Oil Market Forecast - November 2021

Summary

It’s been another eventful month in the oil & gas industry, not least of which was the COP 26 which ran over the first two weeks. We start this edition by looking at some of the notable announcements from the conference, although the content here is more qualitative than quantitative. While things have been quiet on the demand side, there was a fair amount of news on the supply side this month and we will have our first look at 2022 supply demand balance on a quarterly basis. Prices have also been volatile over the last month, and some of the Biden administration’s proposals for regulating the oil & gas industry are starting to take shape.

A few key points:

- The COP 26 did not fulfil the expectations that had been created in the run up to the event, but some steady progress was made.

- Twenty nations announced and end to public funding of international fossil fuel development.

- Thirty nations, three states and a group of automobile manufacturers pledged to phase out gasoline and diesel vehicles by 2035 to 2040.

- Participants reached agreement on the implementation of Article 6, which could provide a framework for an international carbon trading scheme.

- There were some minor changes, but demand estimates from the IEA, EIA and OPEC were broadly flat through 2021 and 2022 against last month’s forecast.

- OPEC+ raised supply for December in line with their schedule.

- Both Brent and WTI came close to $85/bbl, before falling back over the last few days.

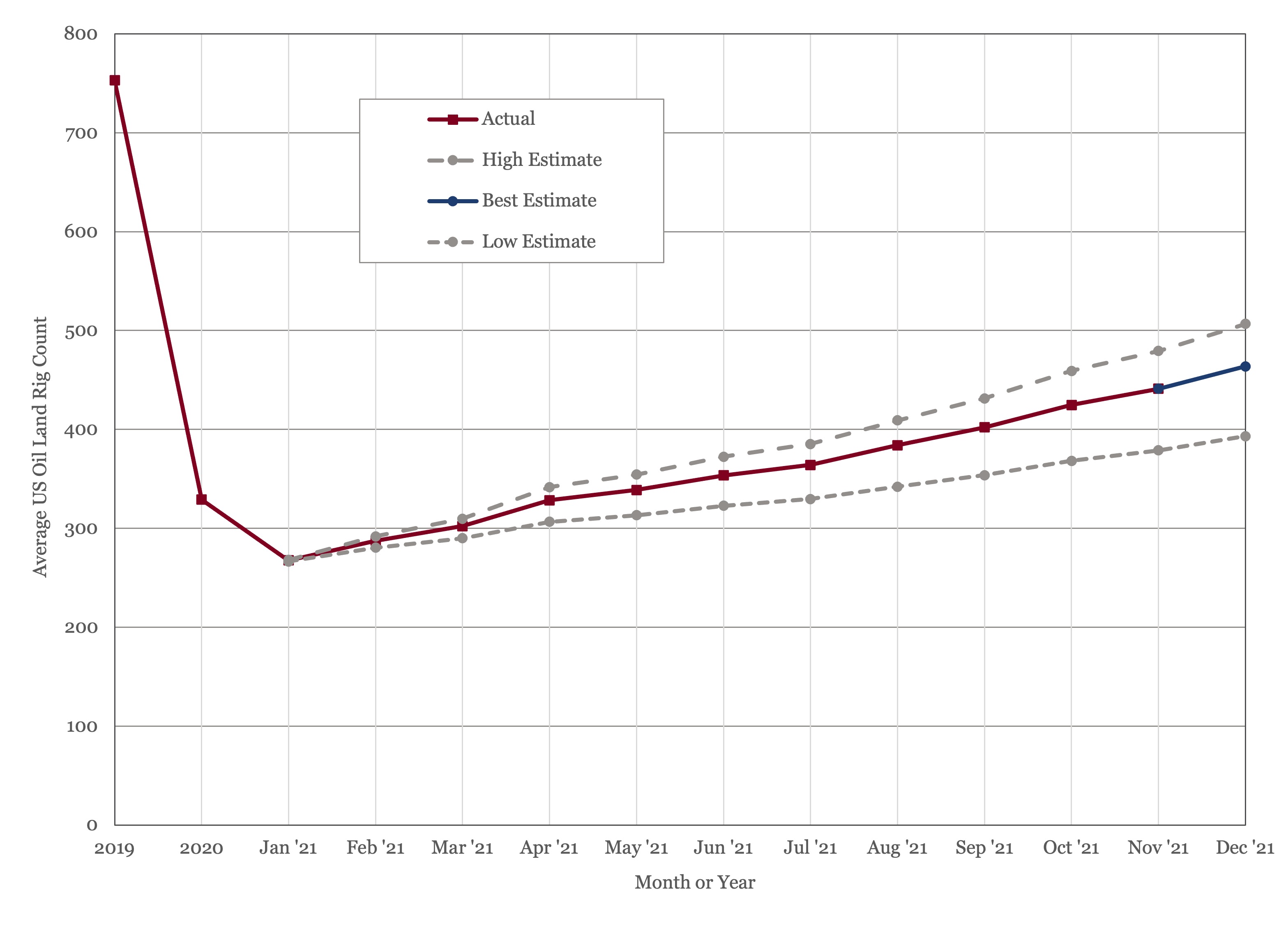

- The US land oil rig count reached 444.

COP 26

The energy industry headlines for the first half of the month were dominated by the COP 26. As the conference closed, however, there was little of substance to analyze. The claim that the conference had kept the Paris target of 1.5ºC within reach was not supported by national pledges, never mind actual legislation. There were several announcements that were made during and after the conference that could impact oil supply and demand and are worth some further examination.

The first was an explanation of the Biden administrations rather confusing policy of advocating an aggressive energy transition while regularly appealing to the OPEC+ group of nations to increase oil production. In fact, President Biden used the G20 meeting, immediately prior to COP 26, to appeal to G20 nations to boost energy production (1). As one of the most effective tools for limiting oil demand is price, this seems counterintuitive. This sparked an angry response from climate change activists and at the COP 26, a few days later, President Biden himself admitted that “It does, on the surface, seem inconsistent” (2). His explanation was that the world still required fossil fuels for the foreseeable future, any other view simply wasn’t realistic. This is a position that the author agrees with, but in recognizing this reality, the Biden administration highlights their inconsistent approach to the US oil & gas industry.

There was a lot of press coverage of the failure of all nations to commit to phase out coal fired power, but less on a commitment by twenty nations, including the US, UK, and Canada, to end public funding for international fossil fuel projects (3). To give some idea of the scale, between 2018 and 2020 the G20 invested $63 billion in international fossil fuel project, about half of which was spent on gas (4). Three of the four largest financiers – Japan, Korea, and China – did not sign the pledge, and it does not include liquified natural gas, which has represented the bulk of US international funding in recent years. Still, this was one of the more significant pledges at the conference and serves make financing even more difficult for the industry.

While financing will impact supply, a group of thirty nations, some high profile automobile manufacturers and vehicle fleet operators pledged to phase out gasoline and diesel vehicles by 2035 in major markets and 2040 worldwide (5). The national signatories excluded the US, Japan, and China, but did include India which is the world’s fourth largest automobile market. While the US did not sign the pledge, California, New York State and Washington State did. The automobile manufacturers included Ford, Mercedes, and General Motors, although Volkswagen and Toyota did not participate, this still covered about 25% of global manufacturing capacity. This would have a significant impact on global oil demand and, looking back to last month’s Oil Market Forecast, while consistent with the IEA and OPEC long term demand forecast, would be at odds with the one published by the EIA.

The final notable development was agreement on implementation of Article 6 from the Paris agreement. Article 6 provides a framework for international trading in carbon credits and this agreement could form the basis for an international carbon market – if not quite a carbon tax, then a mechanism for placing an internationally recognized price on carbon. In the author’s view, this is the second best (after a global tax) approach to the limiting carbon dioxide emissions as imposes a degree of economic discipline on decision making.

