Oil Market Forecast - September 2021

Summary

This September edition of our Oil Market Forecast sees some renewed optimism in oil demand recovery, most notably from OPEC. At the same time, Hurricane Ida is expected to significantly impact US production through both August and September further tightening the market. The first outlines of the US Democratic Party’s $3.5 trillion budget plan have started to emerge this month, providing some insights into what is in store for US producers and consumers over the next few years.

A few key points:

- The IEA, EIA and OPEC all made small downward adjustments to their 2021 demand forecast.

- OPEC raised its 2022 oil demand estimate substantially; OPEC now predicts 2022 oil demand outstripping 2019 demand, signaling a return to real demand growth next year.

- The IEA expects Hurricane Ida to impact US Gulf of Mexico into September, offsetting increased OPEC+ production.

- Both spot and future markets rebounded strongly from their drop last month, with both Brent and WTI futures through 2025 at their highest level of the year.

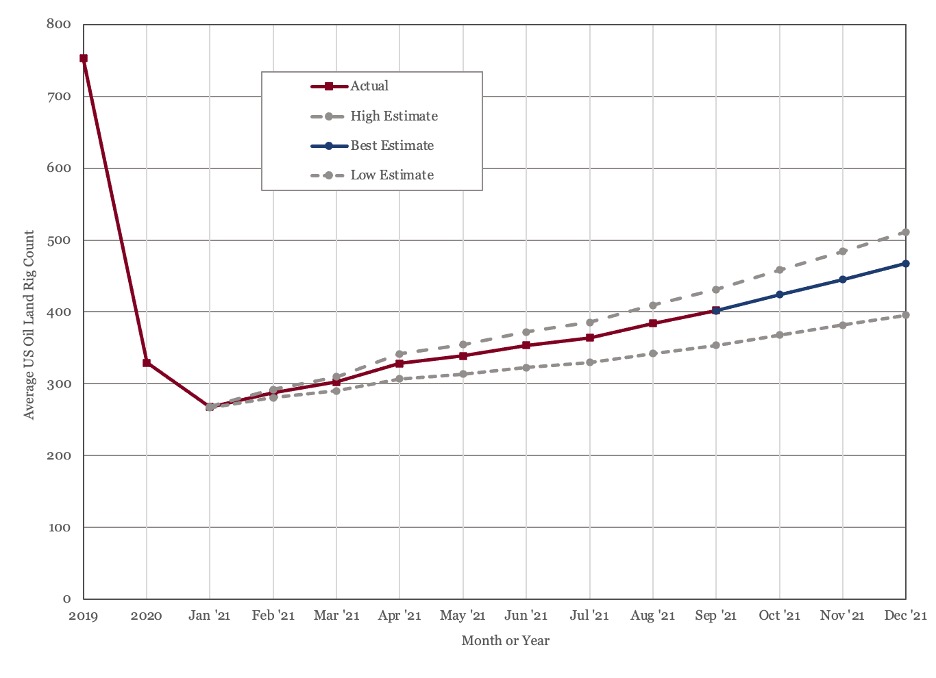

- The US land oil rig count continues to rise, passing 400.

- The US Democrats appear determined to keep gasoline prices low, while discouraging investment in US oil production and supporting the energy transition through a combination of regulation, taxation, and subsidies.

Oil Supply and Demand

In their latest report, OPEC (1) described third quarter oil demand as resilient in the face of the COVID-19 Delta variant but lowered their estimate for the second half of the year, reducing their overall demand estimate for 2021 to 96.7 MMbbl/day. The IEA (2) revised their third quarter average oil demand figures down by another 200,000 bbl/day, lowering their overall demand estimate for 2021 to 96.2 MMbbl/day. The EIA (3) revised their demand estimate for 2021 down by 250,000 bbl/day to 97.38 MMbbl/day.

While the IEA held their 2022 demand estimate steady, OPEC revised their 2022 demand estimate up by 900,000 bbl/day to 100.8 MMbbl/day, putting projected demand above 2019 levels. The EIA went in the opposite direction, reducing their 2022 demand estimate to 101.01 MMbbl/day, from 101.25 MMbbl/day, just shy of their 2019 demand estimate. The OPEC figure is particularly significant as it heralds a return to real oil demand growth.

