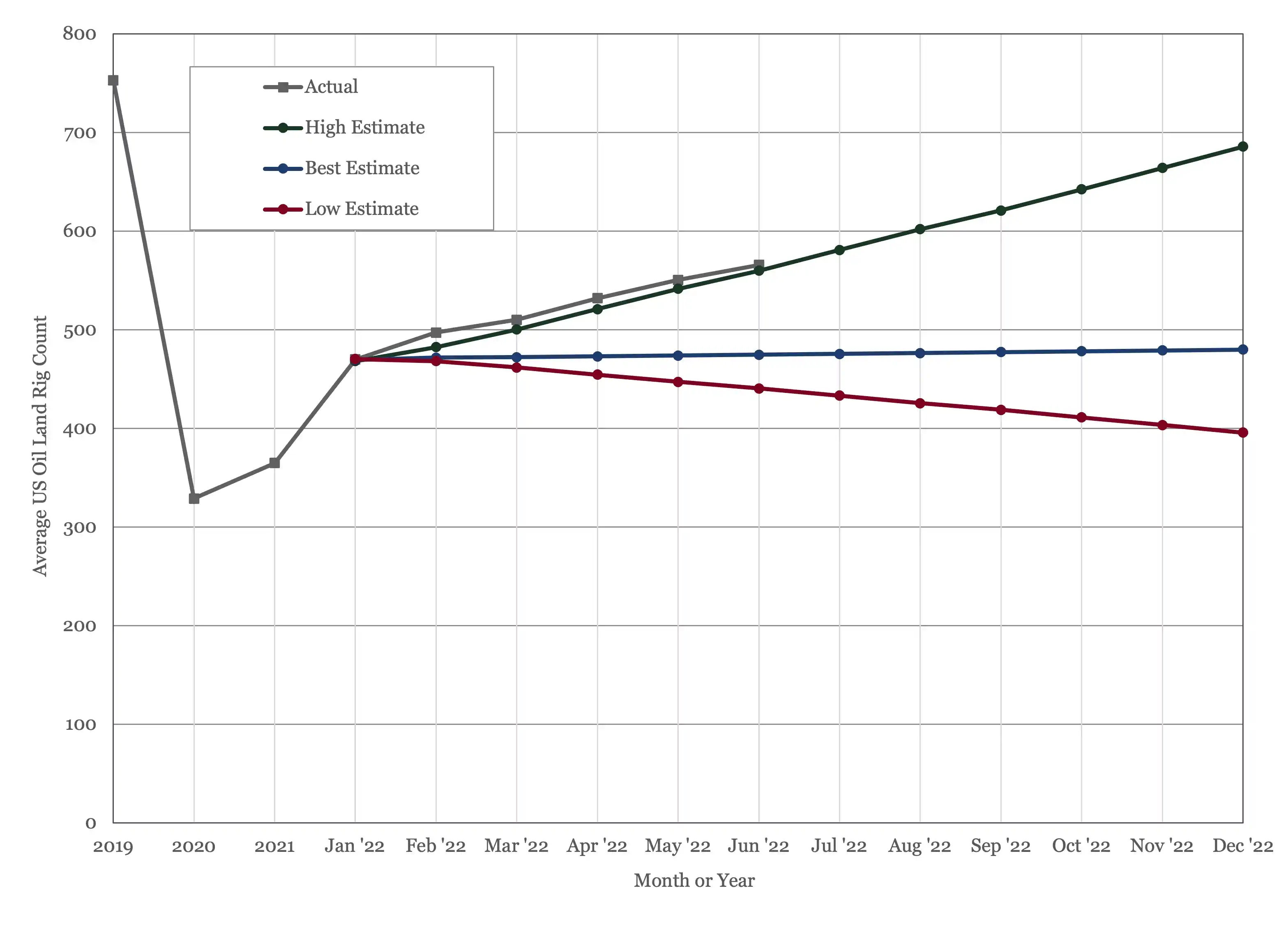

- The US land oil rig count continued to grow, hitting 577 on July 15th.

Oil Supply and Demand

The IEA (1) lowered their 2022 oil demand estimate by 200,000 bbl/day to 99.2 MMbbl/day. The EIA (2) and OPEC (3) kept their 2022 demand estimates flat at 99.6 MMbbl/day and 100.3 MMbbl/day respectively. The IEA lowered its 2023 demand prediction from 101.6 MMbbl/day to 101.3 MMbbl/day while the EIA raised theirs from 101.3 MMbbl/day to 101.6 MMbbl/day. OPEC published its first 2023 demand estimate, and came out swinging, at 103 MMbbl/day, a 3% jump. To put that figure in perspective, the IEA, in their Stated Policies forecast, do not expect oil demand to reach that level until 2029.

Participants at the 30th OPEC and non-OPEC Ministerial Meeting on June 30th (4), agreed to raise August production by 648,000 bbl/day, in line with last month’s increase. As noted in previous editions, these monthly announcements are becoming increasingly symbolic, as actual OPEC+ production increases have been falling further and further behind actual production. As of June, OPEC+ participants who are subject to supply targets were delivering 39.7 MMbbl/day against their target of 42.6 MMbbl/day, a shortfall of 2.9 MMbbl/day. This continued failure to hit production targets is concerning, as it calls into question the group’s actual production capacity. If OPEC+ was delivering against target this year, the oil market would be flooded and we would be dealing with another price collapse, so while it is a concern, it is also welcome.