The COP 26 has been described by activists and in the press as a bit of a disappointment, falling as it did a long way short of the dramatic rhetoric in the run up about constituting the last best chance to save the planet. Again, in the author’s view, that is a little unfair. The expectations were never realistic, but some steady progress was made and a global market for carbon does represent an opportunity.

Oil Supply and Demand

The IEA (6) kept their demand estimates for 2021 and 2022 flat at 96.5 MMbbl/day and 99.8 MMbbl/day respectively in their latest report, as rising gasoline demand and increased international travel are offset by resurgent COVID in Europe and parts of the US. The EIA (7) raised their Q4 2021 demand estimate, due to fuel switching from natural gas to petroleum in parts of Asia and Europe, resulting in a nominal increase to their full year demand. OPEC (8) downgraded their 2021 demand estimate slightly, to 97.7 MMbbl/day due to slower than anticipated demand growth in China and India in the third quarter of this year. OPEC maintained their demand estimate for 2022 at 100.6 MMbbl/day.

In terms of oil supply, the Biden administration made a renewed appeal to OPEC+ to boost production, but at their 4th November meeting, OPEC+ decided to maintain their planned pace, returning another 400,000 bbl/day to market in December (9). The OEPC+ group have been remarkably successful in restoring oil market stability over the last 18 months, and with stocks around their 5 year average, there is little reason to deviate from their plans. The next major policy decision comes next month, at their December 2nd meeting, where they will revisit their planned production schedule. So far, there seems little reason to change course, but with higher prices there may be internal pressure to boost production.

Having failed to spur OPEC+ into action, the Biden administration attempted to co-ordinate a release from national Strategic Petroleum Reserves (SPRs). At the time of writing, it is still unclear whether the US or other IEA member countries will release and oil from their reserves, but China had announced that it would do so (10). Unless the release is sustained it is unlikely to have a long run impact on prices, and as it involves moving crude stored by national governments to crude stored by private enterprises, it doesn’t have any impact on the OPEC+ program of whittling away the crude surplus built up over the last year.

As demand returns the impact of multi-year investment cuts is starting to become evident in some OPEC countries. Kuwait revealed that its production capacity had shrunk to 2.63 MMbbl/day, some 500,000 bbl/day lower than its capacity three years ago. At the same time, it has delayed its plan to reach a capacity of 4 MMbbl/day from 2020 to 2040 (11). This development underscores the point made by OPEC General Secretary, Mohammed Barkindo, last month, when he highlighted the need to boost investment in new oil and gas fields or face the kind if shortages that the IEA and national SPRs were originally created to address.

Venezuela provided some positive news on the supply side, passing 700,000 bbl/day of production in October (12), on the back of increased condensate imports from Iran – Venezuela relies on condensate to dilute its extra heavy oil. In the medium term analysts are expecting a jump in investment in Norway in 2023 in response to new fiscal incentives, which require project approval by the end of 2022 (13).