The IEA reported global crude oil supply falling to 96.1 MMbbl/day in August, driven by unplanned production outages in the Gulf of Mexico from Hurricane Ida. The OPEC+ meeting on the first of September (4) confirmed the groups commitment to continue to return 400,000 bbl/day to the market in September. Despite this, the IEA view is that supply will remain flat through September as continued outages from Ida offset the returning OPEC+ production.

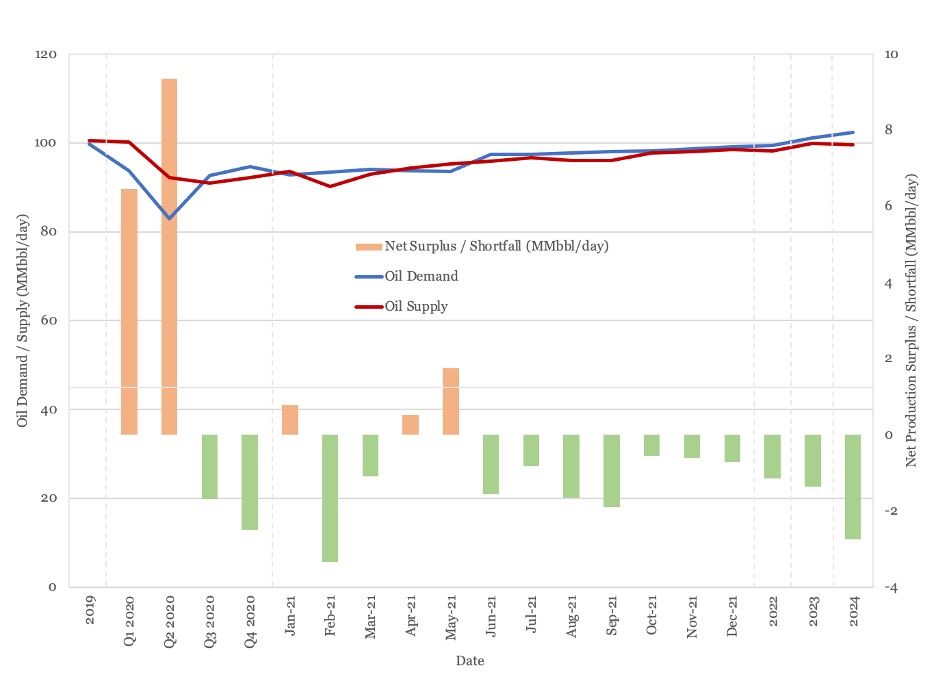

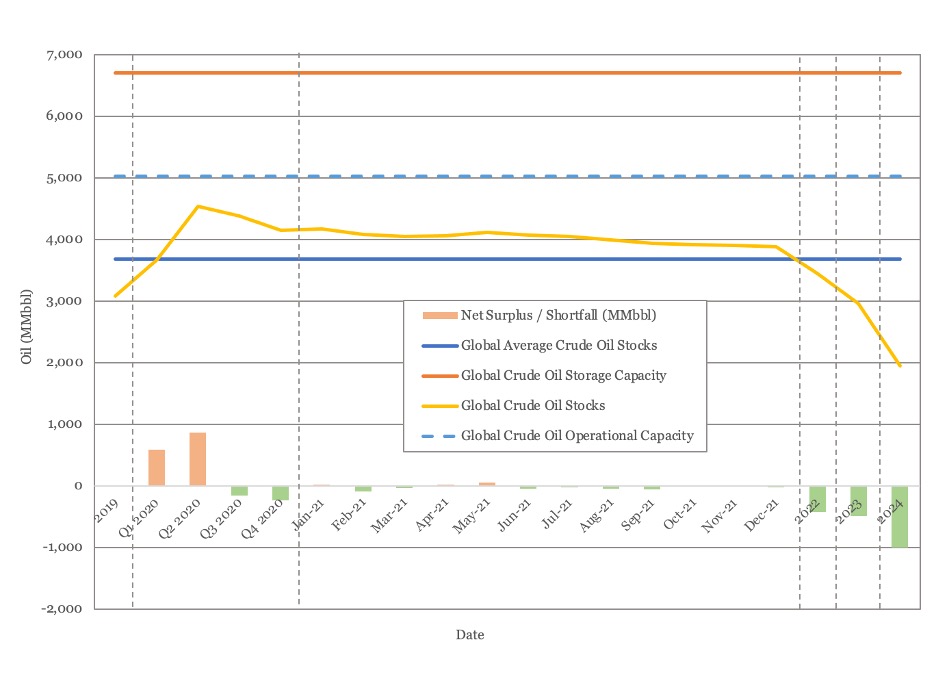

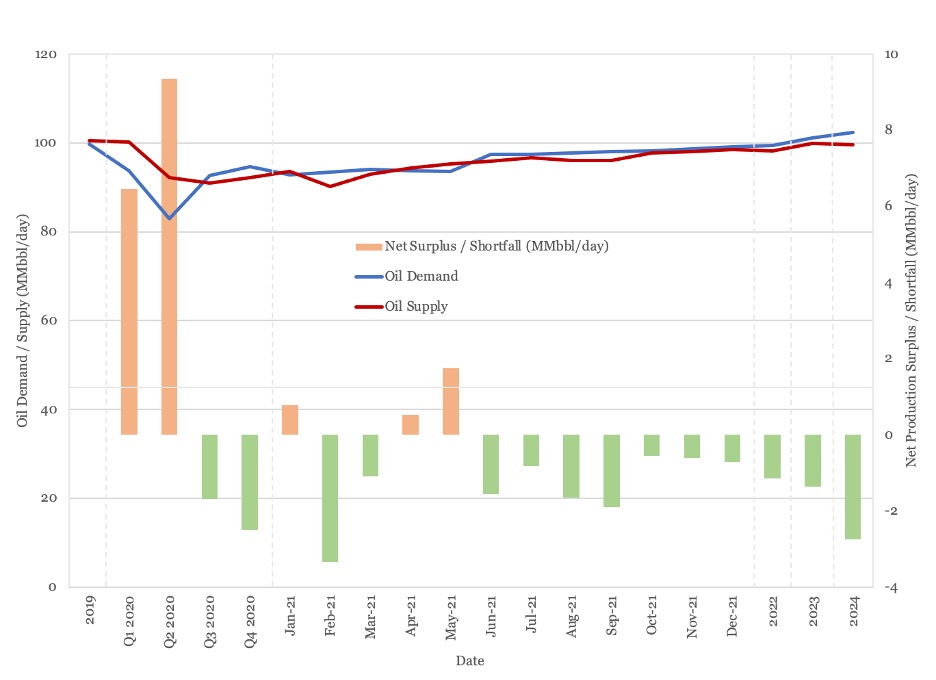

The net effect of this is to push the market into a steeper deficit in August and September than predicted last month. Supply and demand balance is shown in Figure 1.