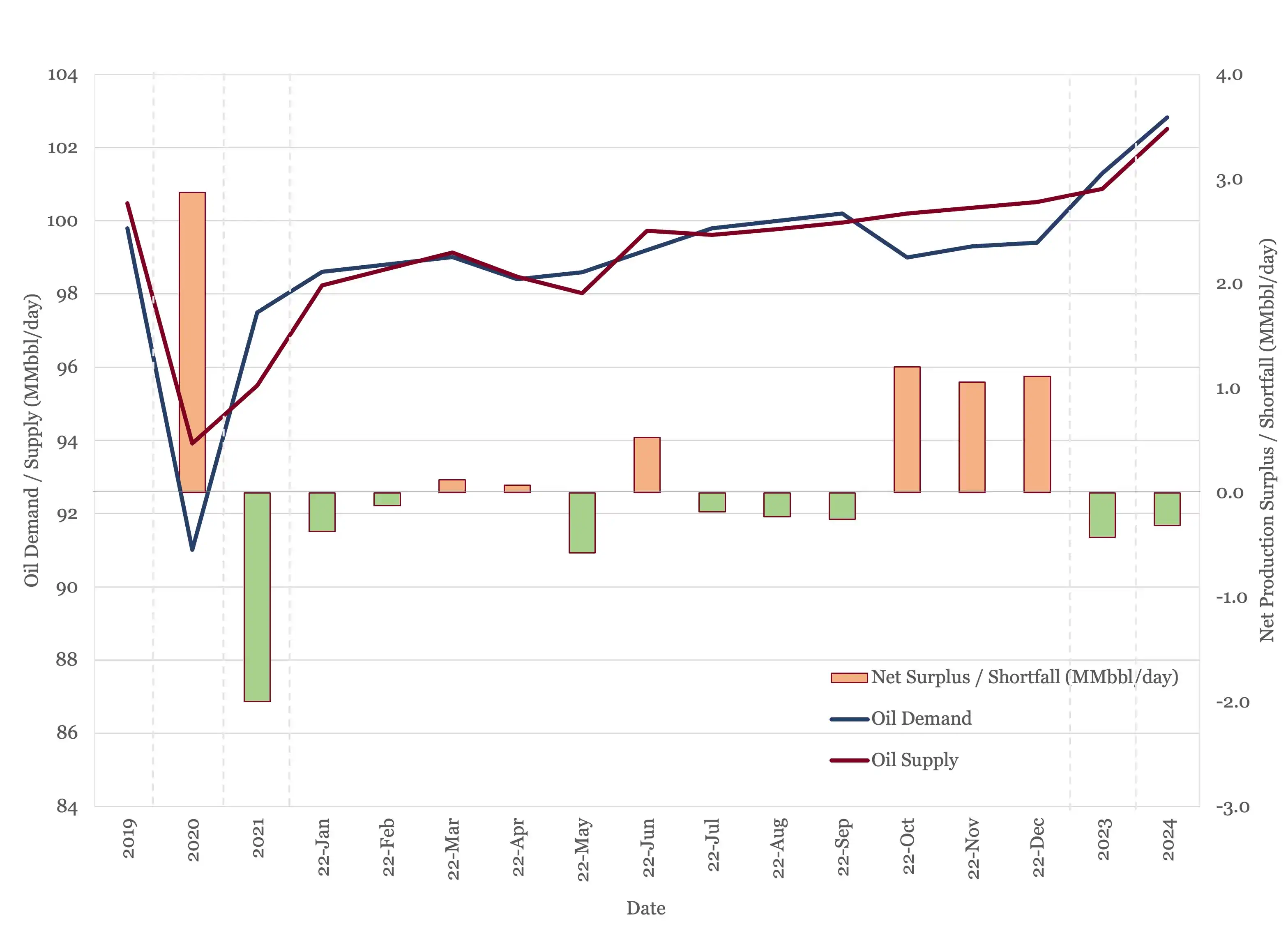

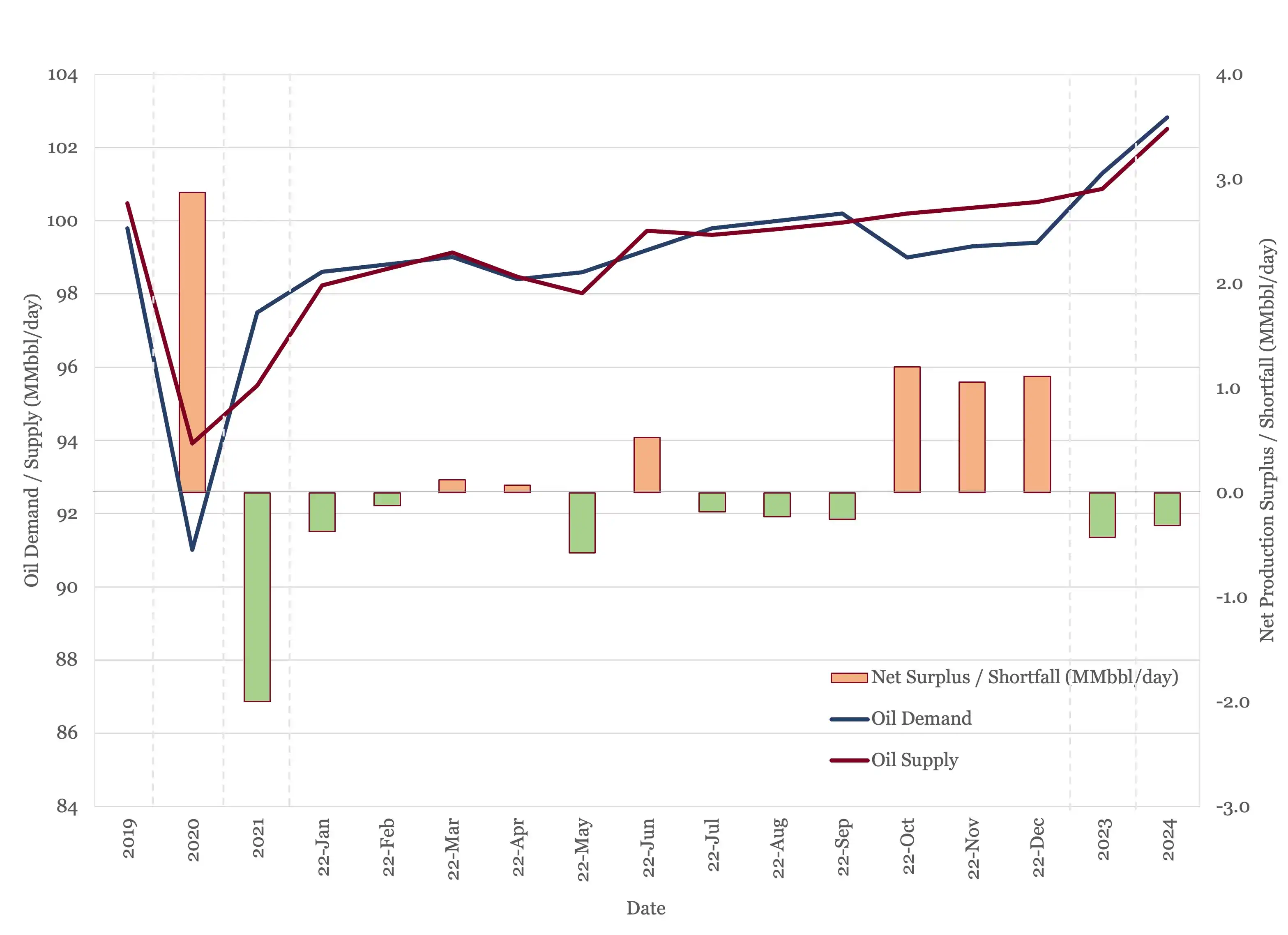

Our forecast has June supply at 99.7 MMbbl/day, largely on the back of increased production from Russia, China, and Canada. In general, our production forecast for the year is more optimistic this month, based mainly on higher estimates of Russian production. This has a more or less balanced market through to Q4, when it will shift into surplus, as shown in Figure 1.