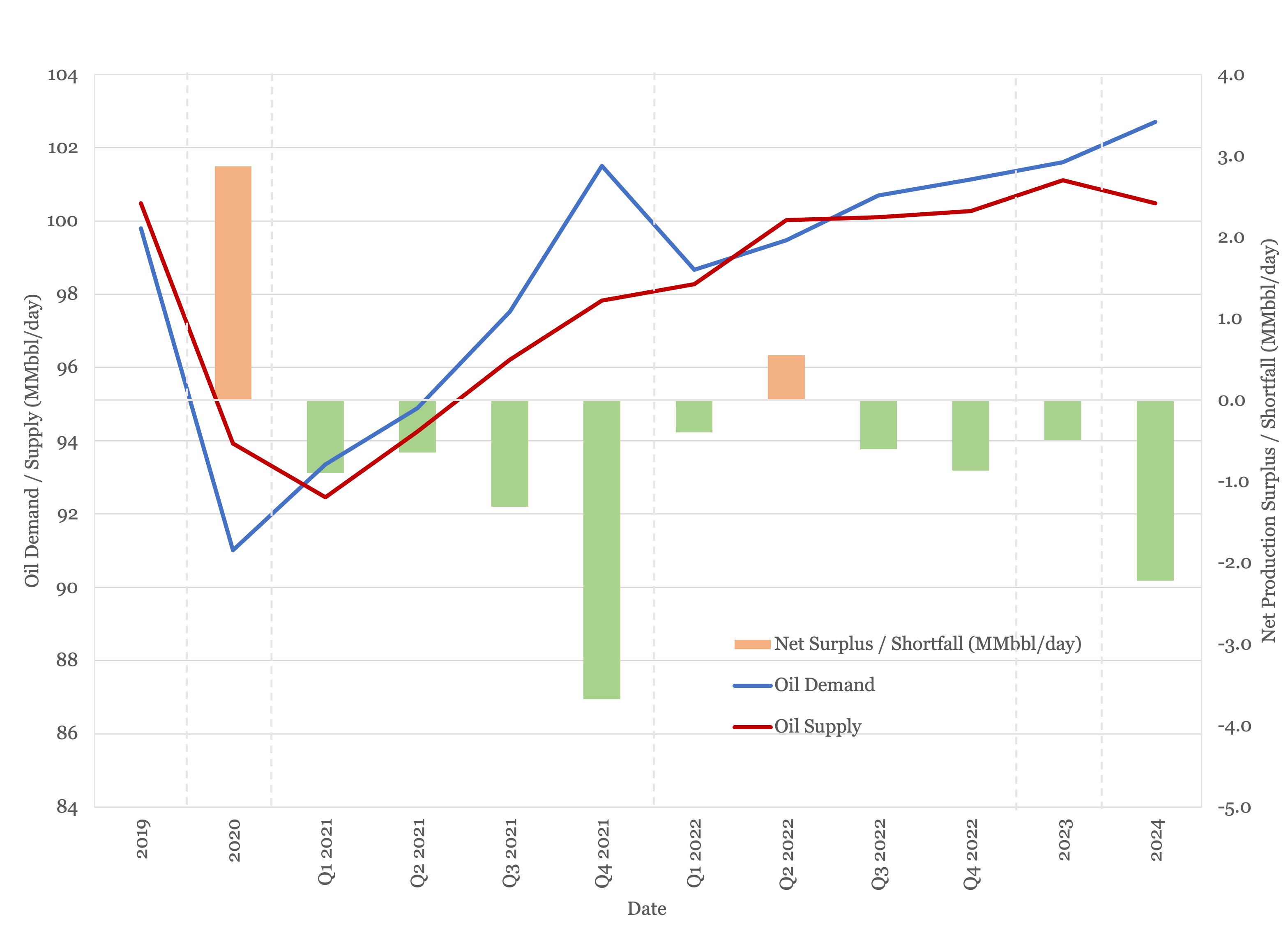

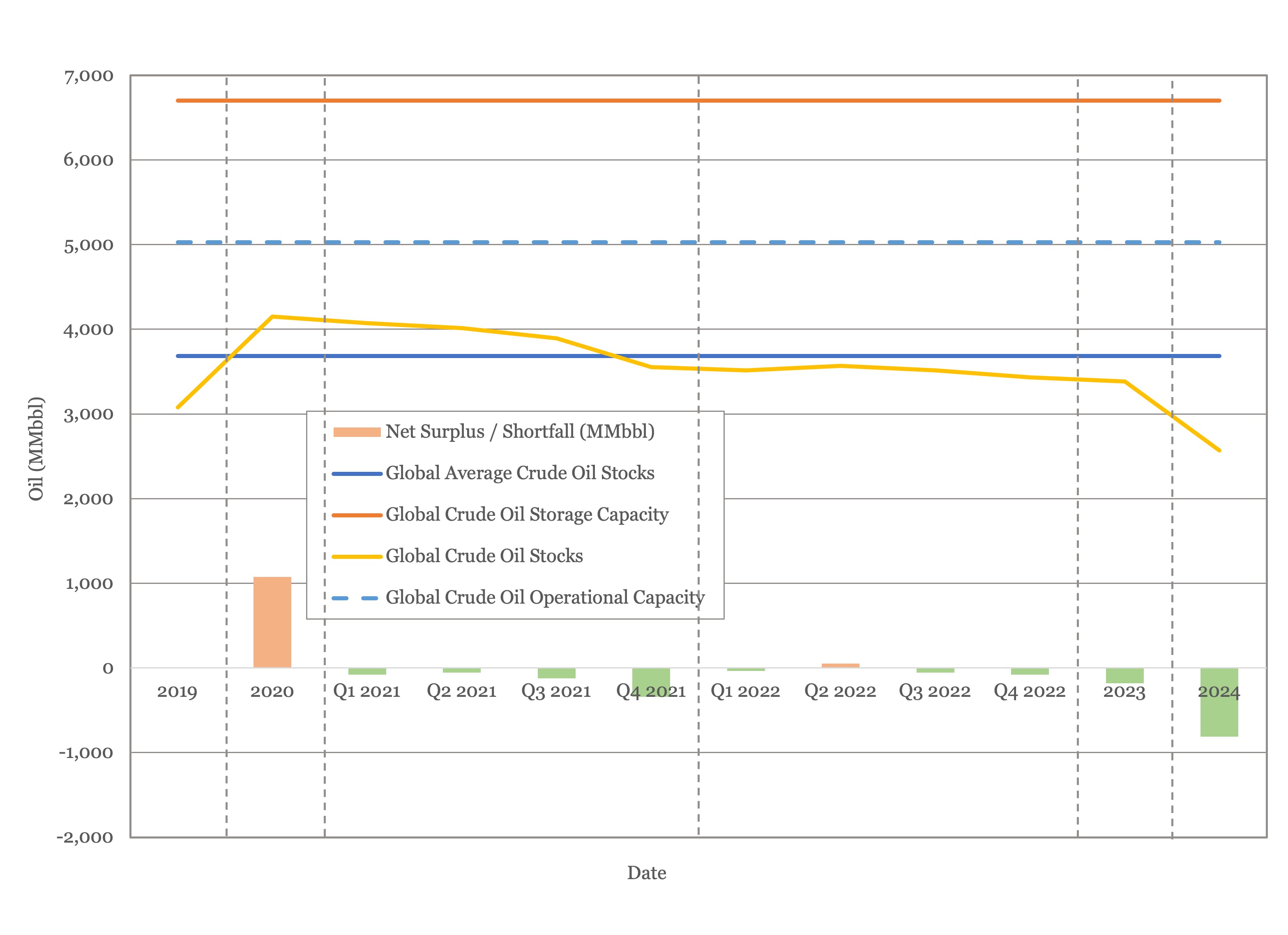

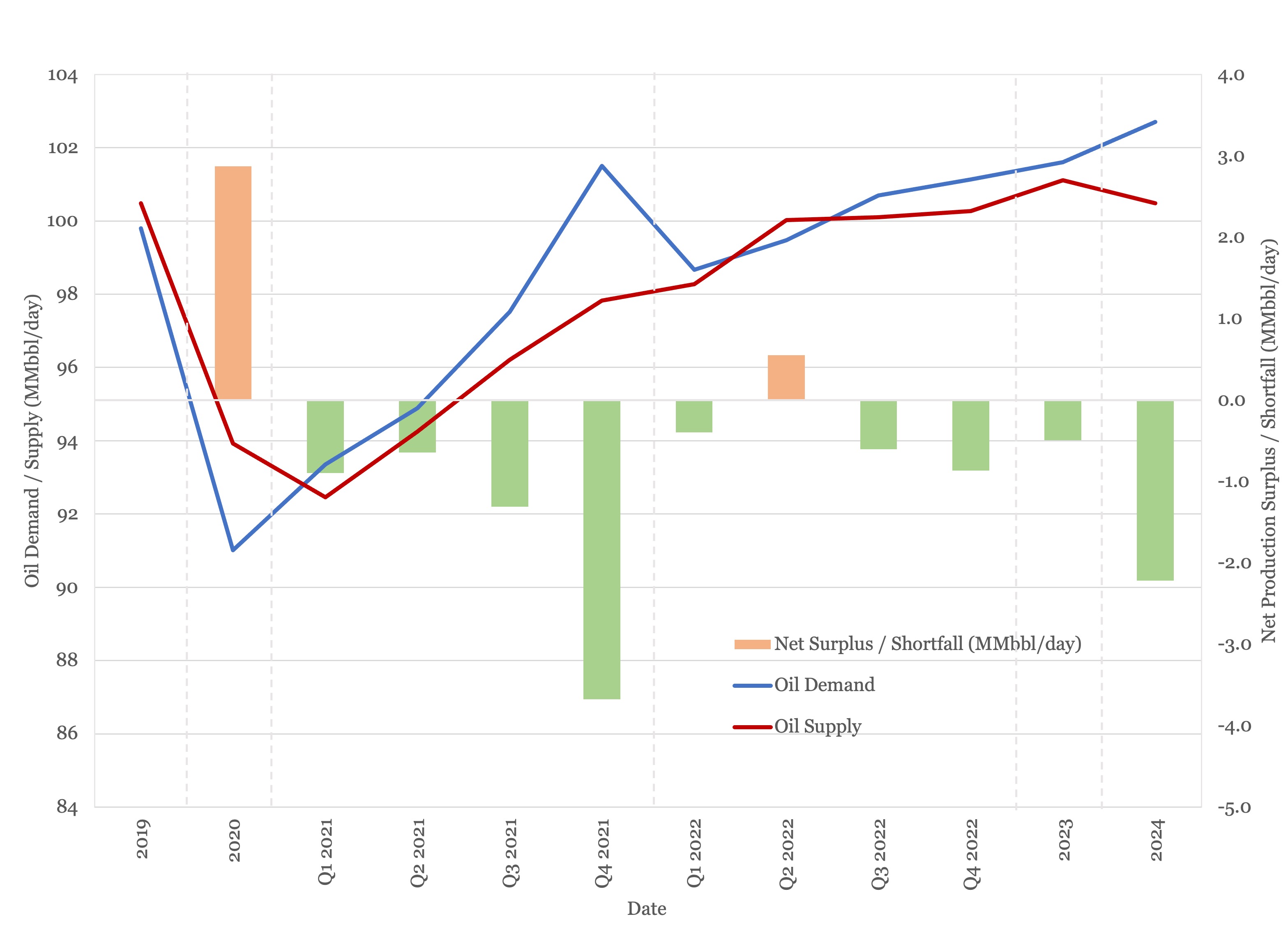

This month is our first look at 2022 on a quarter-by-quarter basis - in next month’s edition we will switch back to month by month for 2022. As in prior forecasts, demand is suspected to outstrip supply through 2022, but a supply surplus is expected in the second quarter, as OPEC+ returns to its reference production levels before demand recovers beyond 2019 levels in the second half of the year. The forecast is shown in Figure 1.