Figure 1 - Supply and Demand Surplus Forecast

Oil Storage

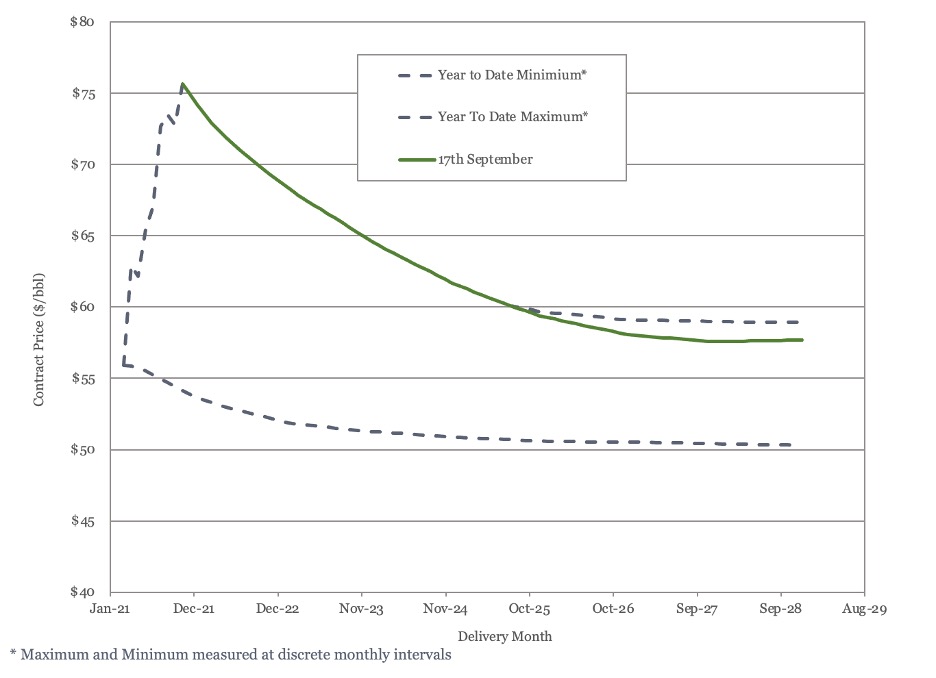

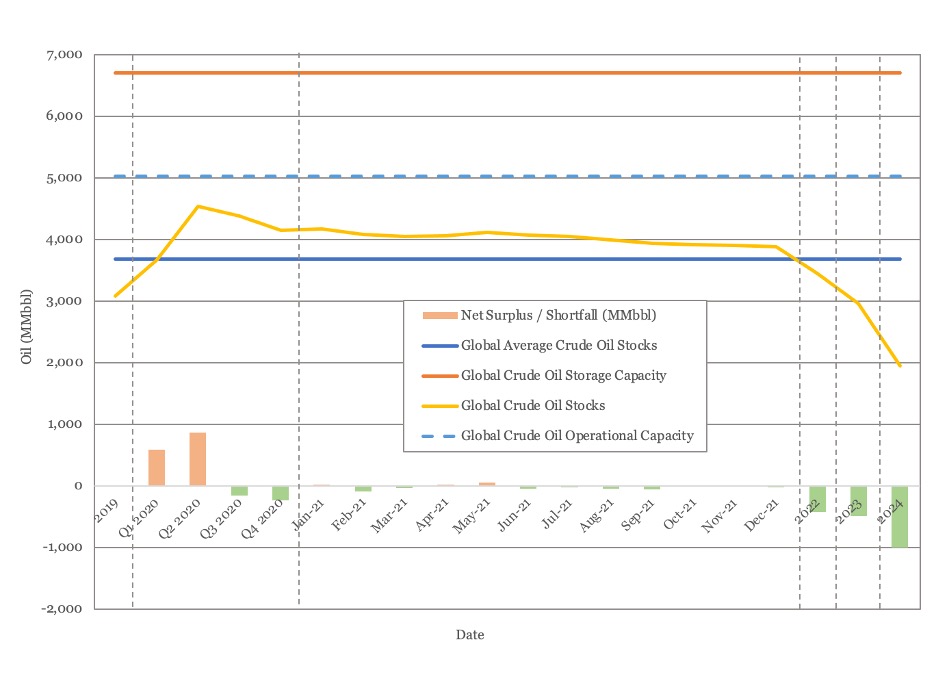

We estimate global oil inventory drawdowns of 80 MMbbl in the first half of 2021, rising to 193 MMbbl in the second half of the year as demand recovers. This represents a sharper drawdown than we anticipated last month.

Figure 2 shows global storage capacity and inventories. If supply and demand follow the current forecast, global inventories will still be slightly above the five year average by year end, falling below the five year average in 2022, with the deficit accelerating through 2023 and 2024.