Figure 1 - Supply and Demand Surplus Forecast

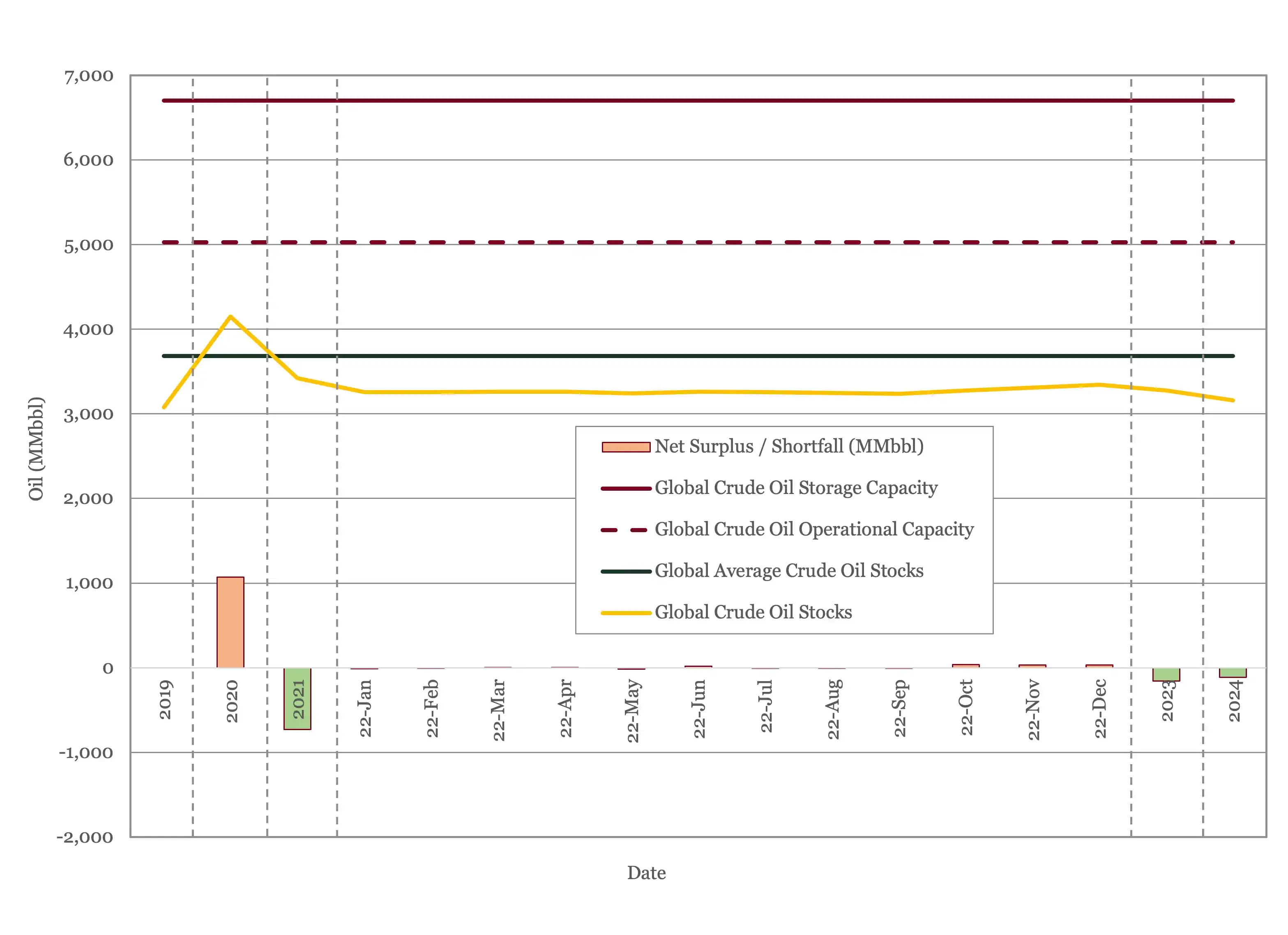

Oil Storage

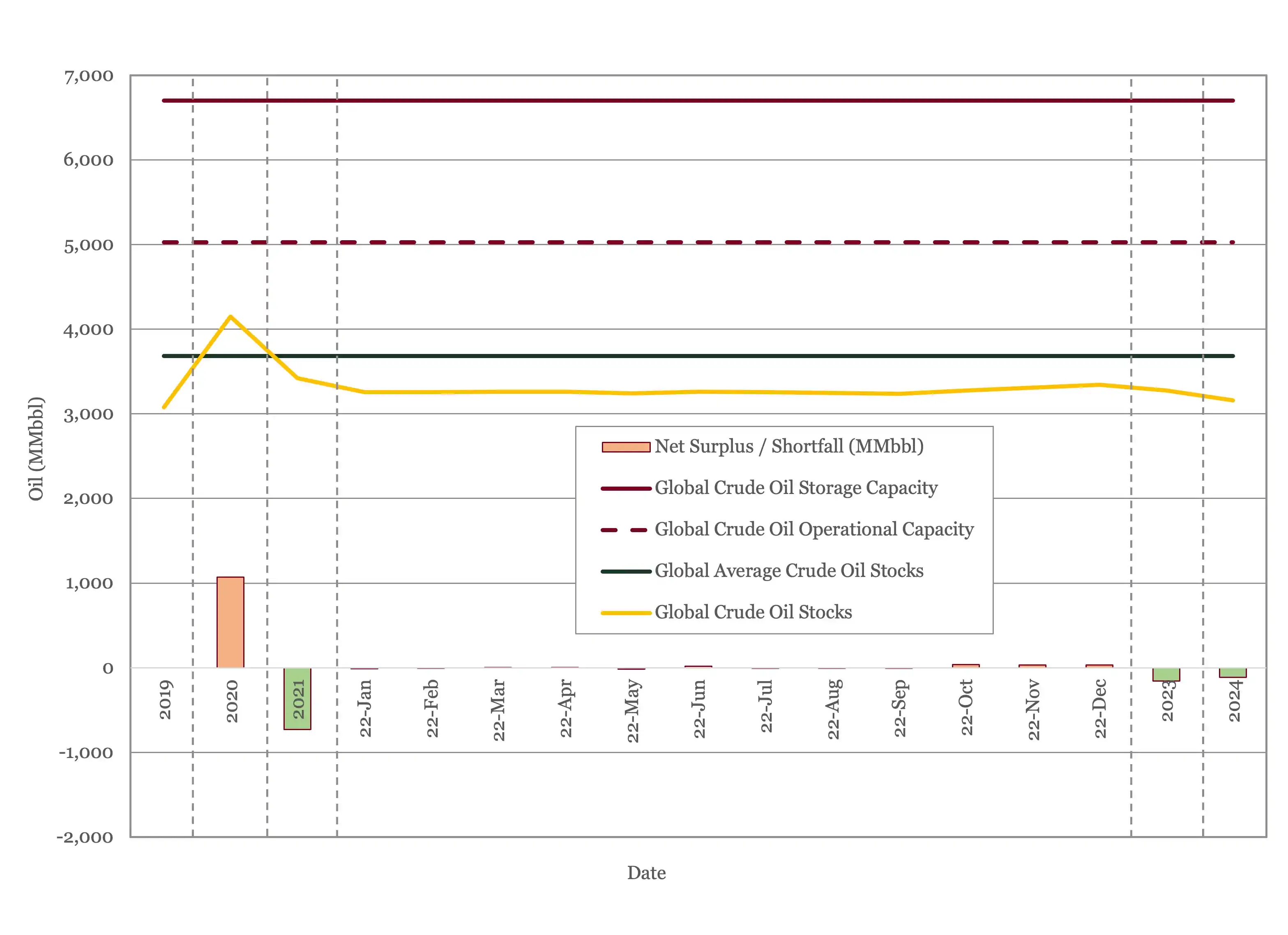

More optimistic supply and more pessimistic demand figures combine to give an oil stocks picture for the year that is essentially flat. We expect to see some stock draws in the third quarter, offset by builds in the fourth quarter, give a net addition for the year of 8MMbbl, as shown in Figure 2.