Figure 1 - Supply and Demand Surplus Forecast

Oil Storage

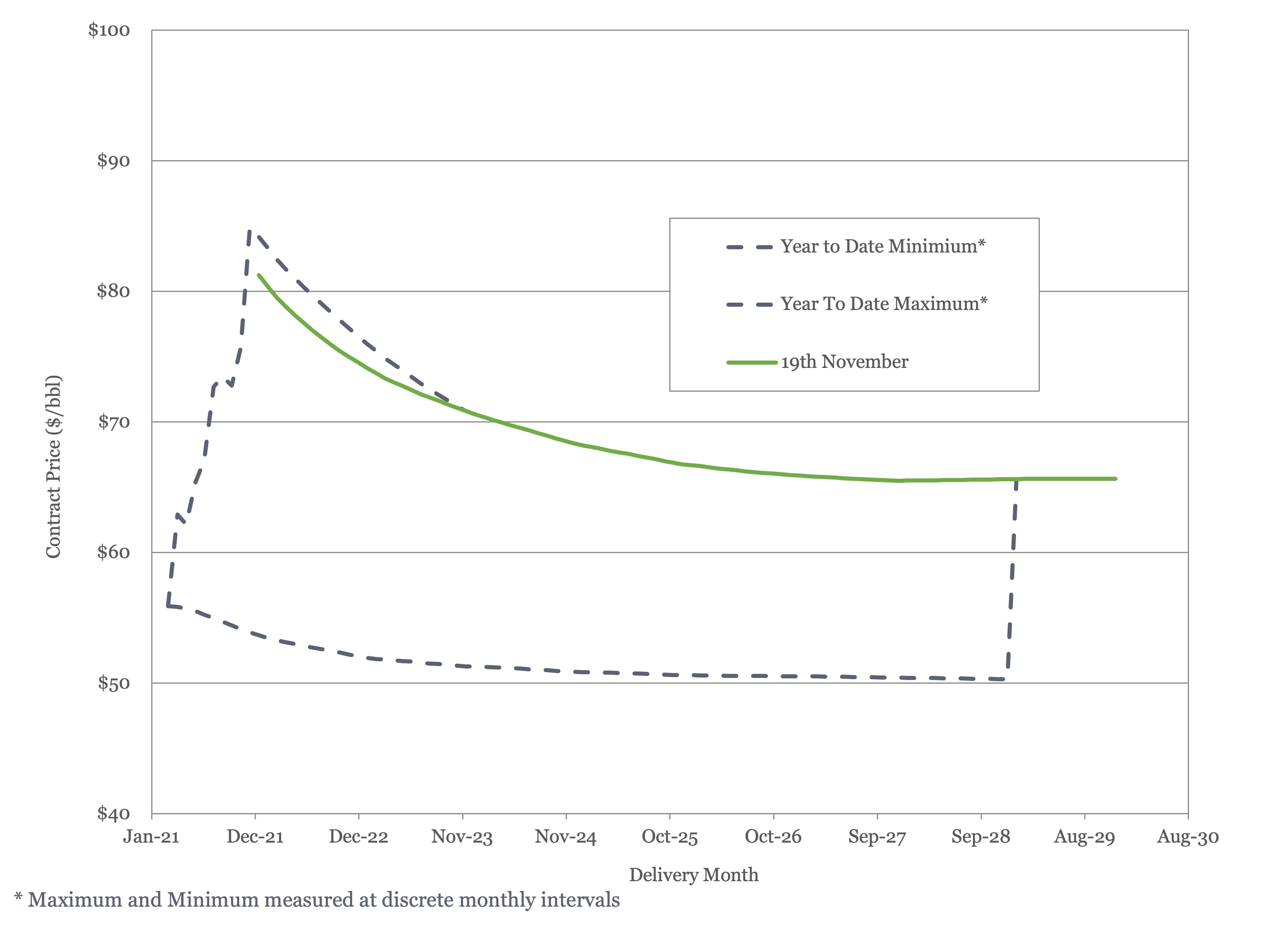

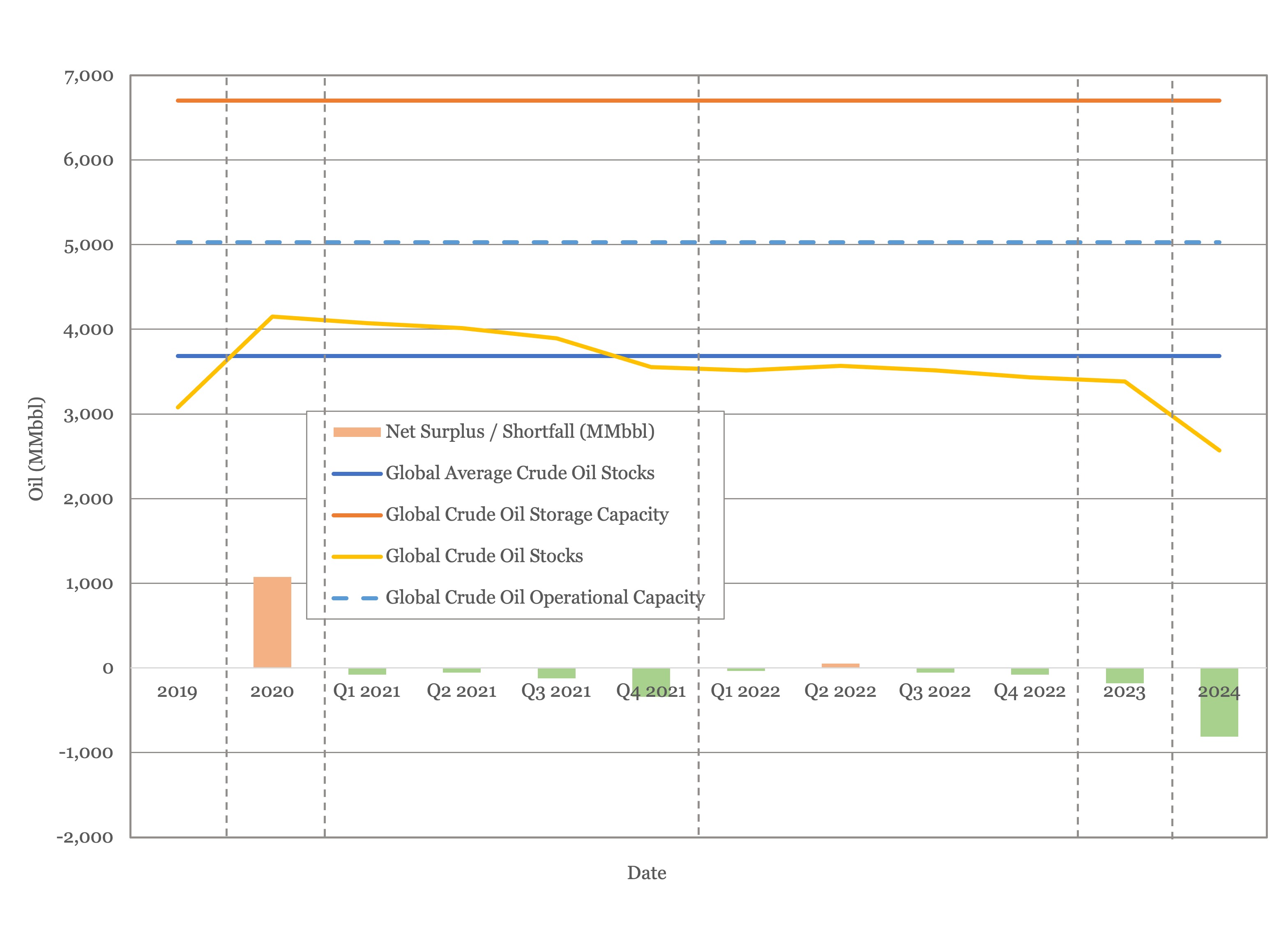

We estimate global oil inventory drawdowns of 485 MMbbl in 2021, falling to 105 MMbbl 2022 as OPEC+ returns to reference production levels. Figure 2 shows global storage capacity and inventories. If supply and demand follow the current forecast, global inventories will be slightly below the five year average for the 4th quarter 2021, remain about that level through 2022 before falling steeply through 2023 and 2024.

Figure 2 - Global Storage Chart

Oil Prices

WTI came within touching distance of $85/bbl earlier this month, with Brent crude getting even closer. At the time of writing, both had fallen back to the mid $70’s on negative COVID news and expectations of a coordinated SPR release. In their latest report the IEA hiked their 2022 oil price outlook for Brent to $79/barrel, suggesting that agencies are beginning to think that prices at this level can be supported through the medium term.