Figure 2 - Global Storage Chart

Oil Prices

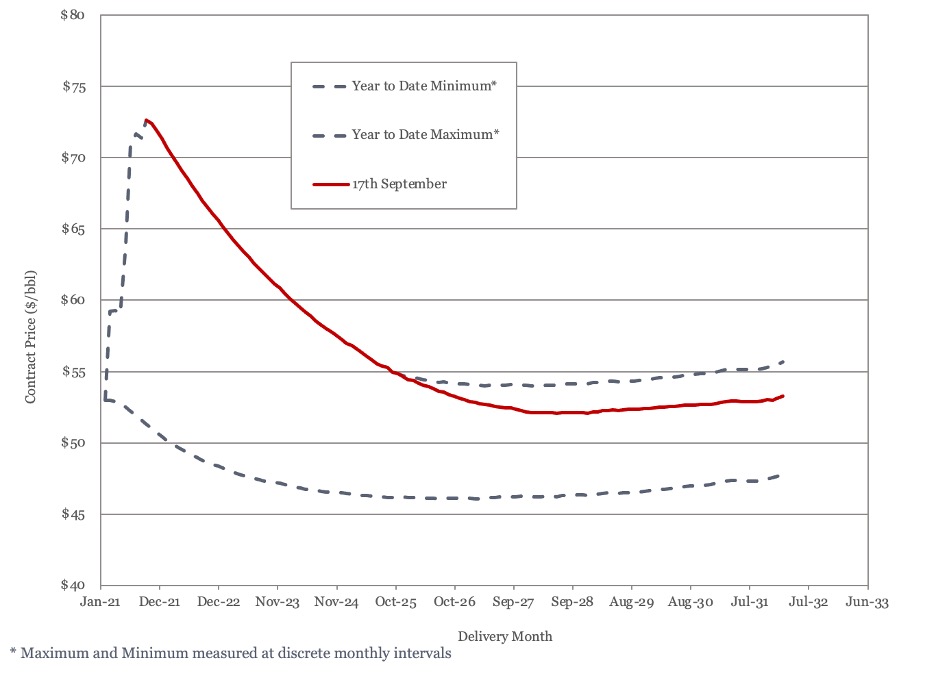

Both Brent and WTI spot prices rebounded strongly after last month’s decline, with Brent back above $75/bbl and WTI back above $70/bbl at the time of writing,