Figure 2 - Global Storage Chart

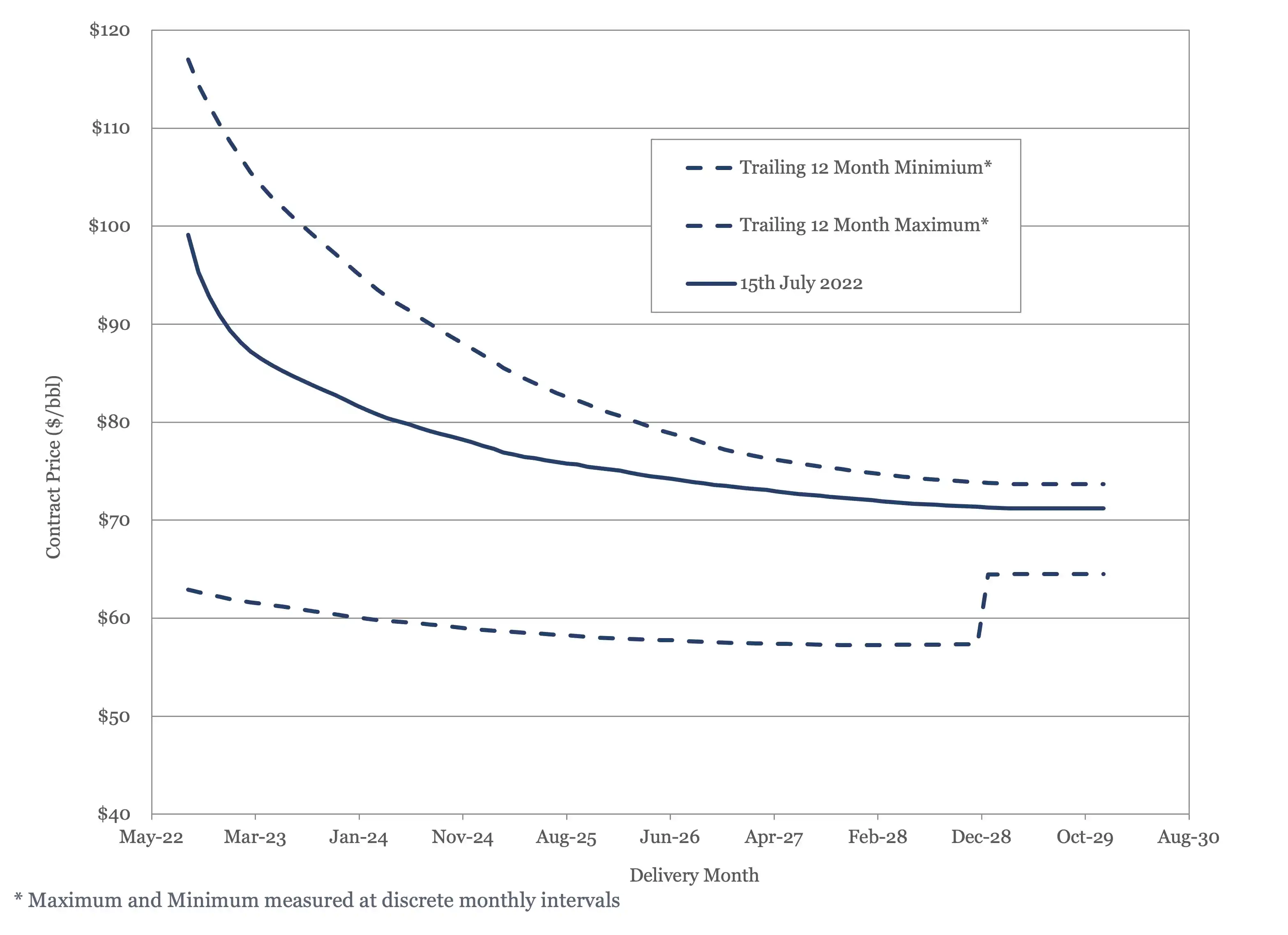

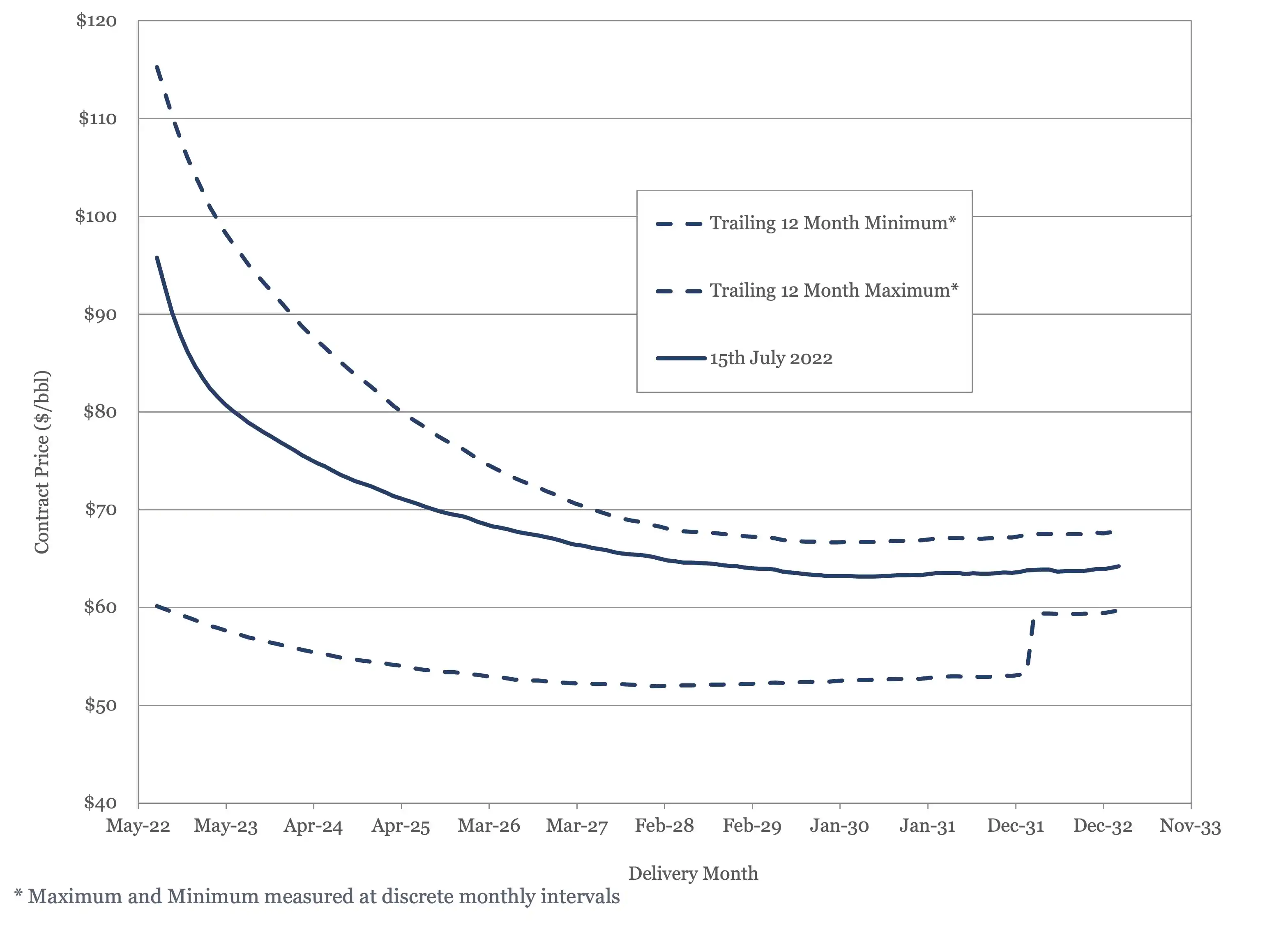

Oil Prices

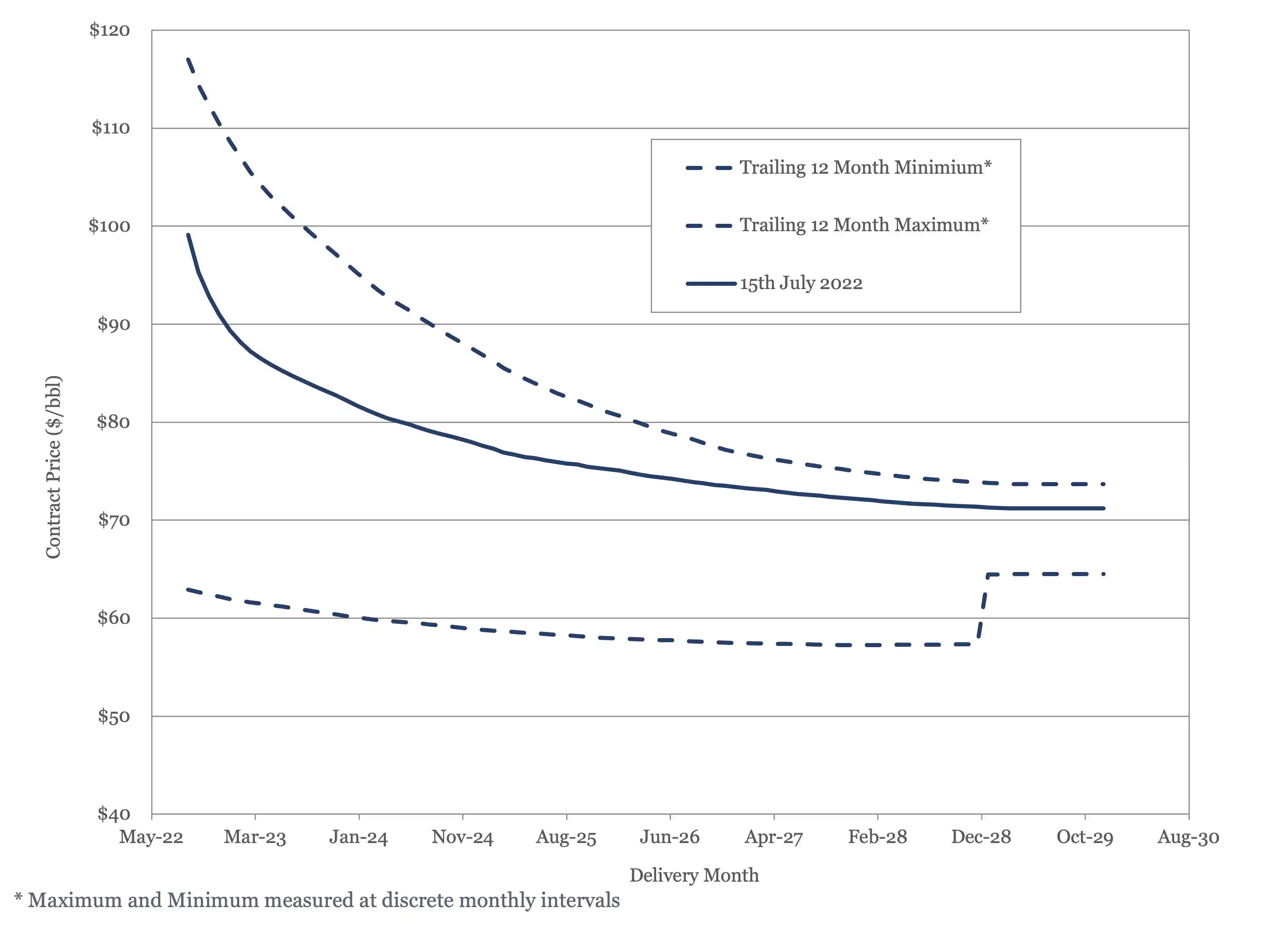

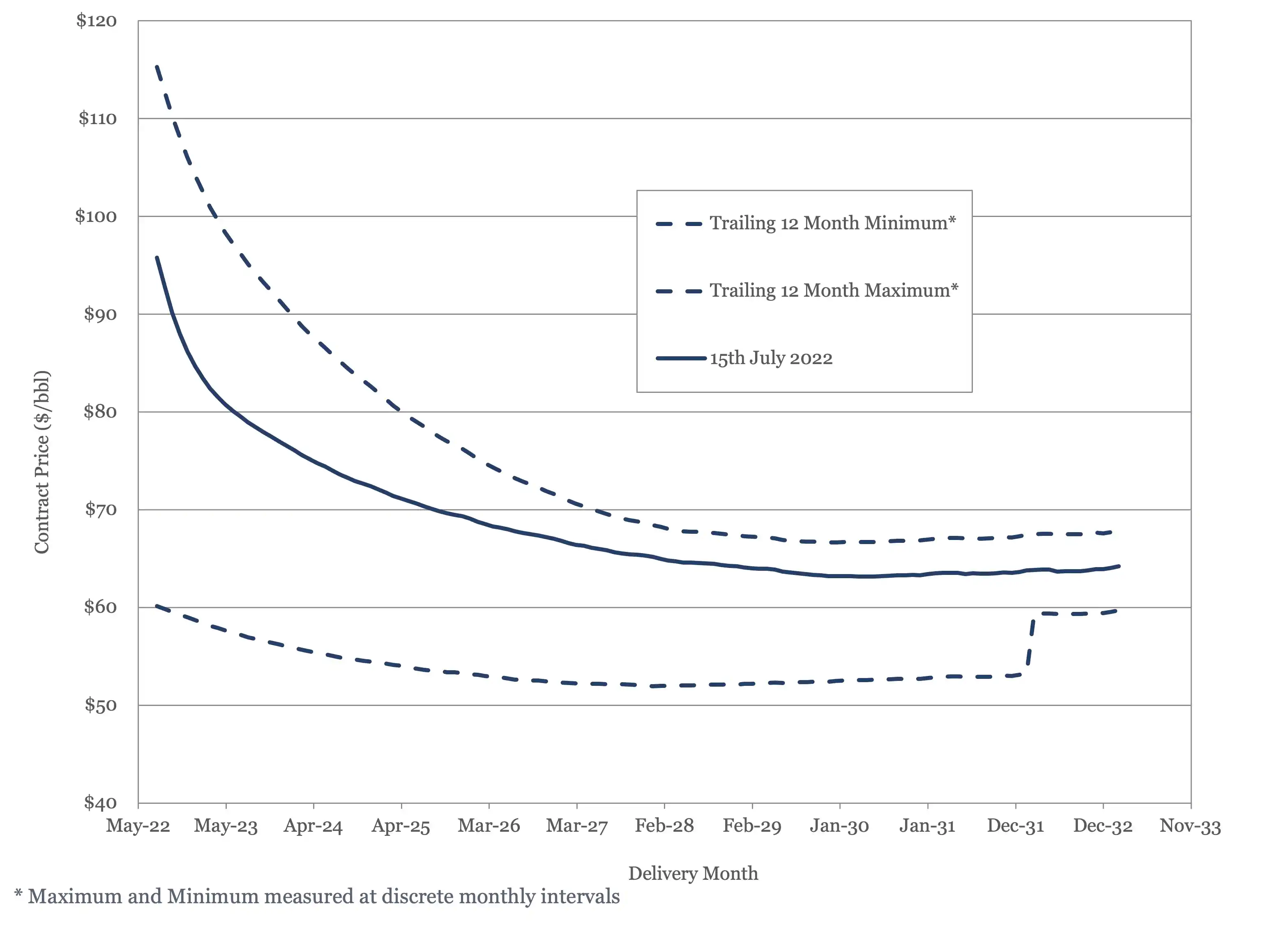

Crude oil dipped under the $100/bbl mark earlier this month. At the time of writing WTI is sitting at about $102/bbl. Both Brent and WTI futures were down sharply this month from last month’s highs.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

The present supply and demand balance doesn’t seem to justify current oil price levels. Stocks are below the 5 – year average, so there is an argument to support prices about the long-term average, but not at the $100/bbl and above level. Conversely, the outlook through 2025 is for the market to tighten, which should dictate rising prices over that period. This suggests we should see a normal, rather than an inverted, futures curve.