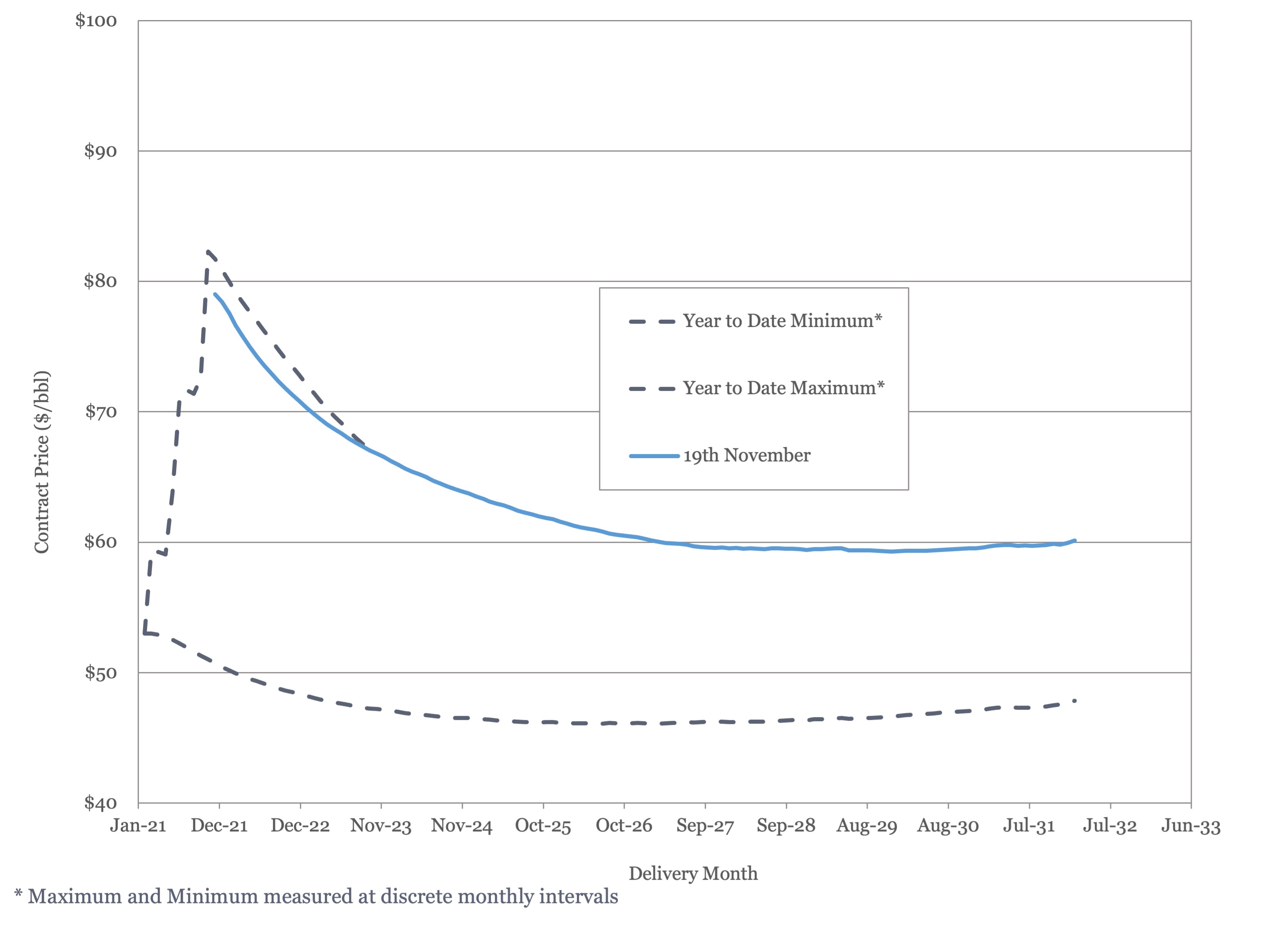

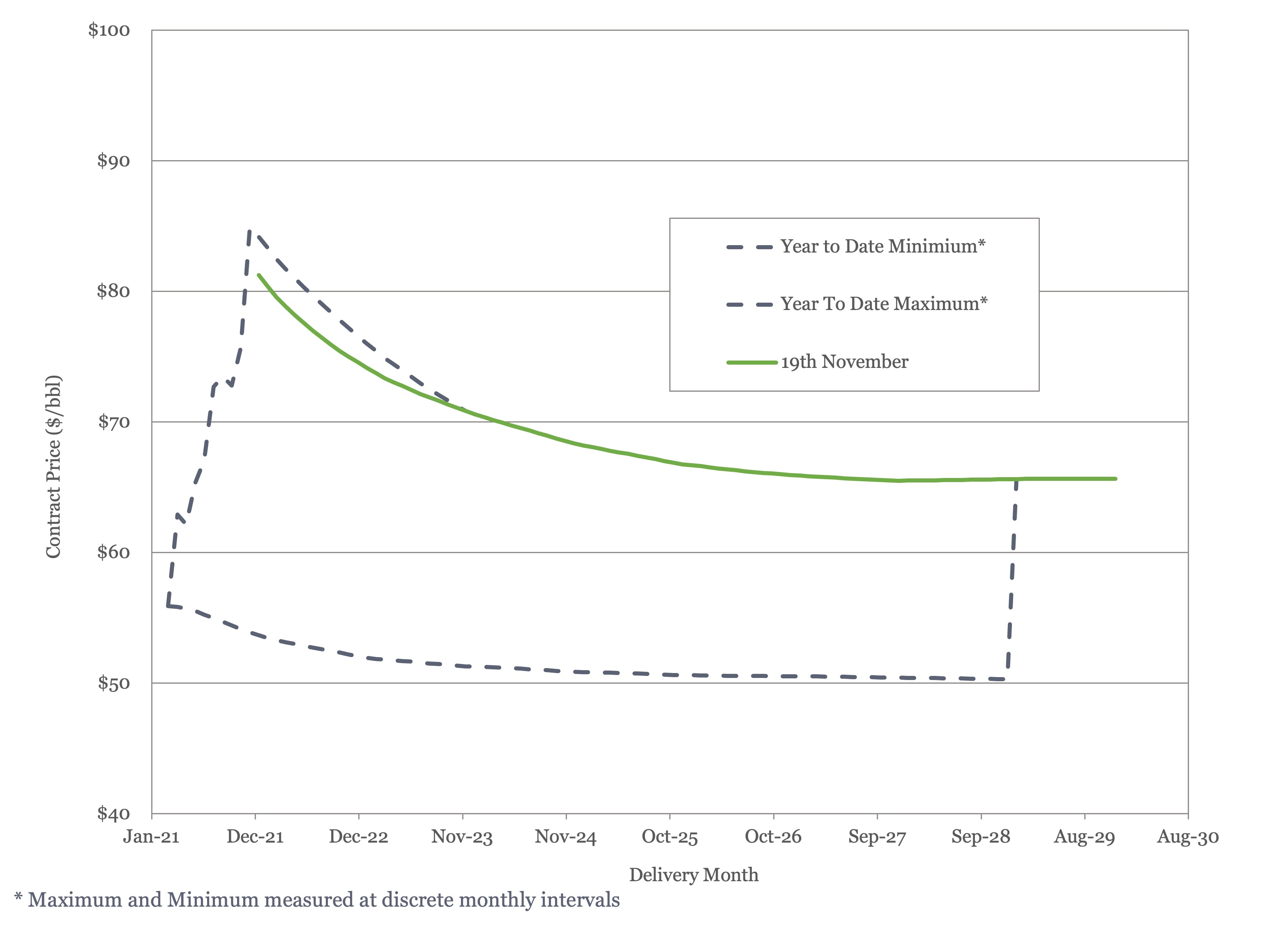

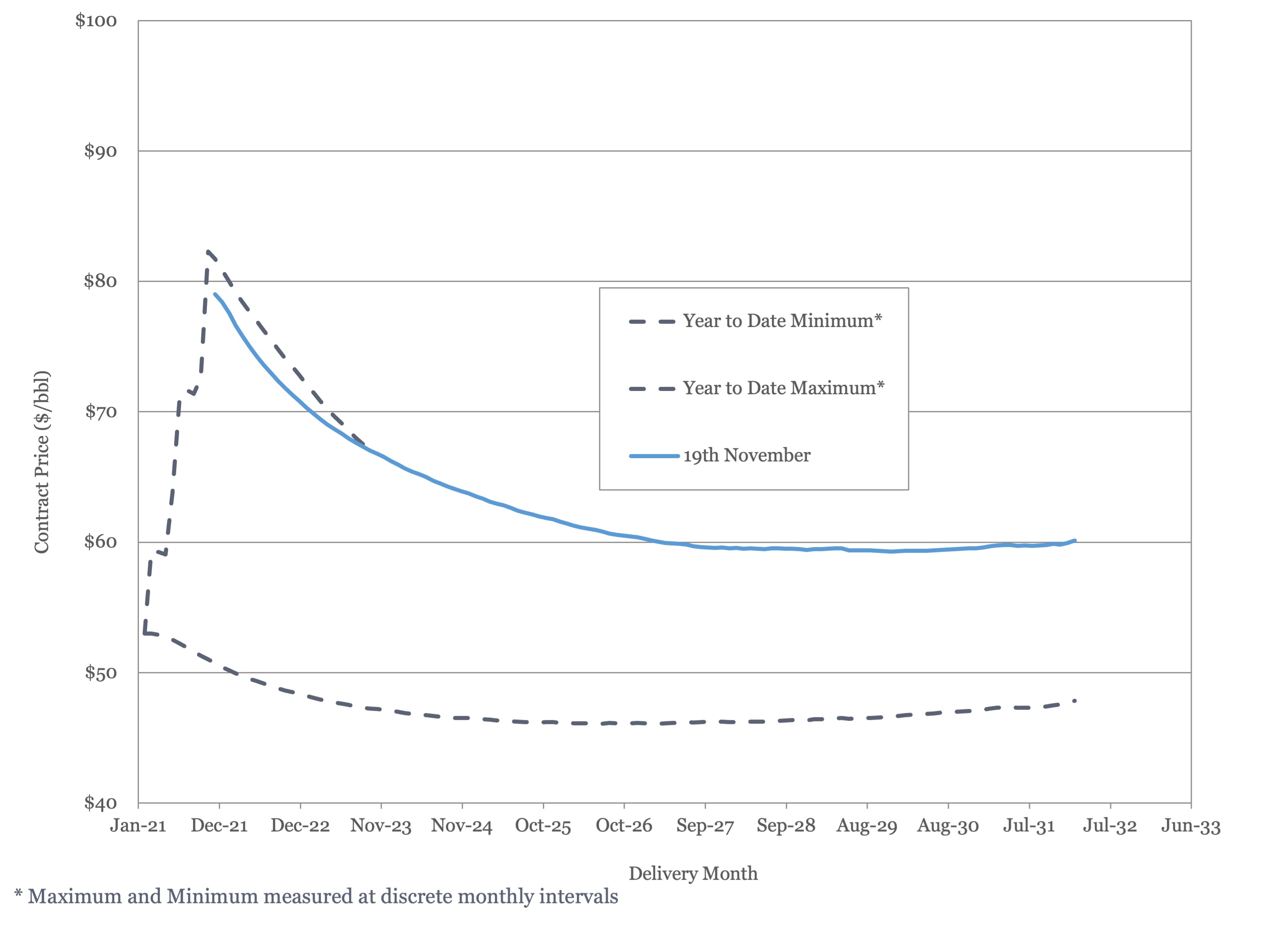

Both Brent and WTI futures showed declines in the near term, but higher prices in the medium terms, reflecting a structure that is closer to the physical market. Brent now has prices above $65/bbl for the rest of the decade.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