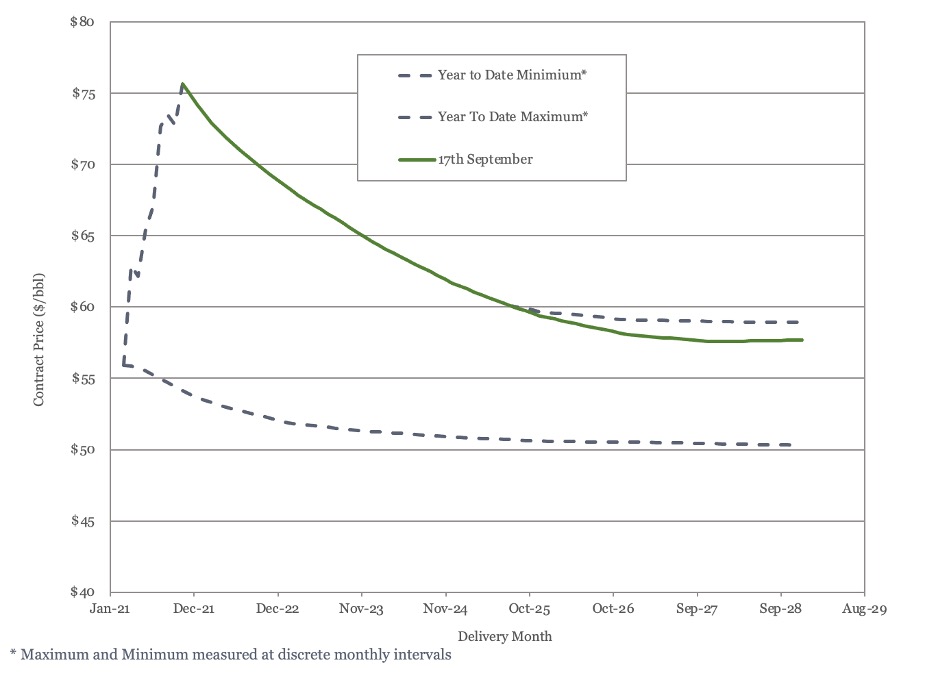

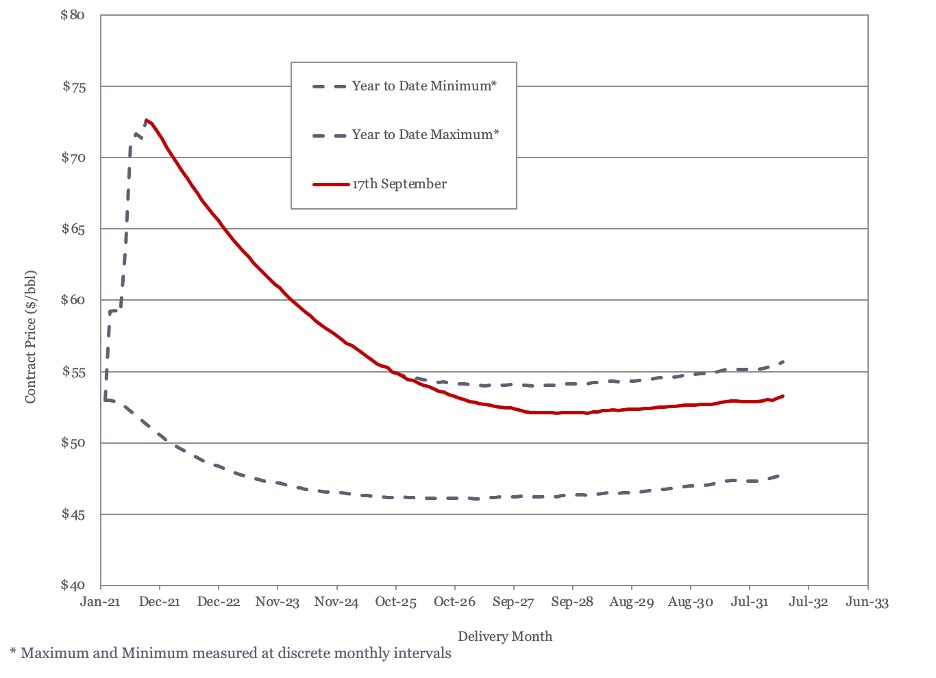

The same pattern has been reflected in the futures market, with both Brent and WTI futures showing their highest prices of the year through to 2025. See Figure 3 and Figure 4.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

This sudden snapback suggests that last month’s concerns about the impact of the Delta variant, while resulting in small downgrades to this year’s demand estimates, may have been oversold.