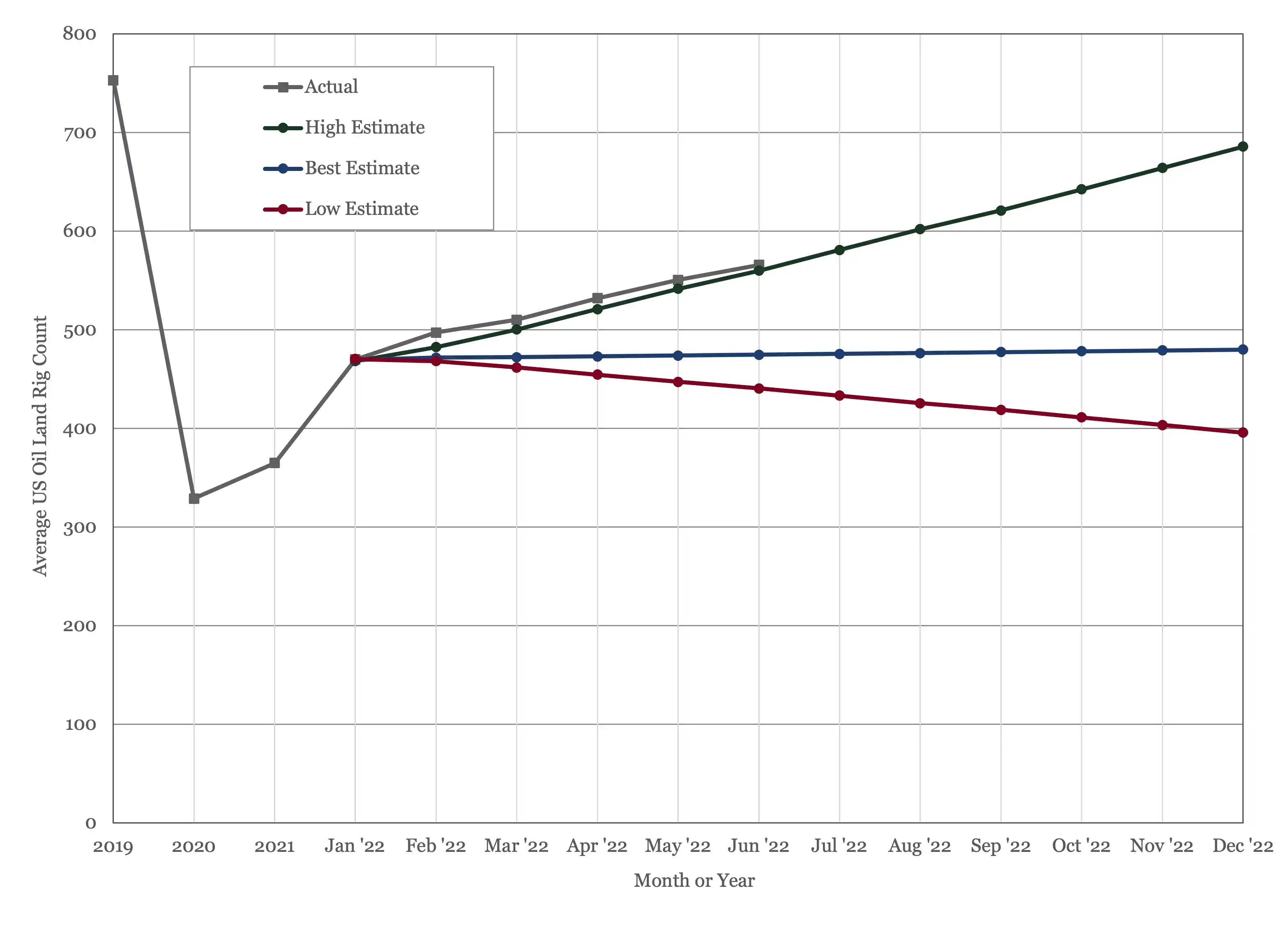

US Activity

The US land oil rig count continues to rise, hitting 577 on the 15th of July. It continues to track slightly above our most aggressive forecast, see Figure 5, but the gap is narrowing.

Figure 5 - US Land Oil Rig Count

(1) Oil Market Report – June 13th, 2022, IEA, Paris.

(2) Short Term Energy Outlook (STEO), July 12th, 2022, U.S. Energy Information Administration.

(3) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, July 12th, 2022.

(4) 30th OPEC and non-OPEC Ministerial Meeting, June 30th, 2022

Oil Market Forecast - July 2022

Summary

There has been a notable deterioration in economic sentiment over the last month, with some commentators, Nomura for example, now putting the chance of US recession by year end at more than 50%. While this has certainly impacted oil prices, oil demand expectations for the year have held fairly steady and OPEC was the latest institution to come out with a surprisingly bullish 2023 demand forecast. The supply picture remains clouded by uncertainty over Russian production, and the growing gap between what OPEC+ says and what OPEC+ does. Meanwhile, in the US, rigs are steadily being put back to work.

A few key points:

- The EIA and OPEC held their 2022 oil demand estimates steady, while the IEA downgraded their estimate by 200,000 bbl/day.

- OPEC published its first estimate for 2023 demand, they expect it to rise by 3% year on year to 103 MMbbl/day.

- We estimate oil supply reached 99.7 MMbbl/day in June.

- Crude oil dipped below $100/bbl, both Brent and WTI futures dipped sharply and remain inverted.

- The US land oil rig count continued to grow, hitting 577 on July 15th.

Oil Supply and Demand

The IEA (1) lowered their 2022 oil demand estimate by 200,000 bbl/day to 99.2 MMbbl/day. The EIA (2) and OPEC (3) kept their 2022 demand estimates flat at 99.6 MMbbl/day and 100.3 MMbbl/day respectively. The IEA lowered its 2023 demand prediction from 101.6 MMbbl/day to 101.3 MMbbl/day while the EIA raised theirs from 101.3 MMbbl/day to 101.6 MMbbl/day. OPEC published its first 2023 demand estimate, and came out swinging, at 103 MMbbl/day, a 3% jump. To put that figure in perspective, the IEA, in their Stated Policies forecast, do not expect oil demand to reach that level until 2029.

Participants at the 30th OPEC and non-OPEC Ministerial Meeting on June 30th (4), agreed to raise August production by 648,000 bbl/day, in line with last month’s increase. As noted in previous editions, these monthly announcements are becoming increasingly symbolic, as actual OPEC+ production increases have been falling further and further behind actual production. As of June, OPEC+ participants who are subject to supply targets were delivering 39.7 MMbbl/day against their target of 42.6 MMbbl/day, a shortfall of 2.9 MMbbl/day. This continued failure to hit production targets is concerning, as it calls into question the group’s actual production capacity. If OPEC+ was delivering against target this year, the oil market would be flooded and we would be dealing with another price collapse, so while it is a concern, it is also welcome.