US Activity

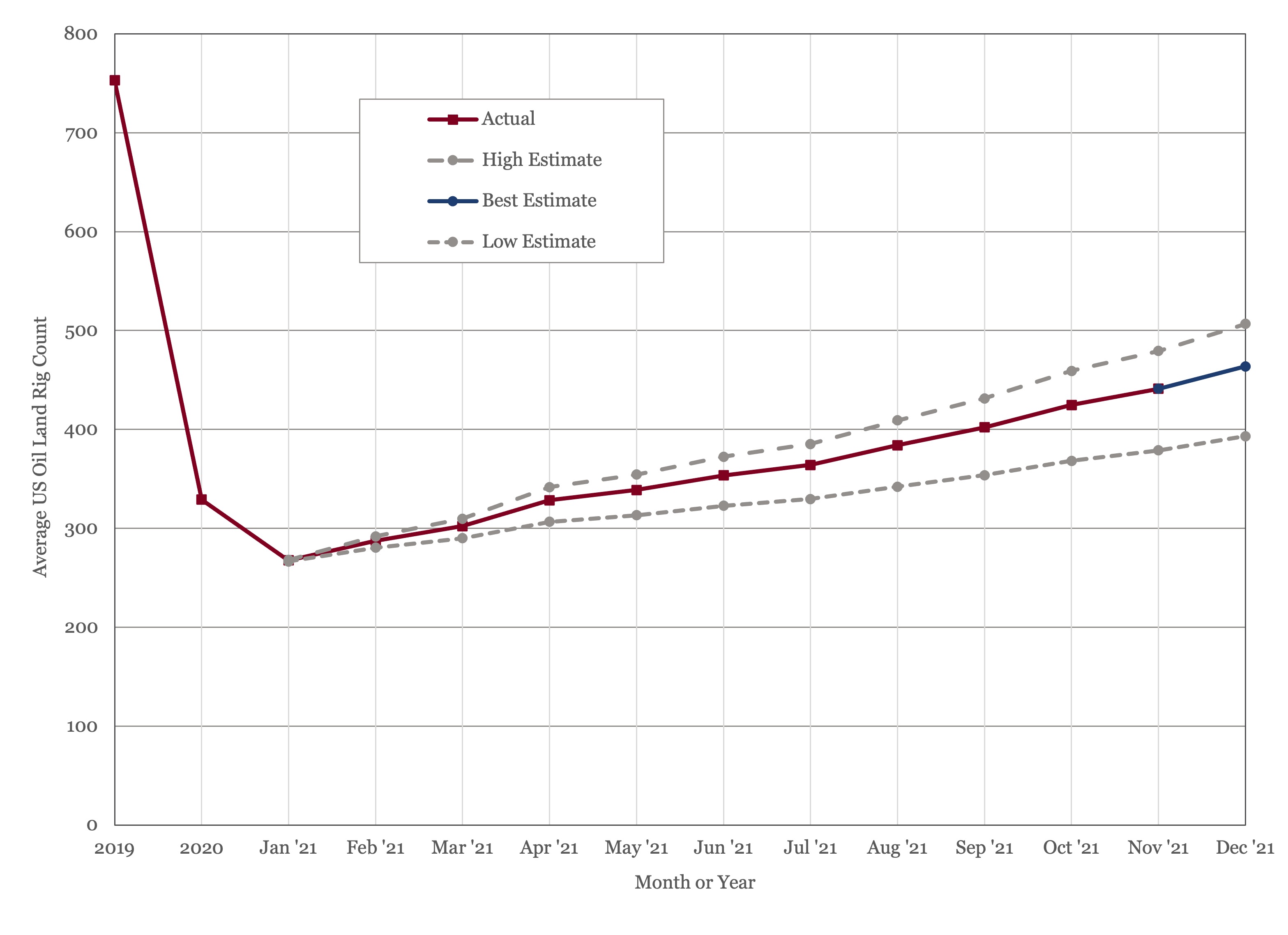

The US land oil rig count fell this month, before climbing sharply just before the end of the reporting period to record an overall gain, rising from 431 on the 18th of October to 444 on the 19th of November. We expect he rig count to stabilize around this level, as our estimate for 2022 is an average of 440 rigs.