US Activity

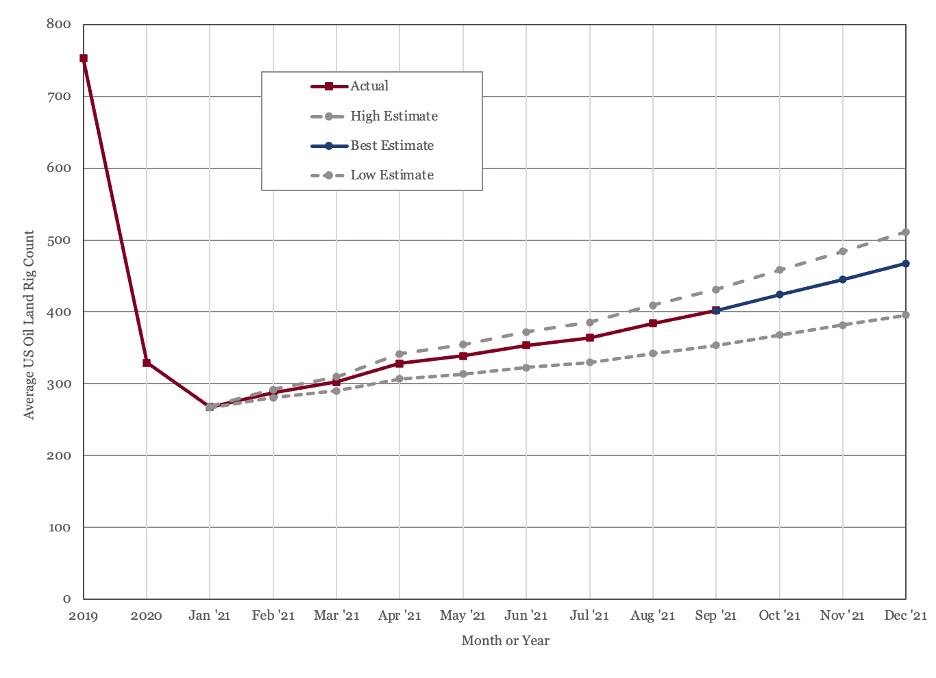

The US land oil rig count continued to climb this month, but at a more moderate pace, rising from 388 on the 20th of August to 406 on the 17th of September. While we expect the rig count to continue to rise through this year and next, there is still no indication of an acceleration in activity.

Figure 5 - US Land Oil Rig Count

September may prove to be an important month for US investment in upstream oil & gas, as the Democratic Party progresses their $ 3.5 trillion budget plan. While nothing is settled, some themes appear to be emerging. Consistent with recent requests to OPEC+ to increase production, there appears to be a marked reluctance to do anything that would increase gasoline prices. In recent days, proposals for a carbon tax have resurfaced, but set at $20/ton and with an exemption for gasoline. A tax at that level would do little to deter people from using internal combustion engine vehicles, even if it was applied.

At the same time, oil producers in the US appear to be targeted with a combination of tax changes and a regulatory assault, that looks to prevent further lease sales and render the industry less attractive for investment. The third prong seems to involve making the transition to electric vehicles (EVs) more attractive through subsidies, tighter emissions standards, and a build out of charging stations.

It appears that the strategy is to keep gasoline prices stable, while moving people to EV’s through subsidies. Presumably, once enough people have made the transition, it will be possible to start raising taxes on gasoline to push those remaining to make the transition. If this is the strategy, it would make more sense to support, or at least tolerate, domestic production until that point is reached, as it avoids the need to request assistance from OPEC+ on a regular basis.

(1) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, September 12th, 2021.

(2) Oil Market Report – September 2021, International Energy Agency

(3) Short Term Energy Outlook (STEO), September 2nd 2021, U.S. Energy Information Administration.

(4) 20th OPEC and Non OPEC Ministerial Meeting, September 1st, 2021.

Oil Market Forecast - September 2021

Summary

This September edition of our Oil Market Forecast sees some renewed optimism in oil demand recovery, most notably from OPEC. At the same time, Hurricane Ida is expected to significantly impact US production through both August and September further tightening the market. The first outlines of the US Democratic Party’s $3.5 trillion budget plan have started to emerge this month, providing some insights into what is in store for US producers and consumers over the next few years.

A few key points:

- The IEA, EIA and OPEC all made small downward adjustments to their 2021 demand forecast.

- OPEC raised its 2022 oil demand estimate substantially; OPEC now predicts 2022 oil demand outstripping 2019 demand, signaling a return to real demand growth next year.

- The IEA expects Hurricane Ida to impact US Gulf of Mexico into September, offsetting increased OPEC+ production.

- Both spot and future markets rebounded strongly from their drop last month, with both Brent and WTI futures through 2025 at their highest level of the year.

- The US land oil rig count continues to rise, passing 400.

- The US Democrats appear determined to keep gasoline prices low, while discouraging investment in US oil production and supporting the energy transition through a combination of regulation, taxation, and subsidies.

Oil Supply and Demand

In their latest report, OPEC (1) described third quarter oil demand as resilient in the face of the COVID-19 Delta variant but lowered their estimate for the second half of the year, reducing their overall demand estimate for 2021 to 96.7 MMbbl/day. The IEA (2) revised their third quarter average oil demand figures down by another 200,000 bbl/day, lowering their overall demand estimate for 2021 to 96.2 MMbbl/day. The EIA (3) revised their demand estimate for 2021 down by 250,000 bbl/day to 97.38 MMbbl/day.