Our forecast has June supply at 99.7 MMbbl/day, largely on the back of increased production from Russia, China, and Canada. In general, our production forecast for the year is more optimistic this month, based mainly on higher estimates of Russian production. This has a more or less balanced market through to Q4, when it will shift into surplus, as shown in Figure 1.

Figure 1 - Supply and Demand Surplus Forecast

Oil Storage

More optimistic supply and more pessimistic demand figures combine to give an oil stocks picture for the year that is essentially flat. We expect to see some stock draws in the third quarter, offset by builds in the fourth quarter, give a net addition for the year of 8MMbbl, as shown in Figure 2.

Figure 2 - Global Storage Chart

Oil Prices

Crude oil dipped under the $100/bbl mark earlier this month. At the time of writing WTI is sitting at about $102/bbl. Both Brent and WTI futures were down sharply this month from last month’s highs.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

The present supply and demand balance doesn’t seem to justify current oil price levels. Stocks are below the 5 – year average, so there is an argument to support prices about the long-term average, but not at the $100/bbl and above level. Conversely, the outlook through 2025 is for the market to tighten, which should dictate rising prices over that period. This suggests we should see a normal, rather than an inverted, futures curve.

US Activity

The US land oil rig count continues to rise, hitting 577 on the 15th of July. It continues to track slightly above our most aggressive forecast, see Figure 5, but the gap is narrowing.

Figure 5 - US Land Oil Rig Count

(1) Oil Market Report – June 13th, 2022, IEA, Paris.

(2) Short Term Energy Outlook (STEO), July 12th, 2022, U.S. Energy Information Administration.

(3) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, July 12th, 2022.

(4) 30th OPEC and non-OPEC Ministerial Meeting, June 30th, 2022

Explore Our Services

Business Development

Oil & Gas an extractive industry, participants must continuously find and develop new oil & gas fields as existing fields decline, making business development a continuous process.

Strategy

We approach strategy through a scenario driven assessment of the client’s current portfolio, organizational competencies, and financial framework. The strategy defines portfolio actions and coveted asset attributes.