Figure 5 - US Land Oil Rig Count

While the oil price has recovered there remain headwinds for the US industry, in both the availability of finance and changing regulation. Earlier this month, Spears and Associates reported a 40% decline in industry funding by JP Morgan and Co. (14), an industry bellwether, in 2021.

A less accommodating regulatory regime also presents challenges to the US industry on several fronts. The SEC has issued guidance relating to shareholder proposals which will make it more difficult for companies to exclude shareholder proposals on climate issues (15).

The EPA has proposed new rules on methane emissions that would require additional monitoring of wells and pipelines and prohibit venting. In the author’s opinion, this is welcome development; as we have argued previously, the world’s most advanced economy should not compete based on the laxness of its environmental regulation. However, this will result in reduced US production

Finally, President Biden’s nominee for Comptroller of the Currency, Saule Omarova, the regulator who is responsible for the Federal Banking System was quoted as saying of domestic fossil fuel producers that we “want them to go bankrupt if we want to tackle climate change,” (16). There could be some rough sledding ahead.

There were also some notable milestones in the US this month. The Permian, which has been quietly recovering, is expected to set a production record of 4.95 MMbbl/day in December (17). Meanwhile, following a judicial intervention in June, the Bureau of Ocean Energy Management (BOEM) raised over $191 million from leasing 308 tracts in the Gulf of Mexico under lease sale 257. The most notable bidders were Exxon and Chevron, indicating both US supermajors continue to see value in investing in the GoM (18).

(1) “Biden pushes G20 energy producing countries to boost production”, Reuters, Andrea Shalal and Jeff Mason, October 30th, 2021.

(2) “Even as Biden Pushed Clean Energy, He Seeks More Oil Production”, Jim Tankersley and Lisa Friedman, The New York Times, November 1st, 2021

(3) “COP 26 Deals Aim to Limit Coal, Oil and Natural Gas Development”, Sarah McFarlane and Sha Hua, The Wall Street Journal, November 4th, 2021.

(4) “U.S. Agrees to End Fossil Fuel Financing Abroad”, Sara Schonhardt, Scientific American, November 4th, 2021

(5) “6 Automakers and 30 Countries Say They’ll Phase Out Gasoline Car Sales”, Brad Plumer and Hiroko Tabuchi, The New York Times, November 9th , 2021.

(6) Oil Market Report – November 2021, International Energy Agency

(7) Short Term Energy Outlook (STEO), November 9th, 2021, U.S. Energy Information Administration.

(8) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, November 11th, 2021.

(9) 22nd OPEC and Non OPEC Ministerial Meeting, November 4th, 2021.

(10) “China to release crude oil volumes from SPR reserves”, Oil & Gas Journal, November 18th , 2021.

(11) “Kuwait on defensive over capacity decline”, Clare Dunkley, Petroleum Economist, November 8th, 2021

(12) “Venezuela’s oil exports bounce to over 700,000 bpd in Oct-data”, Marianna Parraga and Mircely Guanipa, Reuters, November 2nd, 2021

(13) “Norway oil firms raise 2022 investment forecasts”, Reuters, November 18th, 2021

(14) “EP213: Point-Counterpoint: Part 1”, The Drilldown, October 29th, 2021

(15) “SEC Staff Issues Guidance Relating to Shareholder Proposals”, Akin Gump, November 8th, 2021

(16) “We want them to go bankrupt”, The Wall Street Journal, November 15th, 2021

(17) “Permian shale output expected to set a record in December”, Sheela Tobben, World Oil, November 16th, 2021

(18) “Biden Gulf of Mexico Lease Sale Results Are In”, Andreas Exarheas , Rigzone, November 18th, 2021

Oil Market Forecast - November 2021

Summary

It’s been another eventful month in the oil & gas industry, not least of which was the COP 26 which ran over the first two weeks. We start this edition by looking at some of the notable announcements from the conference, although the content here is more qualitative than quantitative. While things have been quiet on the demand side, there was a fair amount of news on the supply side this month and we will have our first look at 2022 supply demand balance on a quarterly basis. Prices have also been volatile over the last month, and some of the Biden administration’s proposals for regulating the oil & gas industry are starting to take shape.

A few key points:

- The COP 26 did not fulfil the expectations that had been created in the run up to the event, but some steady progress was made.

- Twenty nations announced and end to public funding of international fossil fuel development.

- Thirty nations, three states and a group of automobile manufacturers pledged to phase out gasoline and diesel vehicles by 2035 to 2040.

- Participants reached agreement on the implementation of Article 6, which could provide a framework for an international carbon trading scheme.

- There were some minor changes, but demand estimates from the IEA, EIA and OPEC were broadly flat through 2021 and 2022 against last month’s forecast.

- OPEC+ raised supply for December in line with their schedule.

- Both Brent and WTI came close to $85/bbl, before falling back over the last few days.

- The US land oil rig count reached 444.

COP 26

The energy industry headlines for the first half of the month were dominated by the COP 26. As the conference closed, however, there was little of substance to analyze. The claim that the conference had kept the Paris target of 1.5ºC within reach was not supported by national pledges, never mind actual legislation. There were several announcements that were made during and after the conference that could impact oil supply and demand and are worth some further examination.

The first was an explanation of the Biden administrations rather confusing policy of advocating an aggressive energy transition while regularly appealing to the OPEC+ group of nations to increase oil production. In fact, President Biden used the G20 meeting, immediately prior to COP 26, to appeal to G20 nations to boost energy production (1). As one of the most effective tools for limiting oil demand is price, this seems counterintuitive. This sparked an angry response from climate change activists and at the COP 26, a few days later, President Biden himself admitted that “It does, on the surface, seem inconsistent” (2). His explanation was that the world still required fossil fuels for the foreseeable future, any other view simply wasn’t realistic. This is a position that the author agrees with, but in recognizing this reality, the Biden administration highlights their inconsistent approach to the US oil & gas industry.

There was a lot of press coverage of the failure of all nations to commit to phase out coal fired power, but less on a commitment by twenty nations, including the US, UK, and Canada, to end public funding for international fossil fuel projects (3). To give some idea of the scale, between 2018 and 2020 the G20 invested $63 billion in international fossil fuel project, about half of which was spent on gas (4). Three of the four largest financiers – Japan, Korea, and China – did not sign the pledge, and it does not include liquified natural gas, which has represented the bulk of US international funding in recent years. Still, this was one of the more significant pledges at the conference and serves make financing even more difficult for the industry.

While financing will impact supply, a group of thirty nations, some high profile automobile manufacturers and vehicle fleet operators pledged to phase out gasoline and diesel vehicles by 2035 in major markets and 2040 worldwide (5). The national signatories excluded the US, Japan, and China, but did include India which is the world’s fourth largest automobile market. While the US did not sign the pledge, California, New York State and Washington State did. The automobile manufacturers included Ford, Mercedes, and General Motors, although Volkswagen and Toyota did not participate, this still covered about 25% of global manufacturing capacity. This would have a significant impact on global oil demand and, looking back to last month’s Oil Market Forecast, while consistent with the IEA and OPEC long term demand forecast, would be at odds with the one published by the EIA.

The final notable development was agreement on implementation of Article 6 from the Paris agreement. Article 6 provides a framework for international trading in carbon credits and this agreement could form the basis for an international carbon market – if not quite a carbon tax, then a mechanism for placing an internationally recognized price on carbon. In the author’s view, this is the second best (after a global tax) approach to the limiting carbon dioxide emissions as imposes a degree of economic discipline on decision making.

The COP 26 has been described by activists and in the press as a bit of a disappointment, falling as it did a long way short of the dramatic rhetoric in the run up about constituting the last best chance to save the planet. Again, in the author’s view, that is a little unfair. The expectations were never realistic, but some steady progress was made and a global market for carbon does represent an opportunity.