While the IEA held their 2022 demand estimate steady, OPEC revised their 2022 demand estimate up by 900,000 bbl/day to 100.8 MMbbl/day, putting projected demand above 2019 levels. The EIA went in the opposite direction, reducing their 2022 demand estimate to 101.01 MMbbl/day, from 101.25 MMbbl/day, just shy of their 2019 demand estimate. The OPEC figure is particularly significant as it heralds a return to real oil demand growth.

The IEA reported global crude oil supply falling to 96.1 MMbbl/day in August, driven by unplanned production outages in the Gulf of Mexico from Hurricane Ida. The OPEC+ meeting on the first of September (4) confirmed the groups commitment to continue to return 400,000 bbl/day to the market in September. Despite this, the IEA view is that supply will remain flat through September as continued outages from Ida offset the returning OPEC+ production.

The net effect of this is to push the market into a steeper deficit in August and September than predicted last month. Supply and demand balance is shown in Figure 1.

Figure 1 - Supply and Demand Surplus Forecast

Oil Storage

We estimate global oil inventory drawdowns of 80 MMbbl in the first half of 2021, rising to 193 MMbbl in the second half of the year as demand recovers. This represents a sharper drawdown than we anticipated last month.

Figure 2 shows global storage capacity and inventories. If supply and demand follow the current forecast, global inventories will still be slightly above the five year average by year end, falling below the five year average in 2022, with the deficit accelerating through 2023 and 2024.

Figure 2 - Global Storage Chart

Oil Prices

Both Brent and WTI spot prices rebounded strongly after last month’s decline, with Brent back above $75/bbl and WTI back above $70/bbl at the time of writing,

The same pattern has been reflected in the futures market, with both Brent and WTI futures showing their highest prices of the year through to 2025. See Figure 3 and Figure 4.

Figure 3 - Brent Crude Oil Futures

Figure 4 - WTI Crude Oil Futures

This sudden snapback suggests that last month’s concerns about the impact of the Delta variant, while resulting in small downgrades to this year’s demand estimates, may have been oversold.

US Activity

The US land oil rig count continued to climb this month, but at a more moderate pace, rising from 388 on the 20th of August to 406 on the 17th of September. While we expect the rig count to continue to rise through this year and next, there is still no indication of an acceleration in activity.

Figure 5 - US Land Oil Rig Count

September may prove to be an important month for US investment in upstream oil & gas, as the Democratic Party progresses their $ 3.5 trillion budget plan. While nothing is settled, some themes appear to be emerging. Consistent with recent requests to OPEC+ to increase production, there appears to be a marked reluctance to do anything that would increase gasoline prices. In recent days, proposals for a carbon tax have resurfaced, but set at $20/ton and with an exemption for gasoline. A tax at that level would do little to deter people from using internal combustion engine vehicles, even if it was applied.

At the same time, oil producers in the US appear to be targeted with a combination of tax changes and a regulatory assault, that looks to prevent further lease sales and render the industry less attractive for investment. The third prong seems to involve making the transition to electric vehicles (EVs) more attractive through subsidies, tighter emissions standards, and a build out of charging stations.

It appears that the strategy is to keep gasoline prices stable, while moving people to EV’s through subsidies. Presumably, once enough people have made the transition, it will be possible to start raising taxes on gasoline to push those remaining to make the transition. If this is the strategy, it would make more sense to support, or at least tolerate, domestic production until that point is reached, as it avoids the need to request assistance from OPEC+ on a regular basis.

(1) “OPEC Monthly Oil Market Report”, Organization of the Petroleum Exporting Countries, September 12th, 2021.

(2) Oil Market Report – September 2021, International Energy Agency

(3) Short Term Energy Outlook (STEO), September 2nd 2021, U.S. Energy Information Administration.

(4) 20th OPEC and Non OPEC Ministerial Meeting, September 1st, 2021.

Explore Our Services

Business Development

Oil & Gas an extractive industry, participants must continuously find and develop new oil & gas fields as existing fields decline, making business development a continuous process.

Strategy

We approach strategy through a scenario driven assessment of the client’s current portfolio, organizational competencies, and financial framework. The strategy defines portfolio actions and coveted asset attributes.