Oil Supply and Demand

The IEA (6) kept their demand estimates for 2021 and 2022 flat at 96.5 MMbbl/day and 99.8 MMbbl/day respectively in their latest report, as rising gasoline demand and increased international travel are offset by resurgent COVID in Europe and parts of the US. The EIA (7) raised their Q4 2021 demand estimate, due to fuel switching from natural gas to petroleum in parts of Asia and Europe, resulting in a nominal increase to their full year demand. OPEC (8) downgraded their 2021 demand estimate slightly, to 97.7 MMbbl/day due to slower than anticipated demand growth in China and India in the third quarter of this year. OPEC maintained their demand estimate for 2022 at 100.6 MMbbl/day.

In terms of oil supply, the Biden administration made a renewed appeal to OPEC+ to boost production, but at their 4th November meeting, OPEC+ decided to maintain their planned pace, returning another 400,000 bbl/day to market in December (9). The OEPC+ group have been remarkably successful in restoring oil market stability over the last 18 months, and with stocks around their 5 year average, there is little reason to deviate from their plans. The next major policy decision comes next month, at their December 2nd meeting, where they will revisit their planned production schedule. So far, there seems little reason to change course, but with higher prices there may be internal pressure to boost production.

Having failed to spur OPEC+ into action, the Biden administration attempted to co-ordinate a release from national Strategic Petroleum Reserves (SPRs). At the time of writing, it is still unclear whether the US or other IEA member countries will release and oil from their reserves, but China had announced that it would do so (10). Unless the release is sustained it is unlikely to have a long run impact on prices, and as it involves moving crude stored by national governments to crude stored by private enterprises, it doesn’t have any impact on the OPEC+ program of whittling away the crude surplus built up over the last year.

As demand returns the impact of multi-year investment cuts is starting to become evident in some OPEC countries. Kuwait revealed that its production capacity had shrunk to 2.63 MMbbl/day, some 500,000 bbl/day lower than its capacity three years ago. At the same time, it has delayed its plan to reach a capacity of 4 MMbbl/day from 2020 to 2040 (11). This development underscores the point made by OPEC General Secretary, Mohammed Barkindo, last month, when he highlighted the need to boost investment in new oil and gas fields or face the kind if shortages that the IEA and national SPRs were originally created to address.

Venezuela provided some positive news on the supply side, passing 700,000 bbl/day of production in October (12), on the back of increased condensate imports from Iran – Venezuela relies on condensate to dilute its extra heavy oil. In the medium term analysts are expecting a jump in investment in Norway in 2023 in response to new fiscal incentives, which require project approval by the end of 2022 (13).

This month is our first look at 2022 on a quarter-by-quarter basis - in next month’s edition we will switch back to month by month for 2022. As in prior forecasts, demand is suspected to outstrip supply through 2022, but a supply surplus is expected in the second quarter, as OPEC+ returns to its reference production levels before demand recovers beyond 2019 levels in the second half of the year. The forecast is shown in Figure 1.

Figure 1 - Supply and Demand Surplus Forecast

Oil Storage

We estimate global oil inventory drawdowns of 485 MMbbl in 2021, falling to 105 MMbbl 2022 as OPEC+ returns to reference production levels. Figure 2 shows global storage capacity and inventories. If supply and demand follow the current forecast, global inventories will be slightly below the five year average for the 4th quarter 2021, remain about that level through 2022 before falling steeply through 2023 and 2024.

Figure 2 - Global Storage Chart

Oil Prices

WTI came within touching distance of $85/bbl earlier this month, with Brent crude getting even closer. At the time of writing, both had fallen back to the mid $70’s on negative COVID news and expectations of a coordinated SPR release. In their latest report the IEA hiked their 2022 oil price outlook for Brent to $79/barrel, suggesting that agencies are beginning to think that prices at this level can be supported through the medium term.

Both Brent and WTI futures showed declines in the near term, but higher prices in the medium terms, reflecting a structure that is closer to the physical market. Brent now has prices above $65/bbl for the rest of the decade.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

US Activity

The US land oil rig count fell this month, before climbing sharply just before the end of the reporting period to record an overall gain, rising from 431 on the 18th of October to 444 on the 19th of November. We expect he rig count to stabilize around this level, as our estimate for 2022 is an average of 440 rigs.

Figure 5 - US Land Oil Rig Count

While the oil price has recovered there remain headwinds for the US industry, in both the availability of finance and changing regulation. Earlier this month, Spears and Associates reported a 40% decline in industry funding by JP Morgan and Co. (14), an industry bellwether, in 2021.

A less accommodating regulatory regime also presents challenges to the US industry on several fronts. The SEC has issued guidance relating to shareholder proposals which will make it more difficult for companies to exclude shareholder proposals on climate issues (15).

The EPA has proposed new rules on methane emissions that would require additional monitoring of wells and pipelines and prohibit venting. In the author’s opinion, this is welcome development; as we have argued previously, the world’s most advanced economy should not compete based on the laxness of its environmental regulation. However, this will result in reduced US production

Finally, President Biden’s nominee for Comptroller of the Currency, Saule Omarova, the regulator who is responsible for the Federal Banking System was quoted as saying of domestic fossil fuel producers that we “want them to go bankrupt if we want to tackle climate change,” (16). There could be some rough sledding ahead.

There were also some notable milestones in the US this month. The Permian, which has been quietly recovering, is expected to set a production record of 4.95 MMbbl/day in December (17). Meanwhile, following a judicial intervention in June, the Bureau of Ocean Energy Management (BOEM) raised over $191 million from leasing 308 tracts in the Gulf of Mexico under lease sale 257. The most notable bidders were Exxon and Chevron, indicating both US supermajors continue to see value in investing in the GoM (18).

(1) “Biden pushes G20 energy producing countries to boost production”, Reuters, Andrea Shalal and Jeff Mason, October 30th, 2021.

(2) “Even as Biden Pushed Clean Energy, He Seeks More Oil Production”, Jim Tankersley and Lisa Friedman, The New York Times, November 1st, 2021

(3) “COP 26 Deals Aim to Limit Coal, Oil and Natural Gas Development”, Sarah McFarlane and Sha Hua, The Wall Street Journal, November 4th, 2021.

(4) “U.S. Agrees to End Fossil Fuel Financing Abroad”, Sara Schonhardt, Scientific American, November 4th, 2021

(5) “6 Automakers and 30 Countries Say They’ll Phase Out Gasoline Car Sales”, Brad Plumer and Hiroko Tabuchi, The New York Times, November 9th , 2021.

(6) Oil Market Report – November 2021, International Energy Agency

(7) Short Term Energy Outlook (STEO), November 9th, 2021, U.S. Energy Information Administration.

(8) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, November 11th, 2021.

(9) 22nd OPEC and Non OPEC Ministerial Meeting, November 4th, 2021.

(10) “China to release crude oil volumes from SPR reserves”, Oil & Gas Journal, November 18th , 2021.

(11) “Kuwait on defensive over capacity decline”, Clare Dunkley, Petroleum Economist, November 8th, 2021

(12) “Venezuela’s oil exports bounce to over 700,000 bpd in Oct-data”, Marianna Parraga and Mircely Guanipa, Reuters, November 2nd, 2021

(13) “Norway oil firms raise 2022 investment forecasts”, Reuters, November 18th, 2021

(14) “EP213: Point-Counterpoint: Part 1”, The Drilldown, October 29th, 2021

(15) “SEC Staff Issues Guidance Relating to Shareholder Proposals”, Akin Gump, November 8th, 2021

(16) “We want them to go bankrupt”, The Wall Street Journal, November 15th, 2021

(17) “Permian shale output expected to set a record in December”, Sheela Tobben, World Oil, November 16th, 2021

(18) “Biden Gulf of Mexico Lease Sale Results Are In”, Andreas Exarheas , Rigzone, November 18th, 2021

Explore Our Services

Business Development

Oil & Gas an extractive industry, participants must continuously find and develop new oil & gas fields as existing fields decline, making business development a continuous process.

Strategy

We approach strategy through a scenario driven assessment of the client’s current portfolio, organizational competencies, and financial framework. The strategy defines portfolio actions and coveted asset attributes.